Protectionism trend just temporary, says expert

More moves by developed countries to curb investment by Chinese companies are likely, but this trend will not last long, experts said on Wednesday.

The comments were made following the release of the latest risk-rating report by the Chinese Academy of Social Sciences (CASS). It said that the external risks facing Chinese firms in overseas investment saw a clear increase in 2017, while newly emerging economies have the most potential as investment destinations.

The report, called Country-Risk Rating of Overseas Investment from China, was released on Monday by the International Investment Research Office of the CASS.

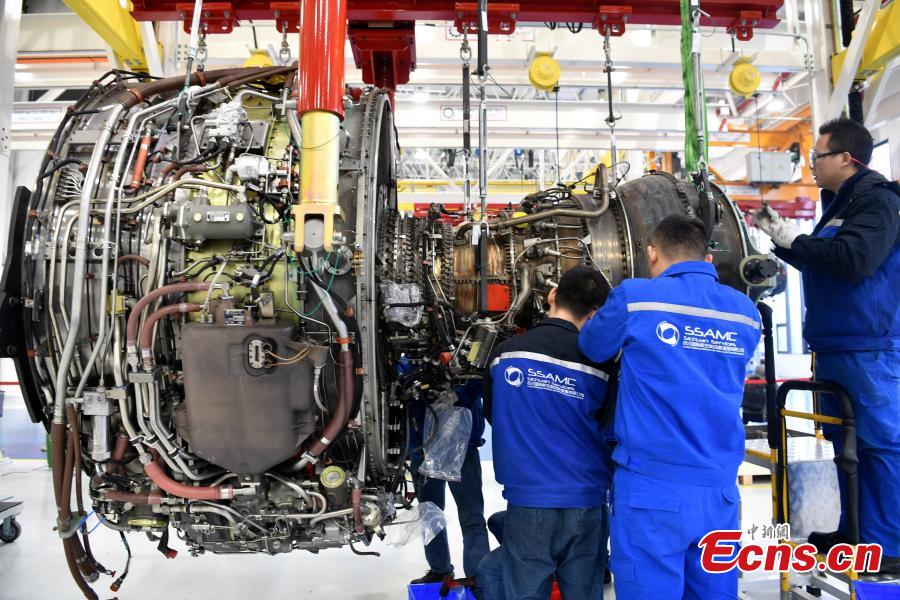

The research team introduced a new indicator in the report, China relations, showing that developed economies have lower scores in this regard, partly because of their increasingly cautious attitude toward Chinese firms, especially State-owned ones. This has led to a decline in bilateral trade and investment with these countries.

Wang Bijun, deputy director of the Department of International Investment with the CASS, said the developed countries are likely to further tighten their scrutiny of Chinese capital this year.

"Unlike the period after 2008 when the financial crisis forced developed economies to seek help from China to fill their capital gap, the last two years have seen their recovery and rising protectionism as they have put their own interests and safety first," she said.

"It is foreseeable that more moves to contain Chinese firms' investment in the developed countries will be conducted this year," said Bian Yongzu, a research fellow at the Chongyang Institute for Financial Studies at the Renmin University of China. However, Bian said the trend was only a temporary adjustment and would not last long.

The developed economies will eventually realize the importance of reciprocity and mutual benefits, Bian told the Global Times Wednesday. "Their protectionism in some areas like high-tech is gradually easing, as China is quickly catching up in terms of technological advancement."

Newly emerging economies still have the most potential for Chinese firms in terms of investment, based on their huge market potential and demand for infrastructure construction. But the overall risks they pose are higher than in developed countries in the categories of economy, society, politics and debt repayment capacity.

Among the 35 countries and regions along the Belt and Road (B&R) routes, whose investment risks were assessed in the report, Thailand, Bulgaria, Tajikistan and the Philippines saw the fastest increases in their score ranking, with a higher score meaning lower risks. Meanwhile, Cambodia, Mongolia, Iran and Greece saw the sharpest falls in their rankings.

There are still some concerns for domestic firms about investing along the B&R routes since only one out of the 35 economies, Singapore, has a rating in the AAA low-risk category.