Markets with fewer restrictions more popular

Although strict home purchase limitations have been imposed in first-tier cities during the past year, demand in the domestic property market remains strong, with some buyers eyeing second- and third-tier cities that have fewer restrictions.

Housing prices in Dandong, Northeast China's Liaoning Province, soared by about 60 percent in two days in late April, as people believed that the city, which borders DPRK, would benefit from the country's recent decision to prioritize its economy and suspend nuclear and missile tests, domestic news site stcn.com reported on Wednesday.

Also, sales of residential apartments in Changchun, capital of Northeast China's Jilin Province, reached 1.71 million square meters in the first quarter, up 23.8 percent year-on-year, the Xinhua News Agency reported on Wednesday, citing the local statistics bureau.

There is considerable demand for property investment in cities that are supported by favorable policies for local development, said Hui Jianqiang, deputy research director with real estate information provider Beijing Zhongfangyanxie Technology Service.

"As the Chinese government has shown its determination to tame the overheated housing market, regulations can be expected to follow immediately if prices surge due to illegal speculation," Hui told the Global Times on Wednesday.

The growth of the property market in South China's Hainan Province is a recent example.

There was spike in activity in the Hainan property market after the central government announced on April 13 a decision to develop the island into a pilot free trade zone.

This prompted the local government in Hainan to act quickly and roll out rules on April 22 to regulate the property market, requiring buyers without local household registration (hukou) to provide proof of having paid taxes or social security locally, for at least 24 months.

"I had been planning for quite a long time to buy a home in Hainan but have now given up because of the restrictions," a veteran property investor surnamed Pei in Guiyang, capital of Southwest China's Guizhou Province, told the Global Times on Wednesday.

"Expectations for the property markets in northeastern China seem to be rising," Pei said. "But regulations are likely to be unveiled if illegal speculation takes place."

Growth potential

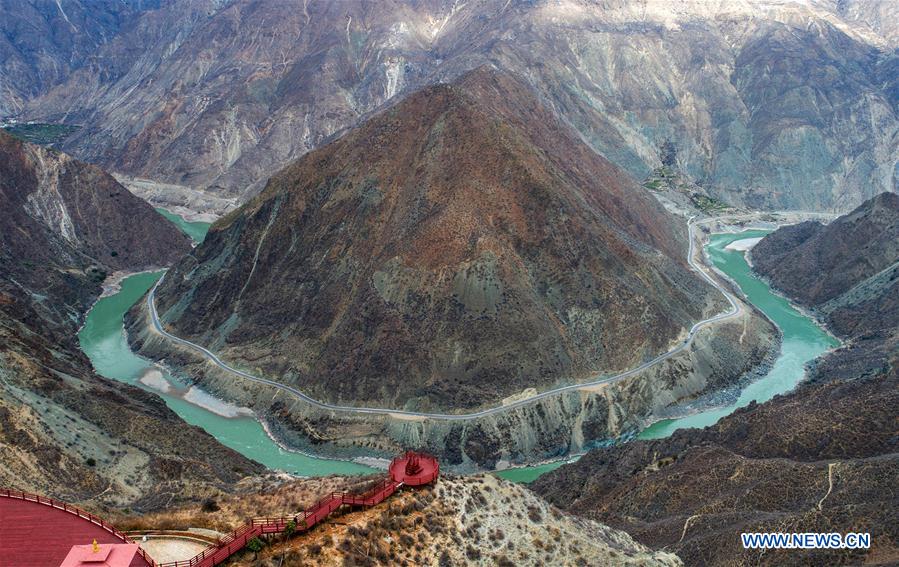

The real estate markets in second- and third-tier cities have great growth potential because subways and high-speed rail links are under construction and the trend of urbanization continues to grow in those cities, Yan Yuejin, a research director at the Shanghai-based E-house China R&D Institute, told the Global Times on Wednesday.

For example, thanks to expansion of Guiyang and relatively loose home purchase policies, the city has seen increasing investment in its property market, Yan said.

Experts said that governments in second- and third-tier cities have rolled out a series of rules to tighten local housing markets in the past year, and these regulations will be maintained in the second half of this year.

The property market in second-tier cities saw slower growth in March, with the year-on-year growth of new home prices sliding by 0.2 percentage points from a month earlier, according to data released by the National Bureau of Statistics on April 18.

Domestic housing authorities are also expected to announce differential policies to help address demand from various buyers, Hui said.

Buyers who work in large cities but have no savings will be encouraged to rent apartments initially, he said.