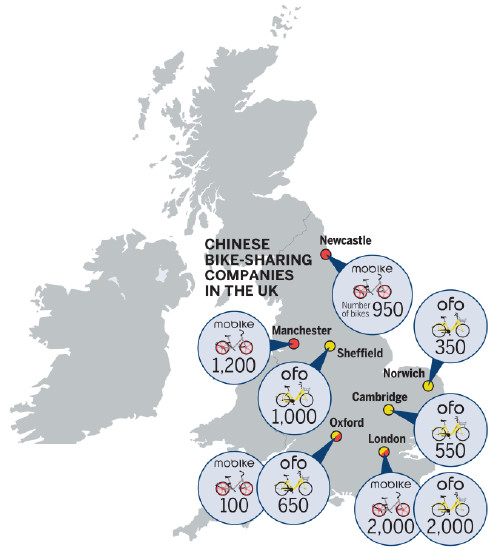

Since launching in Cambridge in April 2017, Ofo has spread to London, Norwich, Sheffield and Oxford, and will soon be available in Leeds.

The bike-sharing company has about 4,500 bikes on British roads-around the same as Mobike, which operates in Manchester, Newcastle, Oxford and London.

"We have 35,000 downloads of our app every month in the UK. We are very bullish about the future of this business," Seal-Driver said.

Both companies operate their fleets without docks, and users lock and unlock bikes using a mobile app.

For many Londoners who live on the outskirts of the city center, the scheme offers an alternative to London's docked bike-sharing system.

"I use both Ofo and Mobike, and the key reason is convenience," said Adam Silver, a bike-sharing user who lives in Southeast London.

"These bikes stretch far into my area and are incredibly easy to use. I go all over town with them, from an evening restaurant booking to a simple errand."

Silver said that he does have concerns over data privacy, as the apps record location information and access contacts.

"I always worry about data concerns, I do with every app but, for better or worse, those concerns are overridden by the convenience of the scheme," he said.

Both Ofo and Mobike say they only share GPS data with councils, and do so for free.

"The data is very valuable," said Pyer. "We don't keep anything about the person. It's all about cycling routes, cycling infrastructure, where the bikes are going. They can see exactly which roads they take, a really rich data set straight away."

For now, both companies say that data will remain with local authorities.

"We're not about to start advertising on bikes, we are not about to start monetizing the data," Pyer said.

As was the case in China when dockless bike-sharing first started, a number of smaller operators have begun to compete for riders across the UK.

Singapore-based operator oBike runs in Oxford, having withdrawn its bikes from London following an ill-fated launch last year when it did not inform councils of rollouts.

British company YoBike operates more than 300 dockless bikes in Bristol, while Dublin-headquartered Urbo runs 500 bikes across three London boroughs and 100 in Ipswich.

McGovern says Urbo's primary concern is not vandalism, but competition from operators with much larger financial clout. Both Urbo and Ofo compete for riders in the borough of Redbridge in East London.

"In Redbridge, we sat around the table with the council and Ofo to make sure we're on the same page," McGovern said. "We needed to ensure that rules were in place to ensure that predatory pricing doesn't occur."

In China, analysts have long warned that the bike-sharing sector is a bubble, with a surplus of operators backed by too much funding competing for too little profit.

Ofo recently raised $866 million in a financing round led by Alibaba Group, having already raised $700 million in 2017. Last year, Mobike raised $600 million in a funding round led by Tencent.

By comparison, Urbo is currently looking to raise 5 million euros ($6.2 million) to fund planned expansions in the UK and Ireland, and GoBee managed to raise $9 million in its last financing round.

Over the last year, four of China's 30-plus bike-sharing operators, including the third-largest, Bluegogo, have gone bust. Mobike and Ofo now control 90 percent of the market in China.

"Regulation is going to be key to ensuring healthy competition in this market," McGovern said. "We don't want to see any predatory pricing like we've seen in China, where some operators were giving free rides for as long as six months, meaning smaller, less-funded operators go out of business."

Dockless bike-sharing is not yet regulated by the UK government, though most operators including Ofo and Mobike have signed up to Bikeplus, an informal governing body for bike-sharing operators in Britain.

Bikeplus director Antonia Roberts estimates ride fares account for around one third of an operator's income.

"It's important that we find a way in order to collectively agree that we should allow businesses that aren't heavily financially backed to be sustainable, and not damaged by prolonged promotions or extremely low pricing and free offers," Roberts said.

Pyer said that Mobike welcomes regulation in the UK following the turbulent beginnings of the bike-sharing industry in Asia.

"With the benefit of hindsight, in China there should have been more regulation to start with," Pyer said.

"In the UK, you've seen images from China of massive bike mountains, and there was a bit of hysteria a year ago. But we've gone the other way-we've started with strict regulation, and everyone is now seeing the benefit."

Going forward, Mobike plans to expand to 15 cities in the UK by the end of the year, while Ofo wants to build its London fleet to 150,000.