Facing grim and complicated situations at home and abroad, China has vowed to lower corporate burden by a record-breaking amount to stabilize growth and benefit a wider range of companies and people.

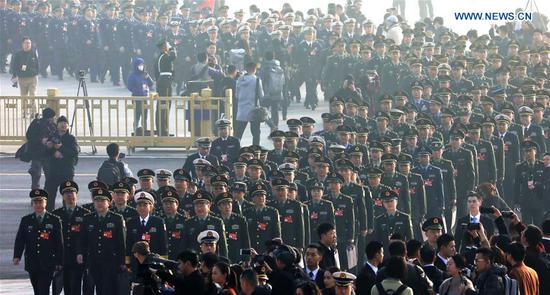

Following colossal tax and fee cuts by around 1.3 trillion yuan (about 194 billion U.S. dollars) in 2018, China will lower corporate burdens by nearly 2 trillion yuan this year, said the government work report delivered by Premier Li Keqiang on Tuesday at the opening of the annual legislative session.

The country will introduce both general-benefit and structural tax cuts, primarily reducing tax burdens on the manufacturing sector and small and micro businesses. It will also lower the share borne by employers for urban workers' basic pension.

Such massive cuts show the country has responded with confidence to greater risks and challenges, both foreseeable and otherwise.

Last year, China's gross domestic product grew by 6.6 percent, outperforming the official 2018 goal of "around 6.5 percent", but lower than the 6.8-percent growth registered in 2017. The national economy is confronted with mounting downward pressure, and the government has set this year's target range at 6 to 6.5 percent.

"We have the unshakable will and ability needed to prevail over difficulties and challenges of any kind, and our economic fundamentals are sound and will remain sound over the long term," Li said.

The massive cuts to corporate burden, along with other policies and measures specified in the government work report, highlight such will and ability and will help ensure stable expectations, steady growth and structural adjustments.

China is making its stance clear that it will never allow economic performance to slide out of the appropriate range, and meanwhile, the benefits from reform and development must be extensively shared.

Since 2018, the State Council has focused on tax-cut policies for small and micro companies in four of its executive meetings, with the latest one in early January 2019 outlining a three-year plan that will cut taxes by 200 billion yuan each year.

Such moves will not only strengthen the basis for sustained growth but also bring tangible benefits to a wider range of small and micro companies, which provide a majority of jobs.

For the fee cuts, although local areas are allowed to lower the basic pension contributions by employers for urban workers down to 16 percent, the government has also moved to ensure that social security funds are sustainable and both enterprises and employees benefit.

All in all, the tax cuts and fee reductions center on tackling the pains and difficulties currently troubling market entities.

As long as market entities are energized, it will become easier for the country to stand up to the downward pressure on the economy and keep the economy running in a reasonable range.