Sources say government mulls offering easier access for funding

The first group of companies to list on the new technology innovation board are expected to be high quality technology firms with good growth potential, as the government looks to encourage technology development by giving qualified companies easier access to funding, according to sources close to the nation's securities regulator.

Companies of a certain scale that possess promising growth potential will be the first to benefit from the new initial public offering platform, but definitive thresholds have not been hammered out and listing requirements are still in the works, sources said.

Unlike earlier market anticipation, the regulatory framework of the new technology innovation board is not likely to be the same as the strategic emerging industries board introduced in 2015, and sources said, "regulators want something new, so not so much can be borrowed from past experience. They want to borrow something good from the regulatory framework in the United States."

The China Securities Regulatory Commission earlier planned to launch a new IPO platform called the strategic emerging industries board in late 2015, but efforts were halted amid significant stock market volatility.

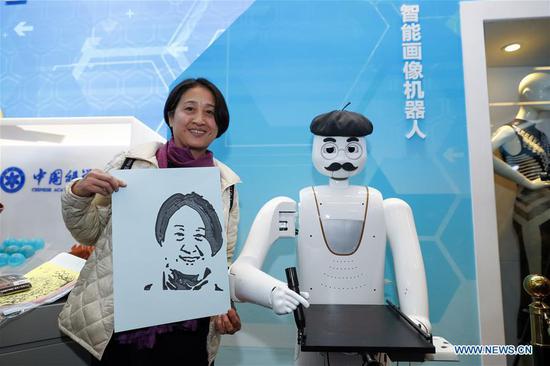

Market interest was reignited again after President Xi Jinping announced the plan to launch a new trading platform on the Shanghai Stock Exchange during the China International Import Expo held in Shanghai earlier this month. Qualified companies will be able to seek listings through a much more efficient registration system than that which currently governs IPOs in China.

"The first batch of companies are expected to be companies that have appointed an investment banker and started to prepare for a listing. They might focus on five major fields including integrated circuits, artificial intelligence, biomedicine, aerospace and new energy vehicles," wrote analysts with Citic Securities.

Some local governments have started to collect names of qualified candidates, setting high thresholds. According to a document from the financial services office of Wuxi, Jiangsu province, companies worth over a hundred million yuan ($14.4 million) and having positive net profits will be qualified to be on the list for further consideration.

Shen Meng, director of boutique investment bank Chanson &Co, said positioning is key. The new plan should become an efficient way for high-quality firms to raise funds and bring overseas-listed Chinese high growth and innovative companies back to raise funds in the domestic market.

Many technology startups and internet giants have adopted the so-called variable interest entity structure to raise funds, as they have difficulty meeting profitability requirements to list on the A-share market.