An employee works on the solar cell production line of a company in Huzhou, Zhejiang province. (XIE SHANGGUO/FOR CHINA DAILY)

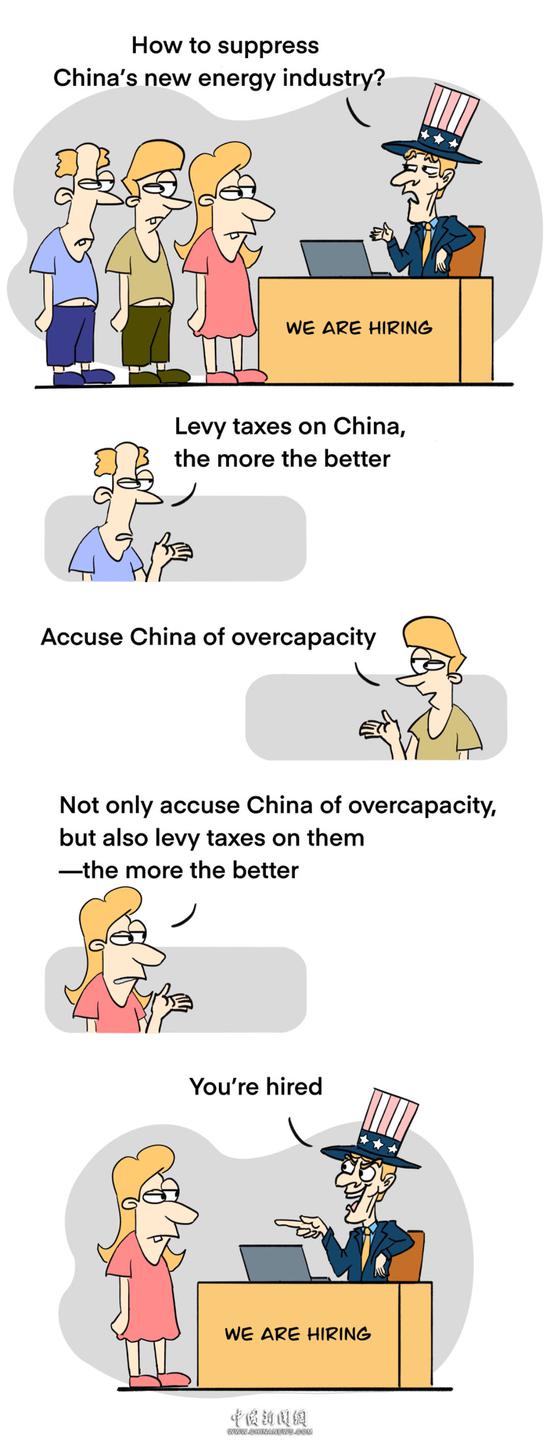

Solar products made by Chinese companies' overseas units or joint ventures are the target of a new round of U.S. investigation into allegations that imports from Cambodia, Malaysia, Thailand and Vietnam are unfairly subsidized and priced low.

Several U.S. solar product makers formally sought the probe last month, stating tariffs are needed for imports of such goods. Given that Chinese solar companies are increasingly setting up production facilities in Southeast Asia, experts said the probe is targeting Chinese imports in response to petitions of U.S. manufacturers who are reportedly struggling from fiercer market competition.

However, as China is diversifying its exports and the U.S.' solar industry is heavily relying on imports from Southeast Asia, any potential tariffs will hurt the consumers of such products in the United States more than the producers. The burden of such tariffs will likely pass on to U.S. solar project developers as well as consumers at large, experts said.

"China's PV (photovoltaic) industry has a significant advantage in technology, prices and (after-sales) service, thanks to years of large-scale development and technological iterations. The U.S. competitors are worried that China's PV industry will quickly dominate the global market, leaving little space for them," said Lin Boqiang, the head of the China Institute for Studies in Energy Policy at Xiamen University.

"Southeast Asia is a major source of imports for the U.S.. If tariffs are imposed, they would hurt the U.S. more as developers of solar projects as well as consumers may face higher payments on electricity amid U.S.' decarbonization of its power sector," Lin said.

In 2023, the top three countries from which the U.S. imported PV cells were Malaysia ($320 million), South Korea ($130 million) and Vietnam ($90 million). Imports from Southeast Asian countries totaled $460 million, accounting for 70 percent of the total U.S. imports of PV cells, data from the China Chamber of Commerce for Import and Export of Machinery and Electric Products showed.

In 2023, PV module imports into the U.S. from Southeast Asian countries were worth $12.51 billion, making up 82.7 percent of the total import value.

"It's hard for the U.S. to find any substitutes to solar products imported either from Southeast Asia or China. Its upstream industrial chain is relatively weak and is seeking new producers from countries such as Mexico and India. The investigation and tariffs are more of a method to win more time," Lin said.

A majority of economies globally are offering financial support to solar companies at an early stage of development — and the U.S. is no exception in this context.

Last year, the U.S. Department of Commerce claimed certain Chinese producers were shipping their solar products through Cambodia, Malaysia, Thailand and Vietnam for minor processing in an attempt to avoid paying anti-dumping and countervailing duties.

"Chinese photovoltaic companies have significantly expanded internationally in recent years. Through joint ventures, they produce related products in Southeast Asian countries. If tariffs are imposed, the cost of these products entering the U.S. market would increase. The move will not only affect Chinese companies but also hurt local firms and international joint ventures in the area that also export solar products to the U.S.," said Zhou Mi, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation.

京公网安备 11010202009201号

京公网安备 11010202009201号