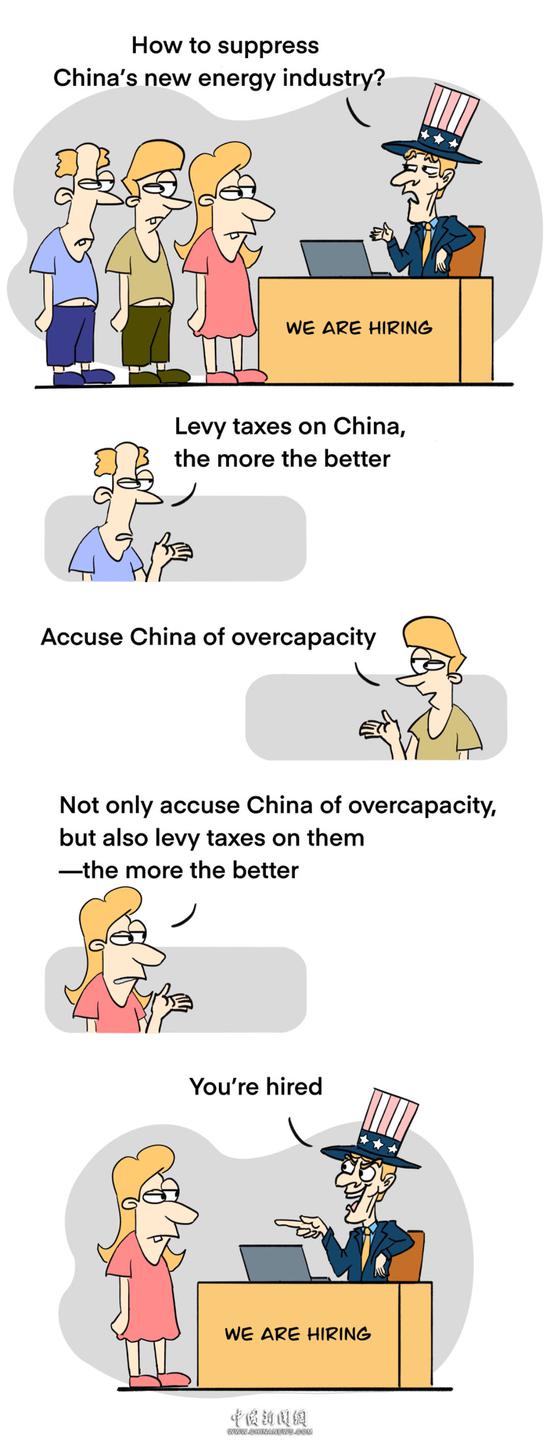

Fast-fashion company weighs options as resistance hinders New York listing

Shein, which is preparing for an initial public offering, has joined TikTok as another company connected to China having to deal with political resistance in the United States.

In November, the fast-fashion e-commerce company filed paperwork confidentially with the U.S. Securities and Exchange Commission for a New York IPO, but it has yet to be approved.

In an interview with the Financial Times published on Thursday, Shein Executive Chairman Donald Tang said progress has been made on changing the perception of Shein in the U.S., but so far it has not been enough to convince U.S. lawmakers.

That has led Shein, valued at $66 billion in May last year by PitchBook, to formulate a backup plan to list on the London Stock Exchange.

While Tang has not confirmed if the IPO is headed to London, several people familiar with the company said it was prioritizing the IPO in the United Kingdom, the FT reported.

Tang, however, said, "No decision has been made."

Shein prefers New York as its listing venue and plans to keep its application current, in case there is a change in the stance of U.S. regulators, a source told Reuters. It may also pursue a secondary listing in New York following the potential London IPO when it deems the political climate to be more favorable, the source said.

David Swartz, senior equity analyst at Morningstar, said in a report last week: "Shein would be a large IPO in the apparel industry. There aren't that many apparel companies in the world with valuations that large. Yet Shein is really stuck in the middle of greater geopolitical forces."

Kathleen Brooks, research director at XTB UK, told Morningstar: "Obviously, it is quite good for the London market regardless of what you think about fast fashion. It is a giant company, and it could be one of the largest stocks if it's on the FTSE 100."

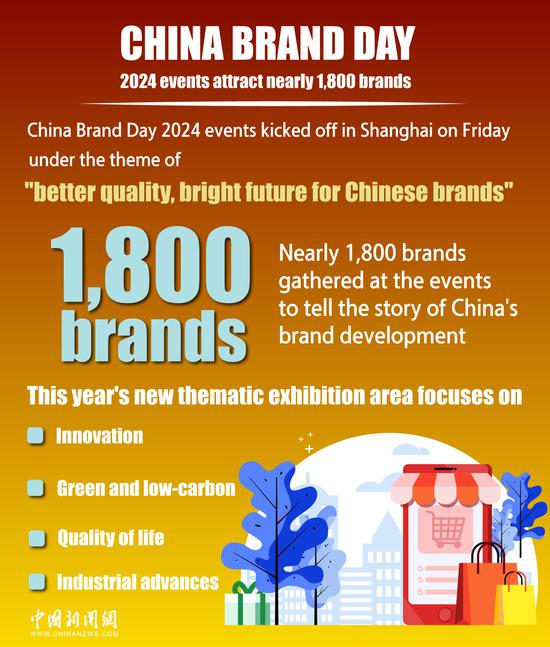

Shein, which sells its products in more than 150 countries, was founded in Nanjing, Jiangsu province, in 2008, by entrepreneur Sky "Chris" Yu. Although it moved its headquarters to Singapore in 2022, its supply chain and warehouses are based in China, particularly in the greater Guangzhou area of Guangdong province.

Shein does not own or operate any manufacturing facilities, relying instead on about 5,400 third-party contract manufacturers, mainly in China.

TikTok, the popular social media app owned by China's ByteDance, has faced repeated political efforts to limit its operation at state and federal levels in the U.S.. That pressure eventually resulted in legislation that gives TikTok until January to either find a buyer or face a U.S. ban.

Shein told fashion publication Women's Wear Daily that it is also considering Mexico as a manufacturing hub, which, under the Mexico-U.S. free trade agreement, would allow goods to be sent duty-free into the U.S..

Repeated rejection

In the U.S., Shein has attempted to join the National Retail Foundation, or NRF, the industry's largest and most influential trade association, but has been repeatedly rejected, CNBC reported, citing people familiar with the matter.

Being a member of the NRF "definitely would put a little bit more pressure on the politicians to accept the company", John Zhang, a Wharton School professor and founding director of the Penn Wharton China Center, told CNBC.

"Simply because the peers recognize the company and they think that it is a worthy competitor. … That would definitely create a little bit more legitimacy," he said.

"Most importantly, I think that (NRF membership) really creates the perception among the investors that this is just one of the normal retailers."

Temu, another highly successful Chinese fast fashion retailer, ran catchy, pricey commercials during the NFL Super Bowl broadcast in February, which CNN estimated cost $15 million.

Shein and Temu have also faced criticism from U.S. lawmakers who said the online retailers take advantage of the "de minimis" rule, which exempts shipments valued below $800 from U.S. customs inspection and taxes, by shipping parcels to the U.S. directly from Chinese ports.

京公网安备 11010202009201号

京公网安备 11010202009201号