A worker at a bridge construction site in Guiyang, Guizhou province. (Photo/Xinhua)

Chinese local governments issued debt worth 378.89 billion yuan ($55.26 billion) last week, a record high weekly issuance amount for the country, according to data from financial information servicer Wind Info.

This came after the surge in local government debt issuance in August and July, said the Ministry of Finance on Friday. The country issued local government bonds worth 883 billion yuan in August and 757 billion yuan in July, with the two-month aggregate exceeding the first six months' 1.41 trillion yuan.

The accelerated issuance in local government debt was mainly due to special-purpose bonds, debts financing specific public-interest projects. August saw the issuance of 428.75 billion yuan worth of special-purpose bonds for new projects, a jump of 293 percent month-on-month and 217 percent year-on-year, according to the ministry.

The newly issued special-purpose bonds, mainly for infrastructure construction projects, could prompt follow-up infrastructure investment and credit expansion, injecting momentum into the economy, said a report by Guotai Junan Securities Co Ltd on Thursday.

The report expected the stimulus to investment will take effect in the fourth quarter, addressing the slackening growth in infrastructure investment of 4.2 percent year-on-year in the first half.

Despite the tremendous increases in local government debt, the total has been well within this year's upper issuance limit set by the nation's top legislative body. Special-purpose bonds, worth about 570 billion and 270 billion yuan, may be issued in September and October respectively, predicted the report.

"Government investment in infrastructure projects could attract follow-up private investments by giving investors the expectation of better operational sustainability and credit endorsement", said Zeng Kanghua, a public finance professor at the Central University of Finance and Economics.

"The total amount of local government debt is currently affordable, with which related systemic risks could hardly happen," Zeng added.

In order to avoid regional difficulties in repaying government debt, the efficiency of project investment in boosting local economies is of importance, he said. "This is because the debts can be repaid by revenue generated by the projects, such as highway charges as well as increased fiscal revenue accompanied by higher economic growth."

Approximately 70 percent of the value of special-purpose bonds issued in January-August were "Project Income Debts", whose principle and interest are repaid only by income generated by the projects, according to the report from Guotai Junan Securities.

Repayment risks have been further controlled under this structure as sources of repayment are planned and specified in advance, said Zeng.

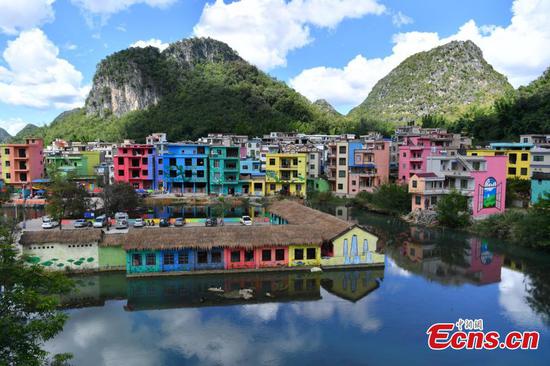

The report also wrote "Project Income Debts" have invested in new target areas this year, such as environmental protection, medical care and water utilities. For instance, Southwest China's Yunnan province issued such a debt of 1.9 billion yuan this year to solve the ecological deterioration of its lakes and wetlands. This trend is in line with the country's proactive fiscal policies to address weak links and boost the real economy.

Chinese provincial-level local governments issued 1.41 trillion yuan worth of bonds in the first half, 24.2 percent below the level recorded in the first half of 2017. Among the total amount, 76.4 percent were swap bonds (issued to refinance legacy debt) and refunding bonds (issued to refinance outstanding bonds).

"This low issuance is because of seasonality and a reduced need for swap bonds, because most of the legacy debt had already been swapped in the previous three years. However, we expect issuance to increase during the rest of 2018," said Daisy Zhang, an analyst with Moody's.