Dubai International Financial Centre (DIFC) has signed a memorandum of understanding (MoU) with China's state-owned Everbright Group (CEG), the DIFC said on Saturday in an e-mailed statement.

As the biggest free zone in the Middle East, DIFC said that CEG aims to explore collaboration opportunities related to China's Belt and Road Initiative (BRI).

The agreement will support the Group, which operates across banking, securities, insurance, funds, asset management, futures and investment management, expand its business across the Middle East, Africa and South Asia (MEASA) region, said DIFC.

The MoU was signed by Arif Amiri, Chief Executive Officer of DIFC Authority, and Ge Haijiao, Deputy General Manager of CEG, following a meeting between Essa Kazim, Governor of DIFC, and Li Xiaopeng, Chairman of CEG.

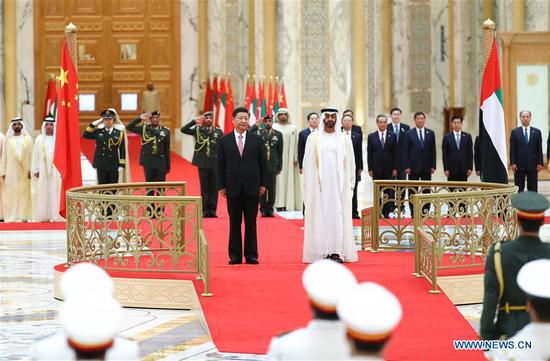

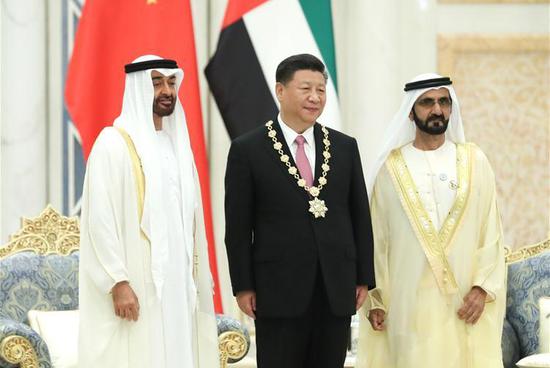

The UAE government supports BRI, proposed by China in 2013, which refers to the Silk Road Economic Belt and the 21st Century Maritime Silk Road, aiming at building a trade and infrastructure network connecting Asia with Europe and Africa along the ancient trade routes of the Silk Road.

Kazim said "through our collaboration with China Everbright Group, we believe that DIFC is perfectly positioned to facilitate significant opportunities as part of the Belt and Road Initiative."

He added "we are proud of the record growth that Chinese institutions have achieved through the DIFC, and are looking forward to supporting the Everbright Group as it expands its global footprint."

Li said the synergies between China and the UAE continue to grow stronger. Dubai, in particular, has proven to be the ideal location from which we can access the fast-growing emerging markets in the MEASA region.

DIFC is already home to China's four largest banks, which have upgraded their banking licences from subsidiaries to fully-fledged branches.

In addition, numerous Chinese corporations headquarter in the region, including PetroChina, Shanghai Electric Investment, ZTE Corporation, New Silk Road Company and CMEC Thar Mining Investments.

DIFC has continued to see growth from the registered Chinese financial institutions, which accounted for 22 percent of total assets in the financial center at the end of the third quarter of 2017.

The total value of these assets reached 33.4 billion U.S. dollars, a 30.5-percent increase from 25.6 billion dollars reported at the end of 2016.

By 2024, DIFC aims to harbor 1,000 financial companies from across the globe.