Rebound: Positive outlook bodes well for flow of capital

The A-share market will recover further in the fourth quarter as China's economic fundamentals continue to improve over the following months and supportive government policies provide more impetus for economic growth, experts said.

The signs of stable economic growth, evident in the areas of business activity and consumption, will form the foundation for a turnaround in the A-share market, where low valuations have already made it an attractive investment prospect, they said.

Supportive policies that the Chinese government introduced earlier this year to invigorate the capital market, combined with the outlook of relaxed global liquidity as interest rate spikes likely come to an end, will usher in more capital flow to the A-share market and boost investors' confidence, they added.

Timothy Moe, Asia-Pacific chief strategist at investment bank Goldman Sachs, said on Tuesday that the sequential improvement in China's fundamentals, low valuation of A shares at present and the typical seasonal tailwind in the fourth quarter will all support Chinese equities for the rest of the year.

In a portfolio strategy research note released on Sunday, Goldman Sachs experts said they hold an overweight strategy for A shares, thanks to the alignment between supportive policies and China's growth objectives, including self-sufficiency, building an electric vehicle supply chain and mass market consumption.

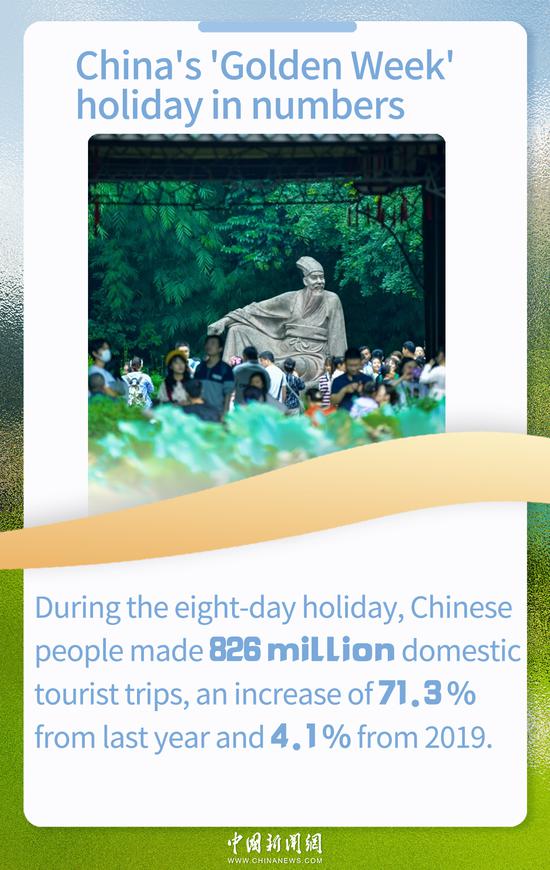

Analysts at China Securities expect a further recovery in the consumption sector, citing the healthy retail and travel data recorded during the recent Mid-Autumn Festival and National Day holidays as proof. The recovery in car sales in September should also be considered a sign of improving consumption data. The momentum is likely to be sustained in October, they said.

Analysts from Essence Securities said the A-share market has already touched bottom in terms of both performance and investor sentiment. Technology companies and small-cap companies may lead the rebound, as previous policies have favored their long-term development.

China's small and medium-sized enterprise development index climbed 0.2 point from a quarter earlier to 89.2 in the third quarter, returning to expansion territory and reaching its highest level in two years. Xie Ji, secretary-general of the China Association of Small and Medium Enterprises, the index compiler, said the increase has demonstrated that the economic stimulus packages introduced earlier this year are showing positive results.

Zhang Qiyao, chief strategist at Industrial Securities, said that foreign institutions' positive outlook on China's economic growth will mitigate the pressure of capital outflow in the A-share market and even result in capital inflow in the following months.

Experts from United States-based Vanguard Investment Group agreed that there are signs of economic growth stabilizing in China, based on the better-than-expected data in trade, inflation and credit demand in previous months. Therefore, they maintain their forecast that China's GDP growth will be between 5.25 and 5.75 percent in 2023.

In late September, JP Morgan raised its forecast for China's 2023 GDP growth to 5 percent, up from its previous estimate of 4.8 percent.

Zhang Xia, chief strategist at China Merchants Securities, said the US Treasury bond yield may start a downward cycle in the near future. Given the cyclical rise of the renminbi's value in the fourth quarter, the liquidity for the A-share market will improve and foreign capital inflow may accelerate in the following months.

But there are also challenges to be addressed. Luca Paolini, chief strategist at Pictet Asset Management, wrote in a note released on Tuesday that a recovery in the property sector is "a missing piece of puzzle" that could bolster consumer confidence.

Similarly, the International Monetary Fund lowered on Tuesday its 2023 economic growth forecast for China to 5.0 percent from 5.2 percent, due to the risks in the property sector stifling economic activity and weighing on household confidence.

The IMF has lowered its 2023 forecasts for all the major economies except the US.

京公网安备 11010202009201号

京公网安备 11010202009201号