The government will continue to expand debt financing channels to support spending on infrastructure construction this year to help offset a sharp slowdown in fiscal revenue growth, said the Ministry of Finance.

The effects of the 2 trillion yuan ($308 billion) tax and fee cut plan-the most aggressive in the country's history-were evident in the first quarter.

Tax and fee growth sharply declined by 11.9 percentage points from a year earlier to 5.4 percent by the end of March, the ministry said on Tuesday.

To supplement the funding gap, the ministry will allow more local governments to sell bonds to retail investors in an attempt to expand financing channels and sustain fiscal balance within the budget.

The new bond issuances are also expected to increase liquidity and provide more investment options for individual savings, said Li Dawei, deputy head of the ministry's National Treasury Department, at a news conference on Tuesday.

The bond pricing mechanism will be further improved, the official added.

Under a pilot scheme, the first group of six provinces and cities sold 6.8 billion yuan in bonds at commercial bank counters to individual buyers between March 22 and early April.

The coupon rates are between 3.01 percent and 3.33 percent, higher than treasury bonds issued by the central government as well as bank deposits with the same maturity.

Gross local bond issuances hit 1.18 trillion yuan in the first quarter, compared with only 219.5 billion yuan in the same period last year.

The total quota for 2019 local government bond issuances is 3.08 trillion yuan, according to the Ministry of Finance.

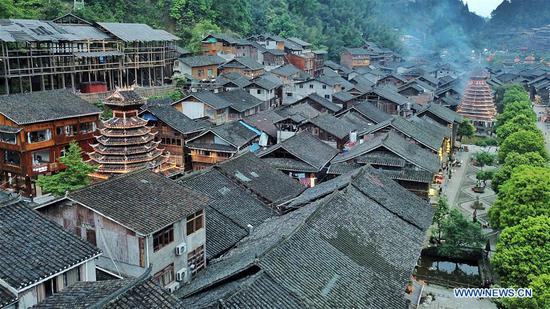

"About 60 percent of the bonds were issued for ongoing construction, especially for shantytown renovation projects, railways and roads," said Hao Lei, head of the ministry's Budget Department.

While debt financing continues to grow, the government is experiencing sharp declines in fiscal revenue growth, especially from tax and land sales, official data showed.

From January to March, government tax income increased by 5.4 percent year-on-year, 11.9 percentage points lower than that in the first quarter 2018.

Individual income tax decreased by 29.7 percent, the largest drop among three major tax items. Value-added tax growth has already slowed to 10.7 percent, down from 20.1 percent a year earlier.

Local government income from land sales fell 9.5 percent in the first three months, the Ministry of Finance said.

As the central bank has taken a pause in monetary easing, fiscal policy should remain proactive to stabilize economic growth and ensure the recent rebound is not just a seasonal fluke, said economists.

Xu Xianchun, a former deputy director at the National Bureau of Statistics, said that fiscal policy should be implemented "with proper intensity and at the right time", to prevent large fluctuations in the investment growth rate and negative impact on economic stability.

Fiscal spending can directly influence fixed-asset investment, and it could also leverage on more bank lending and attract private funds to increase investment, said Xu.

In the meantime, allowing retail access to local government bonds will help diversify the investor base and increase market liquidity, said Amanda Du, an analyst at Moody's Investors Service.

The analyst expected access for retail investors to widen to encompass all local government bonds in 2020.