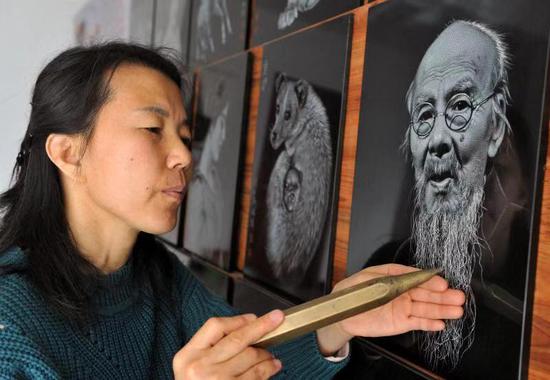

The People's Bank of China, the central bank, is the watchdog of the commercial banks' lending. (ZHANG GANG/FOR CHINA DAILY)

Chinese authorities have taken a series of measures recently to ease the risk of pledged shares.

The measures include providing liquidity to listed companies via financial investments.

Share-pledging refers to shares being pledged as collateral for loans.

This type of lending has grown strongly since 2014 before moderating this year, driving up operating risk for securities companies because of the practical difficulties they face in selling underlying stock collateral in a timely fashion.

Recent stock market volatility has added to the liquidity and credit risk of these loans by reducing the coverage ratio of pledged shares as collateral, said Moody's in its latest credit outlook report.

The Securities Association of China announced on Oct 22 that Chinese securities companies will set up a special scheme to reduce risk on lending on pledged shares.

The scheme has seed funding of 21 billion yuan ($3 billion) contributed by 11 securities companies and has a target of 100 billion yuan, which the association aims to achieve by attracting additional money from banks, insurers, State-owned enterprises and government investment platforms.

If successfully implemented, the scheme will be credit-positive for Chinese securities companies because it will reduce their credit risk on their lending on pledged shares and reduce the potential for impairment losses, according to Moody's.

"We believe the investments will ease the liquidity pressure that pledge borrowers face in refinancing maturing pledged-stock loans. The investments will also fulfill potential margin calls, thus lowering the credit risk that securities companies face," Moody's said in its report.

"Moreover, the Securities Association of China's pledge that the scheme will be run by securities companies under commercial operating principles is likely to restrict its support to only those listed companies with strong credit standings. This reduces the operational and moral hazard risk if the scheme is implemented successfully," the report said.

Three days after the SAC's announcement, the China Banking and Insurance Regulatory Commission posted a notice on its website, allowing insurance asset management companies to set up special financial products to invest in listed companies.

The investment targets of these products include shares of listed companies, publicly issued bonds of listed companies and their shareholders, and non-publicly issued exchangeable bonds of the shareholders of listed companies.

Insurance companies, along with institutional investors such as the National Council for Social Security Fund and the asset management products of financial institutions, will become major investors in the special products, according to the banking and insurance regulator.

For insurance companies, the balance of their investment in these products is not counted as part of their equity assets and therefore is not restricted by the relevant rules. According to the existing regulation, the balance of an insurance company's overall investment in equity assets should not exceed 30 percent of its total assets at the end of the previous quarter.

Asset management professionals considered the change in the investment proportion calculation method as an incentive for insurance companies to increase their investment in listed companies.

Many insurance companies and their asset management subsidiaries, including China Life Asset Management Co Ltd, are preparing for the launch of special products, said people familiar with the matter.

Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, requested banking institutions to manage risk on pledged shares lending scientifically and rationally by taking proper measures, based on a comprehensive evaluation of a company's actual risk and future prospects.