When U.S. President Donald Trump made his first state visit to China in November last year, liquefied natural gas (LNG) related agreements between the U.S. and China were numbered in tens of billions of dollars.

The State of Alaska and Alaska Gasline Development Corporation signed a memorandum of understanding with China Petrochemical Corp, China Investment Corporation and Bank of China for deals valued at $43 billion.

Houston-based Cheniere Energy and China National Petroleum Corporation signed long term LNG sale and purchase agreements valued at more than $10 billion.

The LNG deal between Delfin Midstream and China Gas Holdings was valued at $8 billion.

Those deals were touted by Trump then as a big win for his visit. But now, if China's proposed 25 percent tariff on U.S. LNG takes effect, either they will be off the table or both American and Chinese companies will suffer financially to stick to the deals.

China's tariff proposal is in retaliation to Trump's proposed new round of tariffs on Chinese goods.

The situation has the energy industry in both countries worried, said Barry Worthington, executive director at the Washington-based U.S. Energy Association.

Worthington was in Beijing last week for the International Energy Forum, and he described the mood there as one with "a lot nervousness because no one is sure what will happen with the tariff.

"You have some people on both Chinese and U.S. sides who are convinced that the tariff is going to take effect and have terrific impact on both countries. There are others who think that people on both sides are negotiating a package and that at the end of the day, there will either be no tariff or a tariff for a very short period of time. The opinion is a 50-50 split on both U.S. and China sides."

If the tariff takes effect and remains, the impact will be significant, said Worthington.

"There are multiple buyers and sellers in global market, Chinese buyers will find other sources, U.S. producers will find other buyers, but neither side will be happy," he said. "You will see price adjustment on both sides. U.S. producers sell at lower price, and Chinese buyers are likely required to buy at higher price. Neither side wins with a tariff."

With the price of crude oil going up and currently at above $70 a barrel, West Texas drilling activity, cooled by the price slump two years ago, has been booming again since the beginning of 2018. Yet, the boom could bust sooner than expected with the tariff spat between U.S. and China.

Li Shaolin, president of PetroChina International America, a Houston-based CNPC subsidiary, said that the proposed tariffs list includes not only LNG but also many other oil- and gas-related chemical products. The tariffs will have a profound impact on the U.S. energy sector.

"Then U.S. has to look for other markets around the globe, and this will lower their competitiveness in the global market, consequently impacting oil and gas production," Li said.

It will also force China to look for products elsewhere. "It will affect our business of exporting U.S. crude oil to China," Li said.

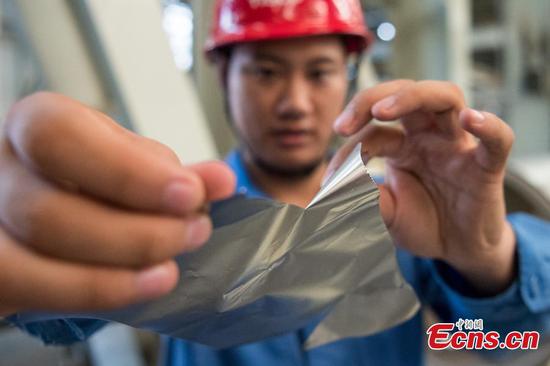

The U.S. lifted LNG export to China about two years ago. With China's policy shift to cleaner energy, anticipated U.S. LNG exports to China and elsewhere initiated construction of a few large LNG terminal projects.

Those projects will be affected by the tariffs, said Worthington.

There are two LNG export terminals in the U.S., one in Maryland and one in Louisiana. They are actively loading shipments as quickly as possible, according to Worthington.

Four more LNG export terminals - one each in Georgia and Louisiana and two in Texas - are under construction and are expected to go into operation by the end of 2019.

"Those are multi-billion dollar investments. Once completed, they will look for export cargos as quickly as they can. The real impact of a tariff will come out for the next a few terminals. If the tariff takes effect, those future terminals might have trouble getting financed," Worthington said.

Despite the potential tariff threat, Worthington said he is optimistic.

"People in the industries and governments are very aware the negative consequence of tariffs on the energy sector. Before both governments allow that to happen, they will find a mutually useful deal for citizens on both sides," Worthington said.