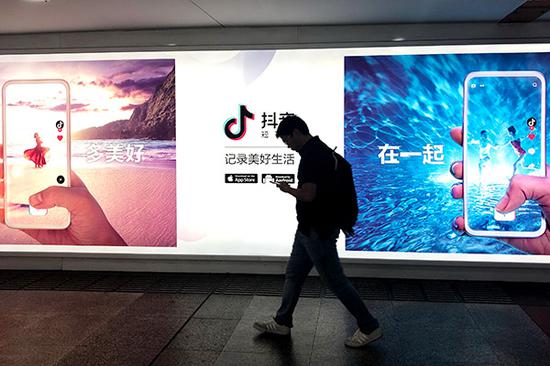

A man passes an advertisement for Douyin in Shanghai. Chinese short video apps such as Douyin have received a boost in recent months, with a particular focus on overseas markets. (Photo provided to China Daily)

Domestic firms seeing increased use of apps overseas, especially in emerging economies

Chinese short video service providers are expanding their focus as they attempt to capitalize on overseas markets.

Dai Bin, mobile analytics company App Annie's country director for China, said China's booming short video services gained strong momentum globally in recent months, as leading domestic companies saw increased use of their apps overseas, especially in emerging markets.

"Chinese short video apps have received a boost in recent months, with a particular focus on overseas markets," Dai said. "For instance, Douyin and Kuaishou have become popular in Japan and Southeast Asia, respectively. I expect they will see more downloads and revenue coming from overseas markets in the near future."

Douyin, a popular short music-video app, recently announced its global monthly active users had reached 500 million in more than 150 countries and regions.

According to consultancy Sensor Tower, Tik Tok, the overseas iteration of Douyin, was downloaded 45.8 million times during the first quarter this year, surpassing Facebook and Instagram to become the most downloaded iOS application.

Tik Tok has also attracted a huge following among Japanese netizens, ranking third in terms of downloads on Apple Inc's App Store and the Google Play Store in June, according to App Annie.

Beijing Bytedance Technology Co Ltd, the parent company of Douyin, which operates several of the stickiest apps in China, has been ramping up efforts to expand its booming short video service empire globally.

Vigo Video, the overseas version of Huoshan Video, which is backed by Bytedance, ranked fourth and fifth for downloads in June on Apple's and Google LLC's Indian and Brazilian stores, respectively.

Similarly, a lip-syncing app purchased by Bytedance last November has also made a name for itself by monetizing young people's massive enthusiasm to produce and share 15-second videos.

Ever since its launch in 2014, with a focus on users in the United States, its digital product has been a runaway success. It ranked eighth for downloads on the iOS and Google Play stores globally, one spot ahead of Tik Tok.

Douyin's rival Kuaishou, which has gained popularity among China's rural communities and migrant workers, took fifth place by revenue in the first quarter of this year, according to App Annie. The analytics company said more than half of Kuaishou's new users in the first quarter were from overseas, compared with Douyin's 40 percent.

The short video frenzy powered by leading domestic firms is unsurprising, considering tech-savvy millennials' rising embrace of the mobile internet and their love for sharing experiences and social networking.

"Short video services meet people's growing need for new forms of entertainment and easily transcend cultural barriers. They still need to focus on facilitating localization in different markets, as it is really hard to apply their former operational experiences to new markets," Dai said.

According to Dai, of all the Chinese apps in overseas markets, social and entertainment apps are the fastest-growing in terms of downloads and revenue, surpassing tools and utilities apps.

A report released by mobile research institution Cheetah Global Lab said it is an opportune time for Chinese mobile internet companies to go global, buoyed by the rising popularity of smartphones globally and the demographic dividends in emerging markets.

Dai said that as domestic firms continue to expand globally, they also need to be more aware of cultural and regulatory challenges in overseas markets.

"They need to take potential regulatory risks into consideration, having a better understanding of local policies," Dai said. "I would also suggest that providers have unique differentiation and newcomers should avoid entering countries already dominated by early arrivers."