(ECNS)-- The world now is in the toil of profound changes unseen in a century combined with a once-in-a-century pandemic. Grey rhinos and black swans have emerged one after another, flooding the world with uncertainties. Looking into the future, people have expectations and confusion.

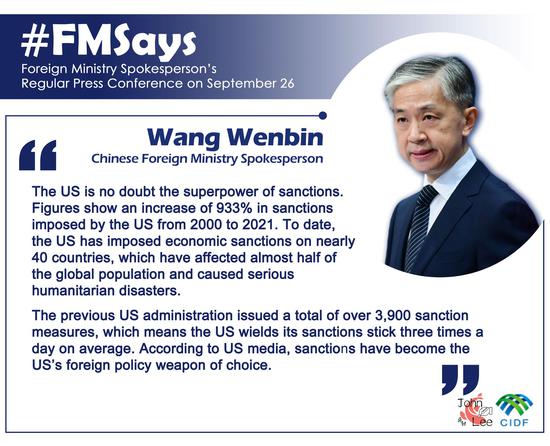

However, when the world is itching for cooperation and solidarity, some Western countries put their own interest first by resorting to unilateral sanctions and long-arm jurisdiction, advocating decoupling and chain-breaking, thus building high walls around their small bloc.

Is globalization, which improved the lives of billions worldwide, really coming to an end? What is the prospect of Sino-U.S. relations which is key to the world situation? In the latest W.E. Talk, Gal Luft, co-director of the Institute for the Analysis of Global Security (IAGS) and also senior adviser for the U.S. Energy Security Council was invited to talk with Di Dongsheng, Professor and deputy dean of the School of International Studies of Renmin University of China and Ding Yifan, former deputy director and senior fellow at the Development Research Center of the State Council.

Here's an excerpt of the dialogue:

Why is the U.S. keen on building blocs in confronting China?

China News Service: How do you evaluate the IPEF promoted by the U.S.?

Gal Luft: I don't think that it's done with enthusiasm. How do you know that two years from now, another president will come and trash the whole initiative and come up with a new genius idea? And the countries in this framework will never do anything that will compromise their relations with China, which is the No.1 trading partner, basically all of them.

Di Dongsheng: In the past 1.5 years, this government of the United States, has already created many new words. All those new cases, new plans, new terms, resulted in nothing in the past 1.5 years since the political division between the two parties and also between the different factions of the same party. So this IPEF might also end in vain.

Ding Yifan: None of these ASEAN countries is really interested in the so-called Indo-Pacific security strategy. Even India doesn't pay a lot of attention to this. The United States wanted to force those countries to choose a side, where none of them wanted. They wanted to maintain this cooperation with everyone in the region. When the United States and China were in good relations, on good terms, those countries feel in a good position, a better position. Frankly, to be decoupled from China will be a huge cost for those countries. While the United States wants them to be decoupled from China, the U.S. is not ready or is incapable of offering much assistance to those countries for their development.

China News Service: Why is the U.S. so keen on building small blocs to contain China?

Ding Yifan: The United States has hundreds of military bases around the globe. They have to spend a lot of money to maintain this kind of military presence, and meanwhile, it has to maintain these relations with those coalition members. After the Cold War, it becomes more and more costly to maintain this kind of coalition. And then, furthermore, you have to find an objective for maintaining this kind of coalition. In Europe, for example, if there were no Russia, there was no reason to maintain the framework of NATO. So to maintain the frame of NATO, you have to create a threat, an enemy. While here in Asia-Pacific, the United States is very concerned to be caught up by China. To maintain its leadership, it wants to somehow retard China's development.

China is like a mirror reflecting the decline of the U.S.

China News Service: What do you think is the core issue or reason for the current difficulties in Sino-U.S. relations?

Gal Luft: The issue between the U.S. and China is not about what China is doing, but about specific actions that China needs to perform. I think it's much deeper than any of this. China is like a mirror. It represents America’s decline. China represents America's inability to lead the world. China represents America's divisions.

China is what China is. China is not going to become America in order to appease America. It's not about you telling China if you all do ABC, we will open a new chapter in our relations.

Ding Yifan: In the nature of the American political regime, when they have some difficulties, they have to find a way to find an external enemy, to try to find a common denominator of national unity. The United States might be caught up in the very near future by China. That's the biggest threat. I think that Gal is right by saying that the more the United States feels its own decline, the more it will take China as a threat or an enemy.

Di Dongsheng: When will the China-U.S. relationship finally be restabilized to come to a new equilibrium? I believe, by then, maybe China's economic size is obviously bigger than that of the United States and Chinese military capacity in some important aspects. By then, Chinese top leaders are still committed to the peaceful rise and a community of shared future for mankind. Then the United States, especially the political leaders, will calm down and gradually more and more politicians will pursue China as a potential partner instead of a real, substantial, fatal threat.

Are we shifting from globalization to regionalization?

China News Service: Why does globalization encounter so many setbacks in recent years? And what are the main characteristics of this tendency?

Ding Yifan: I think the deglobalization has been prompted by those kinds of social redistribution in developed countries, especially in the United States, but also partially in European countries. But emerging markets are considered by those developed economies in Europe and the United States as the biggest beneficiaries of globalization. And so in this way, the developed economies think that globalization has ruined their interests. So they wanted to reverse the tendency of globalization.

In the United States, for example, they are overtly preaching for the return of state intervention and rising against the neo-liberalists. That's why those legislators in the parliament in Europe, the congressmen in the United States, are preaching to force those multinational companies to come back, and so that created a risk of long-term stagflation in the world, especially in those developing countries.

Gal Luft: I would say that globalization was a project of the West, and deglobalization is a project of the West as well. So to me, all it says is that the West is still the designer of any order or disorder that is coming to bear. We've seen how globalization did not deliver in the sense that in the face of a global challenge, we did not see any synergies, and in fact, each country, each region for itself. And I think that is a cautionary tale, because it means the wonderful idea that if we are all in this together, and we are all part of a global village, and when it faces the real stretch test, it fails miserably.

I think it will only add ammunition for the skeptics. What I do think we will see is a shift from globalization to regionalization in which the world would be divided into smaller footprint type of coalitions along more geographical dimensions where they will be able to do their many globalization but on a regional level in which they are less dependent on foreign forces.

China News Service: Do you think the current multilateral, liberal world trade order will somehow be put to an end by deglobalization? And will we see the end of the hegemony of the U.S. dollar?

Gal Luft: The thesis of my book, De-dollarization: The revolt against the dollar and the rise of a new financial world order, and even the title of the book, speaks about the revolt against the dollar. What we are seeing today, is a revolt, a mutiny against the hegemony of one currency, of one country that is also using its economic power to punish everybody right and left and coerced and sanction and intimidate. And in the world, one by one, countries are standing up and saying enough is enough.

I think that the Ukraine story has really boosted this, because countries have seen how vicious and how aggressive the West can be in weaponizing currency. Within less than a year, we've had two cases of the United States freezing central bank assets, first in Afghanistan, and later on in Russia. This is unheard of. You've never seen something like this in the history of money. So I think that this is giving pause to every country, which could be next on the chopping blog. I think the U.S. will be facing more and more the cost of its international behavior.

Di Dongsheng: The world trade will continue, but it will not grow as we have witnessed before in the past four decades, because now as more and more nations are concerned about the resilience of the supply chain, they concern more about the security, stability of the supply chain instead of profitability. So the United States, especially the federal government, is abusing the exorbitant privilege of its own money, which leads to the likelihood of ending or demising this privilege. There must be someone else to stand up and organize a new pattern or a new solution to the whole world trade settlement and denomination.

Ding Yifan: I think that global trade will continue. It will not shrink so sharply. Today, if you look at China's international trade volumes, European Union is still China's biggest exporting market. The United States is as well. But there is a third market that is growing. The third market is ASEAN countries, those so-called Belt and Road countries. So China's international trade volumes with those countries are growing very, very fast. The Chinese export to all those Belt and Road countries and all these ASEAN countries has become the third pillar of China's export. It becomes that there is a more diversified trade.

De-dollarization will be a longer phenomenon, because in the shorter term, the U.S. dollar would still be a predominant currency because of this international chaos. While the U.S. indebtedness vis-a-vis its GDP is growing very, very fast. So that's why it becomes very dangerous for the U.S. economy to maintain this kind of money-printing system.

京公网安备 11010202009201号

京公网安备 11010202009201号