China's financial regulatory policy will focus on supporting the real economy and further opening up the country's financial services industry, said Li Yunze, head of the National Financial Regulatory Administration, here on Wednesday.

Li made the remarks at the two-day 17th Asian Financial Forum 2024 that opened on Wednesday. The event is co-organized by the Hong Kong Special Administrative Region government and the Hong Kong Trade Development Council.

"Under the new situation, financial supply-side structural reform will be the main focus, enabling financial institutions to improve the adaptability of serving the real economy and stabilizing the national economy," Li said while delivering special remarks to the forum.

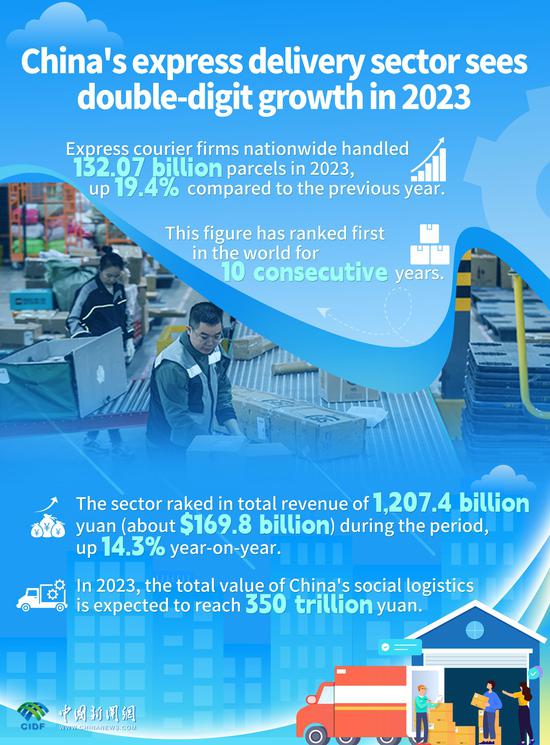

The minister said financial regulatory policy will focus on certain segments like technology finance, green finance, inclusive finance and digital finance.

In the next step, the NFRA will comprehensively strengthen the five major supervision areas of institution, behavior, function, penetration and continuous supervision.

"We will continue to improve the foresight, accuracy, effectiveness and synergy of supervision, and coordinate with all other parties to implement all aspects of supervision in accordance with the law to supervise all kinds of financial activities. We will also accelerate the construction of a comprehensive and effective modern financial supervision system to promote the high-quality development of finance," Li said.

The Chinese economy is improving in the long term, its structure continues to be optimized, and its high-quality development trend will not change, Li said, adding that the national economy will be able to move forward steadily amid difficulties and continue to provide a strong impetus for world economic development.

Hong Kong Chief Executive John Lee Ka-chiu said the "one country, two systems" principle and the far-reaching opportunities it brings "have enabled Hong Kong's financial sector to thrive despite the considerable challenges we face".

"Under the 'one country, two systems' principle, Hong Kong can create opportunities for companies and economies in Asia and around the world. We can, and will, contribute to realizing a bright and shared future for the global community," he said in his opening remarks.

On Wednesday, the People's Bank of China, the central bank, and the Hong Kong Monetary Authority launched six measures that involve financial market connectivity, cross-border capital facilitation and deepening of financial cooperation.

The measures enhancing financial market connectivity include allowing bonds under Bond Connect as eligible collateral for the renminbi liquidity arrangement of the Hong Kong Monetary Authority, further opening-up so that foreign investors can participate in domestic bond repurchase business, and expanding and facilitating individual investment channels in the Guangdong-Hong Kong-Macao Greater Bay Area.

Regarding cross-border capital facilitation, the PBOC and the HKMA recommend implementing policies to facilitate payments for home purchases by Hong Kong and Macao residents in the GBA, expanding the scope of pilot projects for cross-border credit reporting cooperation between Shenzhen in Guangdong province and Hong Kong, and deepening the cross-border pilot program of the digital renminbi to provide more convenience for Hong Kong and mainland residents and enterprises.

The 17th AFF's theme is "Multilateral Cooperation for a Shared Tomorrow". The event focuses on analyzing global economic dynamics, promoting collaboration among stakeholders, exploring sustainable economic development models and identifying opportunities for multilateral cooperation.

京公网安备 11010202009201号

京公网安备 11010202009201号