Demand spreads from first-tier cities to smaller markets; Chinese platforms grow abroad

On a busy day in late August, Zhang Wanchen, 34, a white-collar worker in Guangzhou, Guangdong province, placed an order online using her smartphone, to buy a gift box of Japanese cookies, dried cranberries from the United States, a carton of New Zealand milk, Norwegian salmon and French red wine, all of which would be delivered to her home in the next few days.

"These products all looked and tasted authentic, and seemed worth the prices I paid for them. When I was studying abroad, I often fetched some cosmetics, handbags and electronic devices for my relatives and friends at home," Zhang said.

"After returning to my homeland, I found online shopping very convenient and more discounts are available on such foreign products during some promotional events," she said.

Zhang is among a growing number of Chinese consumers who are exhibiting vibrant purchasing power for imported and foreign-branded products, which have become a key driver of upgraded consumption fueled by preferential policies. Lower tariffs, an expanded list of imported goods and a gradual improvement in cross-border logistics are all a big deal, industry insiders said.

Cross-border online shopping was a term largely unheard of two decades ago. But today, it has become an important driving force for bolstering the steady growth of foreign trade, they said.

According to a report released by Chinese e-commerce giant JD's Consumption and Industry Development Research Institute, people aged 26-35 are the main consumers of imported commodities, accounting for 45 percent of buyers, while consumers in the 46-55 age group have contributed to the fastest growth in purchases of imported products.

Personal care products, cosmetics and skincare, food and beverages, as well as maternity and infant products are the categories most favored by Chinese consumers buying imported goods, the report said.

While residents living in first-tier cities have become the primary purchasers of imported products, consumers in lower-tier markets have shown a growing interest in buying such commodities, it said.

"Chinese consumers have shown rising purchasing demand for diversified, personalized and niche overseas products, and are attaching more importance to the value of the goods they buy," said Zhang Zhouping, a senior analyst who tracks business-to-business and cross-border activities at the Internet Economy Institute, a domestic consultancy.

Zhang said cross-border e-commerce has played a significant role in enriching product supply, bolstering the development of new business models and promoting the recovery of consumption. He called for greater efforts to further optimize the list of imported retail goods for cross-border online purchases.

Orders of online cross-border shopping are still mainly being placed in first-tier cities, but residents in second- and third-tier cities have shown rapidly growing purchasing power, he said.

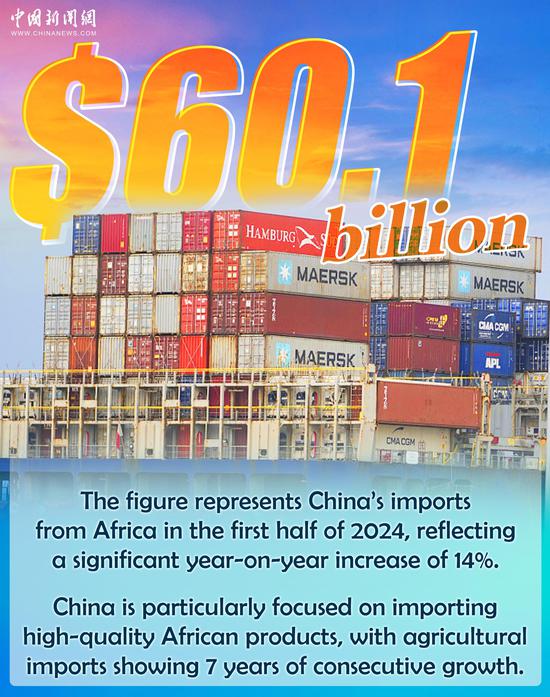

China's cross-border e-commerce industry has seen robust growth in recent years, with the sector's import and export scale reaching 1.22 trillion yuan ($171.5 billion) in the first half of this year, up 10.5 percent year-on-year, data from the General Administration of Customs showed.

Market consultancy iiMedia Research said China's further opening-up, gradual improvement in logistics and deliveries and consumers' rising demand for imported goods will provide a big boost to consumption upgrade.

"The penetration rate of cross-border e-commerce in lower-tier cities and townships has been increasing in the past few years," said Chen Tao, an analyst with internet consultancy Analysys in Beijing.

He said that online shopping via livestreaming videos — a quick way for domestic consumers to find detailed information on overseas products — has become popular among the post-1980s and post-1990s generations of consumers.

Even as foreign brands ride cross-border e-commerce channels to reach Chinese consumers, Chinese platforms are speeding up their push into overseas markets.

Temu, the cross-border e-commerce platform launched by Chinese online discounter PDD Holdings, has gained popularity among overseas consumers as it offers a wide selection of merchandise, including apparel, consumer electronics, jewelry, shoes, cosmetics and baby products at competitive prices.

First launched in the US in September 2022, Temu has entered more than 50 countries in North America, Europe, Asia and Oceania.

Chen Lei, chairman and co-CEO of PDD Holdings, said the company hopes to leverage the supply chain capacities it has accumulated over the past years to create a new channel that enables consumers from different countries and regions to directly purchase products from factories, providing more flexible and personalized supply chains and more cost-effective shopping experiences.

Fast-fashion online retailer Shein is ratcheting up resources to help Chinese manufacturers and brands expand their presence abroad, and give a strong boost to the transformation of traditional industries by making use of its digital and flexible supply chains.

Shein said for sellers who are good at designing and producing products, but have no overseas sales and operations experience, it will provide one-stop services, including commodity operations, warehousing, logistics, customer service and after-sales service.

Cross-border e-commerce is increasingly becoming a new growth driver for China's foreign trade, said Cindy Tai, vice-president of Amazon and head of Amazon Global Selling Asia.

Tai said the company will ramp up efforts to help Chinese merchants build brands, simplify global operations, optimize global supply chain services, expand their global footprint, as well as scale up localization inputs this year.

China's fast-developing cross-border e-commerce sector offers a glimpse of how online shopping activities have injected strong impetus into China's consumption, which has become the main driving force boosting economic growth.

Major domestic e-commerce platforms such as Alibaba Group Holding Ltd, JD and PDD, which connect countless business owners with hundreds of millions of customers looking for cost-effective deals, have already changed the traditional retail landscape of the world's second-largest economy.

Industry insiders said e-commerce had been regarded as a supplement for a long time to brick-and-mortar businesses until a promotional event called Singles' Day shopping carnival turbocharged its stellar rise. Initiated by Alibaba in 2009, the Double 11 or 11-11 promotional gala each November has morphed into the world's biggest online shopping event.

Both Alibaba and JD are now placing greater emphasis on empowering brands and small and medium-sized merchants by helping the latter achieve digitalized operations, as well as providing cost-effective products to capture price-sensitive consumers.

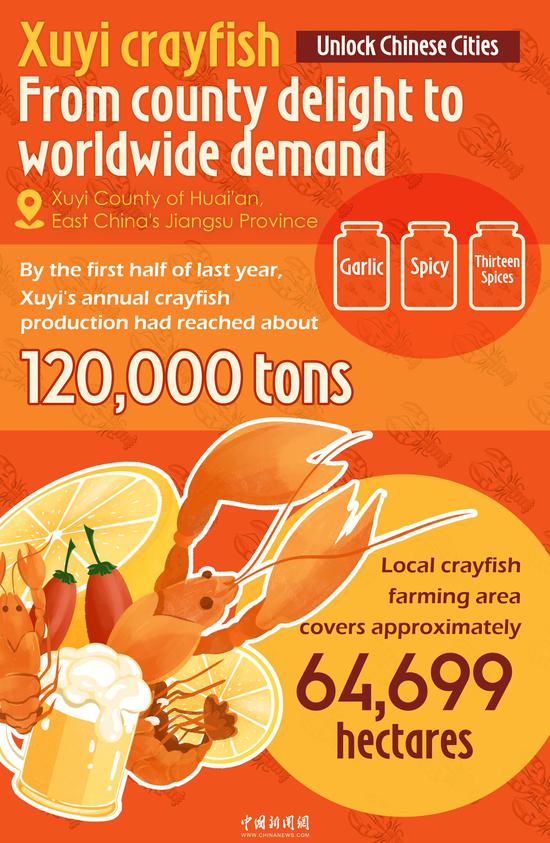

The development of Taobao villages, which refer to a cluster of retailers within an administrative village where residents have embraced e-commerce primarily by using Alibaba's Taobao online marketplace, has helped lift many Chinese rural areas out of poverty by promoting agricultural products and other local specialties online.

Mo Daiqing, a senior analyst at the Internet Economy Institute, emphasized the importance of the online retail segment in boosting consumption, expanding employment and improving people's livelihoods, thus helping enhance resilience of the real economy.

Mo said the major online shopping carnivals like Singles Day and the June 18 promotional campaigns are pivotal to stimulating consumers' purchasing appetites and promoting the recovery of consumption. Meanwhile, more brands are paying enhanced attention to improving consumer experience, as well as providing various discounts and membership services, striking a balance between chasing commercial interests and optimizing user experience.

"Chasing high gross merchandise volume, or GMV, is no longer the focus of China's online shopping extravaganzas, while consumers are increasingly looking for cost-effective local alternatives as Chinese brands' product quality and safety improve," Mo said.

Noting that Chinese consumers are more rational now and carefully review their needs, with an emphasis on quality and product value, Mo said what e-commerce platforms should do is to improve supply chains and optimize business and operational models in accordance with shoppers' buying habits and preferences.

Wang Yun, a researcher from the Chinese Academy of Macroeconomic Research, which is affiliated with the National Development and Reform Commission, said online shopping symbolizes New Retail, and has been playing a significant part in reducing transaction links and information asymmetry, enhancing transaction efficiency of commodities, improving consumer shopping experience and fostering high-quality economic development.

Retail sales, a significant indicator of consumption strength, grew 3.5 percent year-on-year in the first seven months, said the National Bureau of Statistics. Online retail sales jumped 9.5 percent year-on-year during the January-July period, sustaining a relatively high growth.

China's consumer market is expected to see a recovery in growth this year, while calling for efforts to further cut taxes and fees for micro, small and medium-sized enterprises, expand employment and increase household disposable incomes to further perk up consumption, said Zhao Ping, head of the Beijing-based Academy of China Council for the Promotion of International Trade.

In addition, to meet growing consumer demand for a wide range of products and nurture new consumption growth points, Chinese e-commerce platforms should launch customized, intelligent and green products by leveraging next-generation information technologies like 5G, artificial intelligence and big data, she said.

京公网安备 11010202009201号

京公网安备 11010202009201号