Two years after joining the Special Drawing Rights (SDR), an international currency reserve to supplement IMF member countries' official reserves, the Chinese yuan has increased its influence in international foreign exchange reserves and payments.

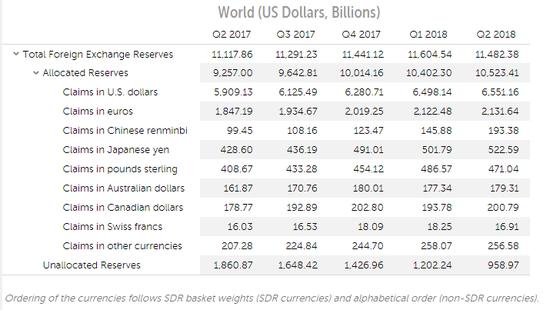

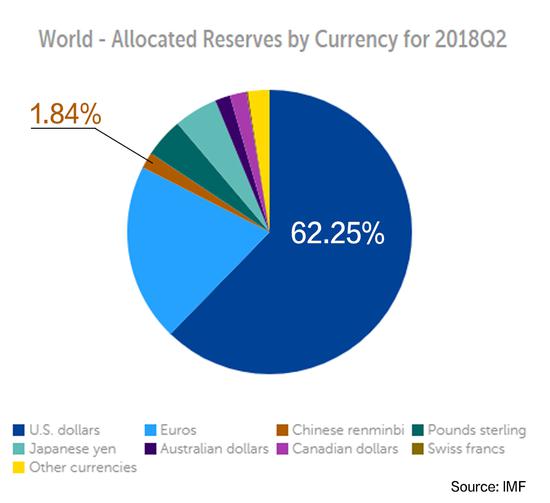

In the second quarter of this year, claims made in Chinese yuan accounted for 1.84 percent in the total foreign exchange reserves, a figure which has increased continually for the past four quarters, according to the International Monetary Fund (IMF).

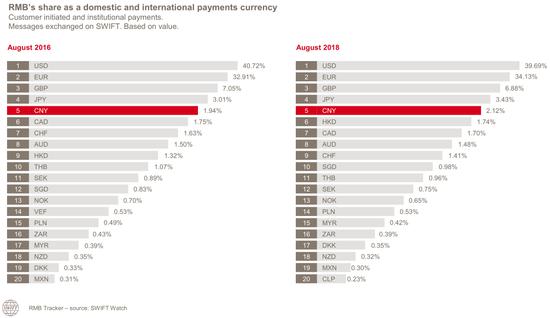

Moreover, the Chinese yuan has kept its position as the fifth most active currency for domestic and international payments by value in August, with a share of 2.12 percent, putting it ahead of the Hong Kong and Canadian dollars, which have shares of 1.74 and 1.70 percent respectively, according to data released by the Society for Worldwide Interbank Financial Telecommunications (SWIFT) last Monday.

According to SWIFT, the value of yuan payments increased by 2.18 percent compared with July 2018, and in general all payments currencies decreased by 1.36 percent.

To further improve the yuan's internationalization, China has offered international investors more access to its financial market, including the Shenzhen-Hong Kong Stock Connect which opened in December 2016 and the Chinese mainland-Hong Kong Bond Connect which started operating in July 2017, allowing Hong Kong and other overseas investors to invest in the China Interbank Bond Market.

Even with all this progress, there are still more issues that need to be accomplished in the coming years, Du Yang, an associate at the University of Cambridge's Moller Institute, told CGTN, noting that the marketization of the yuan is a major hurdle.

The SDR is not the final destination of yuan internationalization. "It very much depends on who wants to hold your currency, and what they want to do with it. This is more critical than simply having one ticket entering the IMF's basket," he said.

"At the moment, the overall asset allocation is just about three-to-five percent from any international investor's portfolio," he said, noting the yuan is still marginal in the largest pension fund and the largest sovereign fund.

To remedy the situation, Du believes there should be more yuan-denominated assets available in the international market. In the meantime, educating market investors is paramount, as Hong Kong could play a larger role due to the experience gained as the very first offshore center for the yuan, he said.