(ECNS) -- As U.S. tariffs on Chinese goods continue to rise, many local companies are shifting their high-quality export products to domestic sales, with some items hitting shelves within 48 hours, while export-oriented merchants in "world supermarket" Yiwu are turning their focus to Europe.

Recently, major retailers including Yonghui Superstores, RT-Mart, Wumart, Bailian Group, Lianhua Supermarket, and Freshippo have all launched support programs to help quality export products shift to domestic sales, establishing dedicated procurement channels and setting up special sales zones.

Ningbo Today Food Co., Ltd. specializes in tuna products and is one of China's largest tuna processing plants, with its goods primarily exported to Europe, America, and Southeast Asia.

According to Zhang Ning, a company manager, currently, 70% of its business is export-oriented, mainly to markets like Europe, the U.S., and the Middle East, while 30% comprises domestic sales via both online and offline channels.

In the past few years, it has been gradually reducing exports to the U.S. market. "So, the U.S. tariffs have limited impact on us," said Zhang.

However, as a company heavily reliant on foreign trade, it can still be impacted by fluctuations in tariffs, shipping costs, and exchange rates, according to Zhang. "That's why we've decided to transform and are now in talks with retailers like Yonghui Superstores," Zhang said.

In addition to Yonghui Superstores, multiple retail enterprises are currently in negotiations with export-oriented companies like Ningbo Today Food Co., Ltd., hoping to quickly advance collaborations.

Since launching its "Introducing quality export products to supermarkets" support initiative, RT-Mart has accelerated the integration of premium export goods into the domestic consumer market through omnichannel resource coordination.

As of Tuesday, the initiative has attracted 77 participating companies spanning categories including home goods, small home appliances, food, fresh produce, and textiles. RT-Mart's category buyers are now actively engaging with these prospective suppliers.

Qingdao Litai Agricultural Products Co., Ltd., a ginger export specialist primarily supplying the U.S. and Southeast Asian markets, promptly applied for collaboration after RT-Mart launched its initiative. Vendor qualification review, product quality inspection, and supply chain coordination plans were completed within 48 hours, while the first batch of a 6.6-ton ginger order was successfully contracted.

The premium ginger has now entered 52 RT-Mart stores across Beijing, Tianjin, and Jinan in Shandong Province. On Tuesday, its daily ginger sales in North China surged sixfold, with 1.2 tons sold within 24 hours.

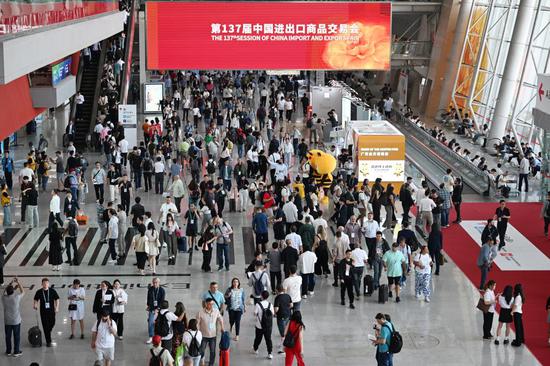

As a global barometer for small commodity trade, Yiwu has become a hot topic in the industry. Local merchants said that while U.S. market orders constitute a certain proportion, they are actively mitigating potential risks through strategies like diversified market expansion and added-value product enhancement.

Sun Lijuan, who runs a toy factory in Yiwu, stated that the U.S. tariffs have minimal impact on her business.

"We do business with customers from all over the world and our main markets are the Middle East, South America, Russia, Europe, Africa, and countries participating in the Belt and Road Initiative, therefore, my business won't be affected by policies of a single country," Sun said.

"The U.S. market accounts for a small portion of our business. Even for affected products, we can quickly pivot by redirecting sales to the EU and other markets," she added.

According to data released by Yiwu Customs, from January to October 2024, the total import and export of Yiwu and countries that jointly built the BRI reached 343.81 billion yuan (about $47.10 billion), up 18.4% year-on-year, accounting for 61.4% of the total import and export value of Yiwu in the same period.

Sun emphasized that Yiwu merchants must promptly adjust their strategies in response to international policy changes, ensuring that no single country's policies affect overall sales performance or market layout.

Another Yiwu toy factory owner, Yamin, noted: "We don't export much to the U.S. and sales have been modest. Although there are some fluctuations, shipments continue."

(By Zhang Dongfang)

京公网安备 11010202009201号

京公网安备 11010202009201号