Emerging economies can diversify FX reserves, boost trade, investment

The renminbi's record high share in Russia's currency trading in March confirms an emerging trend that more commodity-exporting economies are accepting the Chinese currency as an alternative to other leading international currencies, experts said on Tuesday.

Their comments followed a report from the Bank of Russia, the country's central bank, on Monday that the share of the yuan/rouble pair trading on the Russian exchange market reached a new high of 39 percent in March.

During the same period, the share of the US dollar/rouble pair fell to 34 percent, the lowest in recent years, Russia's central bank said. A recent Bloomberg report also said the renminbi has replaced the dollar as the most traded currency in Russia.

Also, some media reports indicated that NBD-Bank, a Russian bank for small and medium-sized enterprises, has joined the Cross-border Interbank Payment System or CIPS, which specializes in renminbi cross-border payment clearing. This development, too, reflects the renminbi's rise in Russia's currency market, experts said.

Joining CIPS can reduce the processing time for renminbi payments in China, which helps speed up settlements and improves the quality of the bank's services for customers engaged in economic activity with China, Russian news agency Sputnik reported, citing a report by Russian newspaper Kommersant.

Yang Haiping, a researcher at the Central University of Finance and Economics' Institute of Securities and Futures, said the use of the renminbi has expanded in Russia as the country seeks to boost local currency settlements in the face of financial sanctions while economic and trade cooperation between China and Russia deepens.

Yang said the growing use of the renminbi in bilateral trade will help the two countries to reduce the risk of using a third-party currency for trade settlements, pave the way for further economic cooperation and reduce their reliance on the greenback.

The renminbi's usage is also gaining traction in other commodity-exporting countries as confidence in the dollar-centered system has been declining.

The Chinese currency has surpassed the euro to become Brazil's second-largest foreign reserve currency, accounting for 5.37 percent of Brazil's international exchange reserves by the end of 2022, said Banco Central do Brasil, the country's central bank. Brazil is a major exporter of mineral and agricultural products.

In March, the Export-Import Bank of China achieved the first renminbi loan cooperation with the Saudi National Bank, the largest commercial bank in Saudi Arabia.

These developments indicate that the share of renminbi use in international trade for energies, resources and commodities may increase, a trend that will help China boost its role in international economic cooperation and consolidate its status in the global supply chain, Yang said.

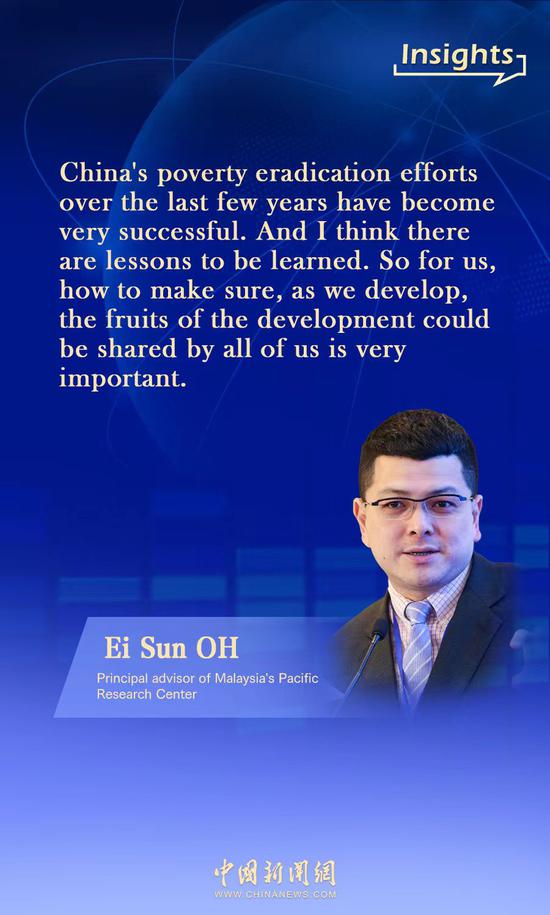

Ye Yindan, a researcher at the Bank of China Research Institute, said the global use of the renminbi will help stabilize the international monetary system by helping emerging market economies diversify their foreign exchange reserves and alleviating the disruptions of dollar liquidity fluctuations on cross-border settlements and financing.

"It would become the consensus among more market players that expanding the cross-border renminbi use will help facilitate stable development of bilateral trade and investment," Ye said.

Despite the positive progress, it still requires yearslong efforts for the Chinese currency to catch up with the heft of leading international currencies, experts said.

The renminbi's share of global foreign exchange reserves stood at 2.69 percent in the fourth quarter of last year, ranking fifth among all currencies yet much lower than the dollar's 58.36 percent, data from the International Monetary Fund showed.

京公网安备 11010202009201号

京公网安备 11010202009201号