A significant drop in Chinese foreign direct investment (FDI) in the United States is affecting America's high-tech sector and related fields, leaders of technology companies and business said during a conference.

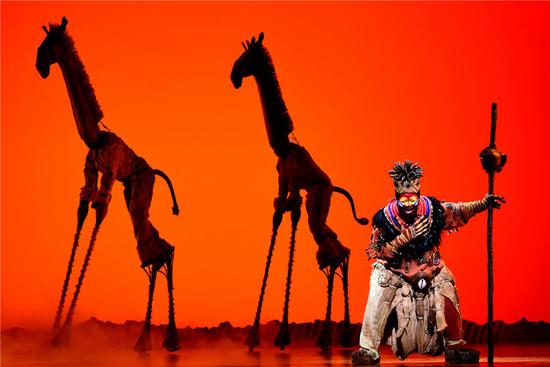

"It has impacted real estate. It has impacted Hollywood. It has impacted these kinds of soft-power segments, like Hollywood, like digital entertainment," said Rebecca Fannin, founder of Silicon Dragon, a news, events and research organization that covers the world's tech clusters and sponsored the conference, Dragon LA 2019.

She spoke Wednesday at the two-day forum in Los Angeles that brought together entrepreneurs, innovators and investors who are on the front line of U.S.-China business.

Fannin is also the author of the recently released book, Tech Titans of China, which discusses the evolution of China's technology scene.

Chinese FDI in the U.S. fell 88 percent to $5.4 billion in 2018 from a peak of $46.5 billion in 2016, according to recent data from independent research company Rhodium Group.

The trend started in 2017, when Chinese FDI dropped 35 percent to $29 billion in consummated deals, according to Huron.

The value of Chinese acquisitions in the U.S. fell to $8.7 billion in 2017, a drop of more than 90 percent from 2016.

U.S. direct investment in China dipped slightly from $14.14 billion in 2017 to $12.87 billion in 2018, according to the U.S.-China Investment Project, a multiyear research initiative led by the National Committee on U.S.-China Relations, and Rhodium Group.

Fannin said Chinese companies used to make robust investments in trophy American startups, but due to new restrictions put in place by the Committee on Foreign Investment in the United States during the Trump administration, many focus on smaller strategic deals.

"So you see Baidu, Alibaba and Tencent were actually the ones that were leading a lot of these deals. So all three of them have pulled back from the U.S., and they are looking at other markets, like Southeast Asia and Israel, but they are still doing strategic deals in the U.S.. This is going to continue to happen, but just not at the pace that it was before," she said.

John Shen, founding partner of Sunstone Management Inc, a Long Beach, California-based investment company, said the Chinese government's restriction on large-scale outbound capital flows also played a role in the decline in Chinese direct investment in the U.S..

David Kaufman, director of global strategies at the law firm Nixon Peabody LLP, noted that competition between the U.S. and China will continue to make Chinese investment in the high-technology sector problematic.

"Even if there's a trade deal, even if there's frankly a new administration, there is going to be a lot of challenges for investment in high technology," he said.

However, collaborations between the two countries are occurring in fields such as healthcare, energy, entertainment, industrial, food and beverage, and agriculture, Kaufman said. In addition, there's also a lot of support for people-to-people interaction between the two countries.

"So that's essentially tourism and travel and education, so university students and things like that. That I think is going to be a great place for more cross-border investment," he said.

Eric Mika, who heads government/business affairs and business development at Canoo, a California-based electric-vehicle company with an office in Shanghai, said the decline in Chinese FDI will affect growth in both countries.

"That's going to have a significant impact on every aspect of investments, so from the entertainment industry to startups to electrical vehicles to Silicon Valley. Equally so, it will have the same negative impact in China as well for growth," Mika said.

"It's not always monetarily that we judge this, but also the exchange of ideas and growth and innovation. There's no doubt that America and China are the two largest nations of growth and innovation, and if we don't' collaborate one way or the other, we are going to see an effect," he added.