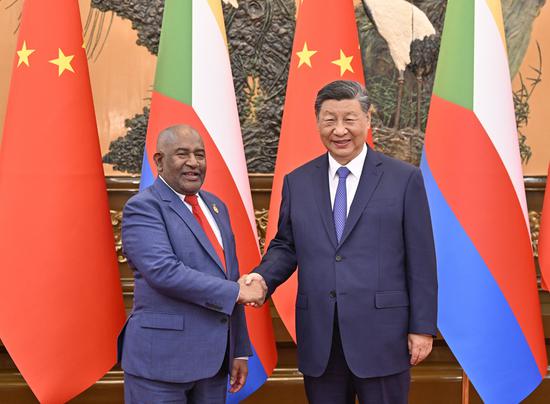

Visitors check out promotional videos at the China Minmetals booth during an expo in Shanghai in May. (Photo provided to China Daily)

The A-share market's increased focus on high-quality development has been reflected in the recent wave of mergers and acquisitions among leading market players and the industrial restructuring initiated by State-owned enterprises.

According to the China Securities Regulatory Commission, A-share companies have disclosed 46 major asset restructuring projects since May, seven of which have been submitted to the CSRC for registration.

Of late, there have been a number of signature cases under the market lens.

State-owned China Minmetals Corp plans to acquire 681 million shares of Qinghai Salt Lake Industry Co Ltd, according to the latter's announcement on Sunday. China Minmetals will become the actual holder of Qinghai Salt Lake Industry once the deal concludes.

Guotai Junan Securities and Haitong Securities, both State-backed, said last week that the former would acquire the latter.

Zhu Jian, chairman of Guotai Junan Securities, said during the company's half-yearly results briefing on Tuesday that the restructuring will strengthen the core function of both brokerages and improve financial services rendered to the real economy.

Industrial chain integration has been the major trend among the recent M&As.

Shenzhen-listed AVIC Zhonghang Electronic Measuring Instruments', or ZEMIC's, acquisition of AVIC Chengdu Aircraft Industrial took effect on Aug 5.

The deal, which cost State-controlled ZEMIC 17.4 billion yuan ($2.4 billion), has become the largest M&A transaction at the Shenzhen bourse since it implemented a registration-based IPO mechanism in August 2020.

The acquisition will help ZEMIC research and produce aircraft weapons systems and civilian airplanes. It will bring deep integration and complement each other's technologies, market and resources, it said.

On July 4, State-controlled China Tungsten &High-tech Materials' acquisition of Hunan Shizhuyuan Non-ferrous Metal Ltd for about 5.2 billion yuan was approved by the State-owned Assets Supervision and Administration Commission of the State Council (SASAC).

China Tungsten &Hightech Materials believes the deal will enhance its control over the whole tungsten industry chain, thanks to Shizhuyuan's rich tungsten ore resources and advanced mining technology.

The State Council, China's Cabinet, released in April nine measures to advance the high-quality development of the capital market.

Public companies are encouraged to adopt M&As and industrial restructuring to seek high-quality growth, according to the measures.

Lao Zhiming, managing director of Huatai United Securities, said China's M&A market has in recent years returned to rational behavior and the logic of industrial integration, abandoning its previous focus on profiteering.

Zhang Zhongwei, managing director of China Securities, said the valuation gap between the primary and secondary markets has narrowed, leaving little room for profit-seeking or speculation.

Industrial integration's value in terms of coordinating development, optimizing market resources and facilitating industrial upgrading has also become more noticeable.

Industrial M&As, as an option for securitization of quality assets, will grow into a medium — to long-term trend in the Chinese capital market, he said.

According to Xie Xuecheng, deputy head of the research institute of China Galaxy Securities, the recently introduced supportive policies have facilitated M&As by public companies and such activity is likely to become further elevated.

While the valuation of the overall A-share market is relatively lower at present, it also provides a good strategic opportunity for cash-rich companies to conduct M&As. Technology, manufacturing and pharmaceutical industries are likely to see higher M&A activity, he added.

It can be inferred from the recent deals that SOEs have played an important role in boosting M&A activity.

Li Jin, deputy head of China Enterprise Reform and Development Society, said integration among SOEs and the continued optimization of their industrial structures will be one major theme of reforms at these companies in the next five years.

Such integration will also help drive their endogenous development and innovation, he added.

京公网安备 11010202009201号

京公网安备 11010202009201号