Domestic demand for gold in China, the biggest buyer of gold bars, coins and jewelry, is expected to recover very slowly from the slump in the first quarter of the year due to the coronavirus outbreak, even though most of the processors have resumed production, experts said.

According to Zhu Yi, senior analyst of metals and mining at Bloomberg Intelligence, the prolonged global COVID-19 outbreak will dent demand for jewelry and industrial purchases in the upcoming months.

"Jewelry demand that was lost during the first quarter will not be regained despite the possible strong purchases during the rest of the year, as the COVID-19 epidemic has clouded economic growth and raised consumer concerns," she said.

"In the meantime, the epidemic has also caused supply disruptions as some overseas countries are facing lockdowns and mines have reduced output or shut down. Gold prices will continue to be volatile this year."

Last year, Chinese consumers accounted for about a fifth of the total gold demand of 4,356 metric tons, according to the World Gold Council.

According to a note by Citigroup Inc, gold price premiums in China "have collapsed to negative levels not observed since the Great Financial Crisis". The bank said that jewelry consumption could hit lows not seen in a decade or more.

Zhang Yongtao, chief executive officer of the China Gold Association, said earlier that domestic demand for gold will recover very slowly as there are no orders, even after processors resume production.

Consumers will not return to buying gold jewelry until the epidemic ends, and Chinese investors are not willing to purchase gold with their deposits at the moment, he said.

Gold consumption in China dropped 48.2 percent to 148.63 tons during the first quarter of this year, with consumption via the jewelry sector falling by 51.06 percent to 92.04 tons, China Gold Association said on April 28.

The novel coronavirus outbreak, together with rising gold prices, led to a downtrend in gold consumption, said the association. Some of the gold jewelry processing enterprises are yet to resume production as they hardly have any orders on hand, it said.

Consumption in other forms also witnessed a sharp drop, with gold bars and gold coins falling 46.97 percent year-on-year to 37.67 tons, and gold used for industrial and other purposes falling 32.04 percent year-on-year to 18.92 tons.

The increasing sales of gold jewelry and gold coins achieved through the online platforms are satisfactory, but not enough to make up for the loss of in-store sales, it said.

According to the association, Chinese jewelers have been increasing their efforts in online marketing, recognizing the importance of online channels when the public is confined to their homes. Many jewelry manufacturers across the nation are also bringing their businesses online, helping to reduce health risks and improving efficiency.

Cui Jiangu, deputy head of the association, encouraged enterprises to take advantage of the existing situation, especially the e-vouchers and online channels, and gain a much deeper understanding of online and digitalized business models.

According to the association, China's gold output dropped by 10.93 percent year-on-year in the first quarter to 82.63 tons.

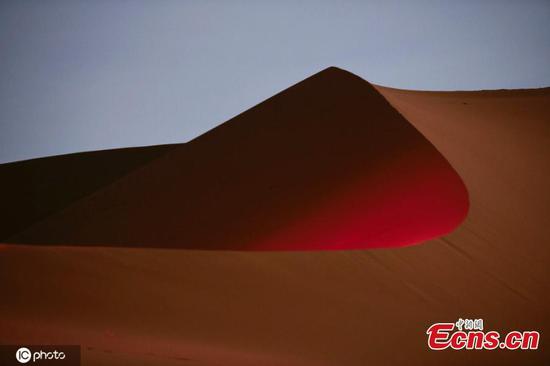

Shandong, Yunnan, Henan, Inner Mongolia and Jilin saw the most gold output nationwide, with total production exceeding 22 tons, more than 33 percent of the country's total gold output, it said.

Zhu from Bloomberg said China's output of gold is likely to rise in the second quarter as higher gold prices offer wider margin for producers, and operations are gradually returning to normal as the virus is being reined in.

"Demand in the second quarter is also recovering. Gold's safe-haven appeal is expected to increase as economic growth slows down, inflation rises and market becomes volatile," she said.