Market shift

Yun, NAR's chief economist, said: "Fewer foreign buyers means fewer home sales and, consequently, slower US economic activity. However, America is currently in a unique situation, with a housing shortage stemming from multiple years of underproduction of new homes. Therefore, a lack of foreign purchasers is quickly being filled by domestic buyers, and not necessarily causing notable harm.

"In future years, when the market is back to normal, foreign buyers will be important in terms of sales and prices."

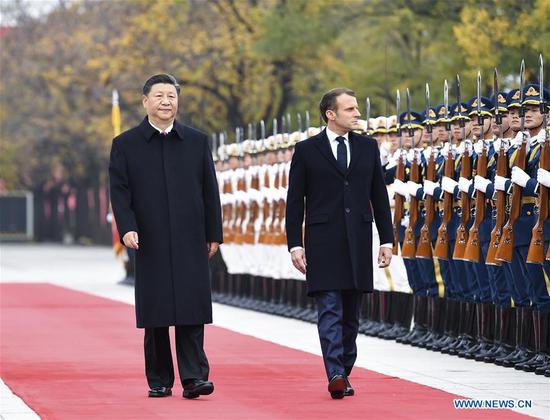

In its 2019 Wealth Report, property consultancy Knight Frank said that the current trade relationship between China and the US may cause Chinese investors to shift to other key markets. It suggested that investment could instead go to major cities in Australia, Japan and the United Kingdom.

According to property portal Juwai's Chinese Consumer International Survey 2019, which polled 678 respondents online in June and July, Australia is the most popular destination for overseas house purchases.

Some 29 percent of respondents cited living environment and education in Australia as key factors, followed by Canada (18 percent) and the US (14 percent).

Lo said that in the 1960s, the first batch of home buyers from Hong Kong bought properties in the US, followed by people from Taiwan in the 1980s, and then from the Chinese mainland in the 1990s. There was a sharp rise in the number of mainland buyers in the 2000s, especially after the 2008 financial crisis, when many countries were hit by a housing market crisis, he said.

Despite uncertainties, a weaker yuan and stronger capital controls, Lo said the fall in the number of Chinese buying homes in the US was a "natural result".

"As Chinese people get wealthier and travel the world, living in the US is not as attractive as before," he added.