The financial district of Pudong New Area. (Photo by Gao Erqiang/China Daily)

China's monetary policy is likely to remain accommodative — and further easing might ensue if economic recovery fails to maintain the momentum gained from the solid first-quarter performance, according to officials and experts.

Zhu Hexin, deputy governor of the People's Bank of China, the country's central bank, said the series of monetary policy measures introduced earlier are producing the desired effects gradually, with the Chinese economy continuously recovering, having got off to a good start this year.

"There is still room for future monetary policy adjustments," Zhu said at a news conference on Thursday. "We will closely observe the effects of the policies, the state of economic recovery and the progress of achieving (economic) targets, and will make good use of the reserve tools at an opportune time."

He further said the PBOC has stepped up efforts to encourage financial institutions to pursue a balanced credit expansion throughout the year, with the moderation in credit expansion in the first quarter preserving room for loan growth in the coming quarters.

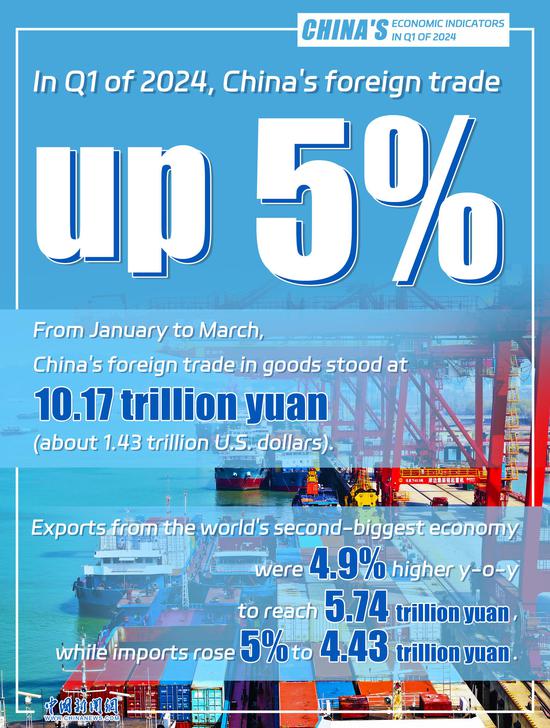

Zhu's comments came after China's GDP grew 5.3 percent year-on-year in the first quarter, beating expectations and cementing market participants' confidence in China's ability to achieve this year's growth target of around 5 percent.

Global banks such as UBS and Deutsche Bank have already upgraded their growth forecasts accordingly, expecting China's economy to grow 4.9 percent and 5.2 percent this year, respectively.

With the full-year growth target now appearing well within reach, experts said the immediate need for additional monetary stimulus has eased, especially considering that the US Federal Reserve may delay interest rate cuts due to sustained price pressures.

Yet, China's monetary policy is expected to remain accommodative amid remaining challenges such as the property market downturn and insufficient domestic demand. Zhu's statements underline the PBOC's willingness to take more action to bolster the economy when needed, they said.

"There remains the possibility of further cuts to the reserve requirement ratio and interest rates, which will largely depend on the economic performance in the second quarter," said Chris Liu, a senior portfolio manager at Invesco.

"However, the scope and timing of these potential adjustments may be influenced by the US Fed's moves. If the Fed delays its rate cuts, and then if China were to implement significant monetary easing, it might raise concerns about volatility in the yuan."

Zhu, who is also head of the State Administration of Foreign Exchange, said the first quarter's economic pickup will help buffer external shocks to the yuan; and the central bank is resolutely committed to guarding against the risk of exchange rate overshooting.

Official data showed that while the yuan depreciated against the dollar since the beginning of the year, the Chinese currency appreciated against a basket of currencies.

Also, the yuan has ranked as the world's fourth-biggest payment currency for the fifth month in a row as of March, accounting for 4.69 percent of global payments by value, said global financial messaging platform Swift.

Wang Chunying, deputy head and spokeswoman of SAFE, said foreign investors have sped up their investments in renminbi bonds in the first quarter, when the net increase in foreign holdings of onshore bonds reached $41.6 billion, exceeding $23 billion in 2023.

Wang said China will continue to expand bond market opening-up, including making the onshore repo market open to more foreign institutions and continuing to promote domestic renminbi bonds as widely accepted collateral in offshore markets.

While foreign investors' holdings of Chinese bonds increased, China has cut its holdings of US government bonds for two months in a row this year. China's holdings of US Treasury securities came in at $775 billion as of the end of February, down $22.7 billion month-on-month and down $74 billion year-on-year, said the US Department of the Treasury.

京公网安备 11010202009201号

京公网安备 11010202009201号