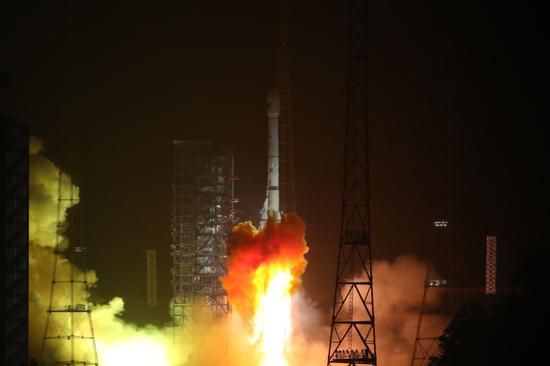

The freight train carrying the first batch of solar modules for China Energy Engineering Corp's 1-gigawatt projects in Uzbekistan, departs from Xi'an, Shaanxi province, on Aug 3. (PHOTO/CHINA DAILY)

Chinese enterprises led by China Gezhouba Group Overseas Investment Co, an overseas investment arm of China Energy Engineering Corp, recently embarked on a transformative journey to Central Asia, amid the strong push globally for green energy transition.

Earlier this month, a freight train carrying solar modules left Xi'an, Shaanxi province, to the construction sites of two upcoming photovoltaic power plants, of 500-megawatt capacity each, in the Bukhara and Kashkadarya regions in Uzbekistan. In the following months and years, more batches of such freight trains will set forth to these destinations to build the groundbreaking 1-gigawatt energy projects.

"The investment and construction of renewable energy projects have played a leading role in transforming Uzbekistan's energy structure and infrastructure," said Jurabek Mirzamahmudov, minister of energy, Uzbekistan, during an event to celebrate the departure of the first freight train.

This endeavor, part of a cooperation outcome after the China-Central Asia Summit in May, marks the first bold leap into new energy investment in the Central Asian region, and one of the results of the Belt and Road Initiative.

The project is estimated to generate 2.4 billion kilowatt-hours of clean electricity and mitigate carbon emissions by about 2.4 million metric tons annually. It will help improve the local power infrastructure and upgrade its energy consumption, said Lin Xiaodan, president of the CEEC unit.

Beyond its green impact, the project is also set to spur socioeconomic development, as it is expected to generate around 1,600 local jobs and inject a projected $140 million in tax revenue, Lin added during the ceremony.

A total of 60 freight train trips will be arranged before the end of next June, bringing over 3,000 photovoltaic modules to the construction sites, the CEEC unit said.

Such a footprint of the centrally administered State-owned enterprise in the Uzbek market is nothing short of profound.

With commitments exceeding $1 billion, spanning green energy, environmentally friendly construction materials, and urban development, the company is eying opportunities from Uzbekistan's surging population and accelerated internal reforms, which are "a fertile ground for investments for the company", Lin said.

Going forward, the company has a blueprint drawn up well through 2025. It has committed to bolster infrastructure investments and pioneer benchmark projects in global novel energy fields, especially in BRI-related markets, such as Kazakhstan, Indonesia and Vietnam, Lin said.

LONGi Green Energy Technology Co, a leading PV company in China that is also taking part in the BRI project, will enhance cooperation with all parties on this project, and seek a bigger role in boosting the new energy transition of the Central Asian markets, said its President Zhong Baoshen.

According to a report by CITIC Securities in July, Chinese infrastructure bidders will embrace more opportunities in BRI regions this year — the 10th anniversary of the initiative — as the release of pent-up demand is gathering pace in the post-COVID-19 era.

Citing demand for infrastructure in BRI-related markets, CITIC Securities said conditions have recovered to pre-COVID-19 levels, and projects that were delayed by the pandemic are also progressing quickly since the beginning of the year.

"Infrastructure companies seeking bigger global presence, especially in Central Asian and Southeast Asian nations, boast diplomatic advantages earned by the nation through its efforts in advancing multilateralism in recent years, for example, the BRI. And with the nation's competitive edge in infrastructure building, major Chinese players in the sector, central SOEs in particular, will stand out from global peers for their solutions and operations," said Long Chaocan, an investment consultant with China Galaxy Securities Co Ltd.

However, the impact of geopolitical tensions is weighing on companies striving for a global presence, he said.

"The ongoing tussle between China and the United States, and the unstable global industrial chain due to geopolitical tensions, must be taken into consideration while making global investment strategy, as there may be invisible obstacles affecting implementation efficiency and investment returns," he added.

京公网安备 11010202009201号

京公网安备 11010202009201号