An employee oversees a digital production line at a tech company in Fuzhou, Fujian province. (WANG WANGWANG/FOR CHINA DAILY)

Total factor productivity gains would undergird GDP objective

China should be able to sustain an economic growth rate of about 5 percent in the coming years by achieving a relatively high growth in total factor productivity (TFP), as the country accelerates efforts to foster new quality productive forces via technological innovation alongside reform and opening-up, said a renowned economist.

Liu Qiao, dean of Peking University's Guanghua School of Management, said in an exclusive interview with China Daily that "China is an undeniable candidate to make a growth miracle", in contrast to some speculation that the country's economic development has peaked.

Liu said that such speculation stems from a pessimistic estimate of China's TFP growth. The TFP is a measure of productive efficiency, measuring how much output can be produced from a certain amount of aggregate inputs.

Historically, Liu said, it has been difficult for an economy to maintain a high TFP growth after it completes industrialization. Even the United States, which boasts the world's largest investments in basic research, had a TFP growth of below 1 percent over the past 40 years, which led to its long-term economic growth rate being only around 1.5 to 2 percent.

However, there are fundamental differences between China and US economic growth models, Liu added, meaning that China — unlike the US — still has a huge industrial system and enjoys vast investment opportunities brought about by reindustrialization, digital transformation and energy transition.

Official data show that China's manufacturing output accounts for around 27 percent of its GDP, whereas in the US it stands at about 11 percent.

Also, Liu said China's per capita GDP is around $12,000, which means there is huge development space left.

Therefore, Liu said China should be able to maintain an economic growth rate of around 5 percent in the coming years if it can bring its annual TFP growth from the current level of about 1.8 percent to a level of above 2 percent by boosting technological innovation, deepening reform and opening-up and developing new quality productive forces.

"This will help the country realize basic socialist modernization by 2035."

In an earlier interview with China Daily, Steven Barnett, senior resident representative of the International Monetary Fund in China, also recommended that China should carry out more reforms to give the market a more decisive role in order to lift long-term growth prospects.

Looking at this year, Liu expressed confidence that China will hit its annual economic growth target of about 5 percent, anticipating that China's first-quarter growth rate may come in at around 4.5 percent.

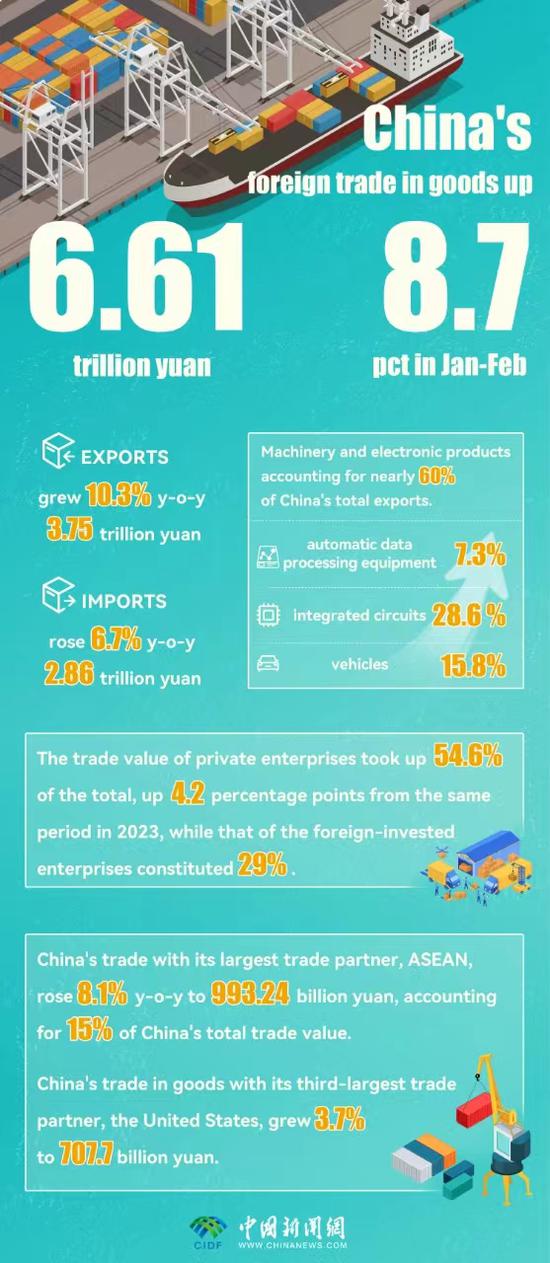

The National Bureau of Statistics said on Monday that China's economic recovery gained further momentum in the first two months of 2024 as industrial output, fixed-asset investment and export growth accelerated, though retail sales slowed.

While external demand improved with the better-than-expected foreign trade performance in the first two months, Liu highlighted the need to bolster domestic demand and boost investment confidence among private enterprises.

He emphasized the country's plan to issue 1 trillion yuan ($139 billion) in ultra-long-term special government bonds this year as a key fiscal move to bolster the economy, saying it is advisable to issue more such bonds this year and use proceeds raised in areas like fundamental research and subsidies to low-income groups.

Liu also cautioned that China still faces a big problem with real estate that will take time to resolve, necessitating the monitoring of key indicators. If such indicators as new housing starts, property sales and housing prices do not substantially improve year-on-year in the first half, more resolute support through macroeconomic and industrial policies, including those to facilitate debt restructuring, would be warranted.

NBS data showed that China's January-February property development investment dropped 9 percent year-on-year, compared with a 9.6 percent drop in 2023.

京公网安备 11010202009201号

京公网安备 11010202009201号