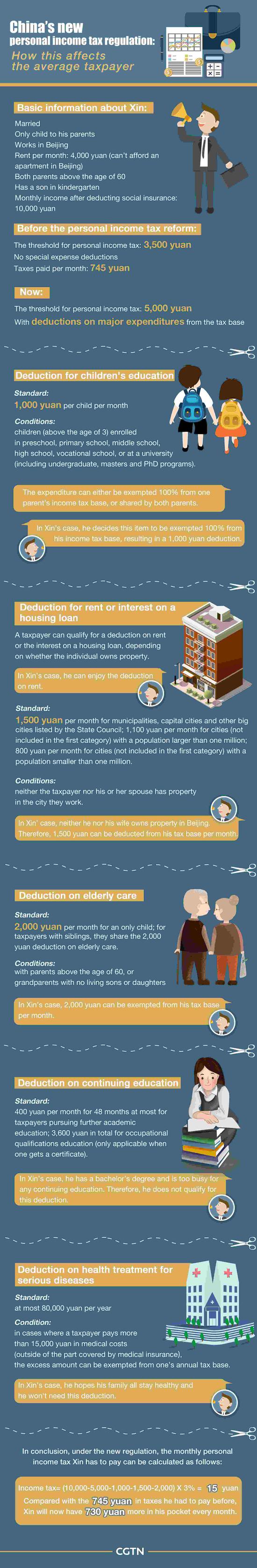

For Chinese taxpayers, 2019 kicks off with a big New Year gift – a notable decrease in income tax from January 1.

Under a new law, taxpayers can claim deductions for expenses on children's education, continuing education, health treatment for serious diseases, housing loan interests, rent and elderly care. The deductible amount under each category ranges from 1,000 yuan per month to 2,000 yuan per month.

The move, following the new tax brackets that raised the minimum threshold for personal income tax from 3,500 yuan to 5,000 yuan per month starting last October 1, is the latest by Chinese authorities to relieve the household tax burden in the hope of spurring growth.

Finance Minister Liu Kun said the changes will improve the income distribution system and people's livelihoods as well as release consumption potential.

The average wage in Beijing in the first half of 2018 was 10,531 yuan, according to a report by Zhaopin.com, a leading recruitment website in China. The calculation above shows that under the new regulation, the tax burden for some could be reduced to zero.

According to a research report by CITIC Securities, one of China's major investment banks, more than 100 million Chinese people will no longer have to pay taxes from January 1.

To make it easy and convenient for taxpayers to handle their income tax deductions, Chinas' State Administration of Taxation has launched an app, through which one can complete a tax form within minutes.