China's central bank and finance officials have been engaging in a row over the country's financial problems, with the research head of the People's Bank of China warning that the country's current fiscal policy is not active enough.

In a rare move, Xu Zhong, research head of China's central bank wrote an article published last week, where he openly criticized the country's fiscal policy, claiming that it is not being implemented actively.

The claims were rebutted by an article published on Monday, which claimed to have been written by an official who works in the finance system. It said that authorities have been working to increase the activeness of the current fiscal policy.

Such open spat between the central bank and the finance ministry implies that some problems could be brewing, testing policymakers' will and wisdom to align the country's fiscal policy with its economic development, analysts said.

The Chinese economy is encountering structural and institutional problems, while some evidence suggests that the current proactive fiscal policy is not active enough, which has actually been tightened, Xu, head of the research bureau at the People's Bank of China, the country's central bank, said in a recent column.

Regarded as deleveraging in the financial sector, monetary policy should be stable and neutral to prevent financial risks. As a result, there should be a more positive fiscal stance, Xu noted.

However, the deficit budget for this year is 2.6 percent, slightly lower than 2017's 3 percent, which shows that the current fiscal policy is not positive, he claimed.

Furthermore, the current fiscal expenditures are mainly targeting short-term problems, which shows there is a lack of financial system design for long-term issues, Xu said.

Issues such as local hidden debt problems and growing pension gaps need to be tackled in the long run, which require higher efficiency of fiscal expenditures, he continued.

However, an unnamed official who claims to work for the country's finance system later questioned the column piece in an article on Monday.

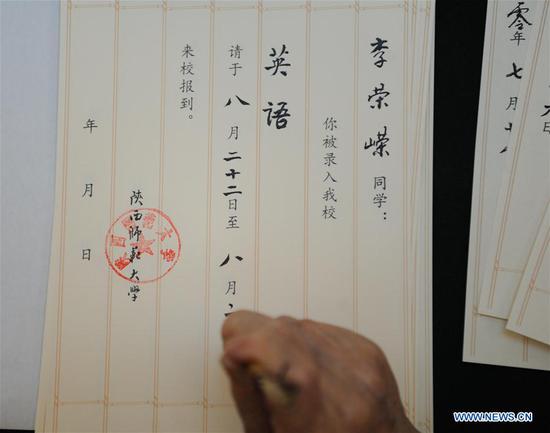

The official, who goes by the pen name of Qingchi, said that China's 2018 fiscal budget report highlights major tasks including stabilizing and adjusting budgets to handle income, deficits and special debt.

"Authorities have taken various measures to increase the activeness of the current fiscal policy, so even though the deficit budget is tighter compared with last year, it will still be effective," Qingchi said.

The finance official also refuted one of Xu's ideas, claiming that assets currently held by State-owned financial institutions do not contain authentic data, as the finance ministry had previously not injected any money.

In contrast, Xu had argued in his column that in actual fact, with the help of the central bank, financial institutions had bought national bonds, which was a way to self-financing. "This is misunderstood," Qingchi claimed.

Also, the finance official disagreed with Xu's statement that financial institutions are the victims of local government debt problems. Qingchi suggested that financial institutions actually play the role of "collusion" or "accomplice" in local debt chaos.