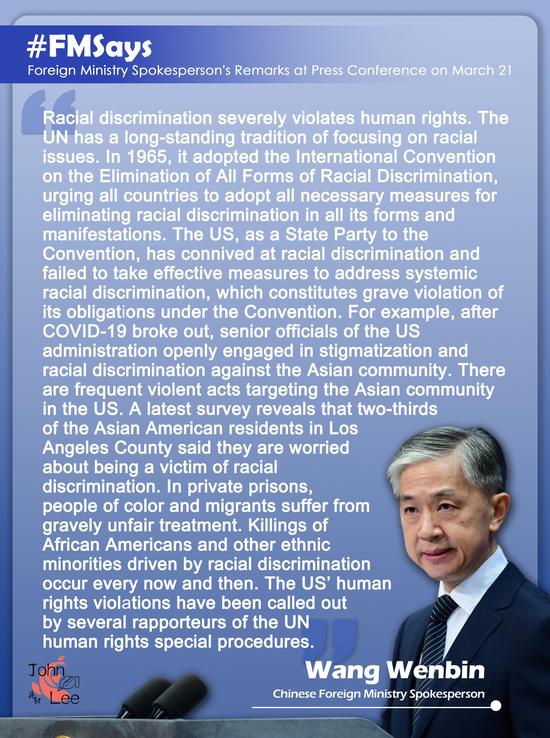

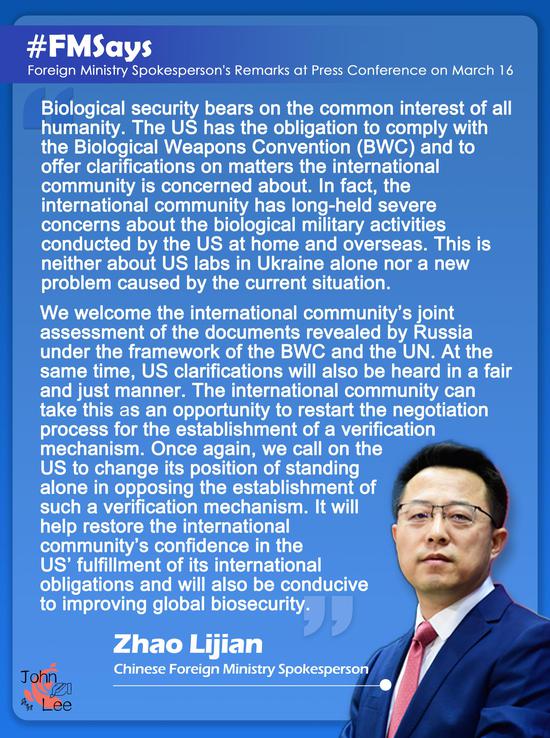

Employees work on an auto assembly line in Qingzhou, Shandong province, on March 1. (WANG JILIN/FOR CHINA DAILY)

Also seen easing cost burdens on micro, small biz, key sectors in manufacturing

China's latest arrangement on the issuance of large-scale value-added tax credit refunds will significantly boost market confidence, spur business investment and stabilize the overall economy amid downward pressures, experts said on Tuesday.

They explained that the arrangement will help alleviate cost burdens on micro and small businesses as well as enterprises in key manufacturing sectors, marking an important step for China's ongoing efforts to improve the system for refunding VAT credits.

Their comments came after an executive meeting of the State Council chaired by Premier Li Keqiang on Monday decided to refund VAT credits to micro and small enterprises, and self-employed households as general VAT payers across all sectors, worth around 1 trillion yuan ($160 billion), accounting for two-thirds of total VAT credit refunds this year.

Outstanding VAT credits will be refunded in one lump sum by the end of June. Newly added credits will be fully refunded on a monthly basis starting on April 1, according to the meeting.

Outstanding VAT credits will be fully refunded to enterprises engaged in manufacturing, research and technical services, power supply, heating, gas and water supply, software and information technology services, ecological conservation, environmental governance, transportation, storage and postal services.

The refunding process for these will start on July 1 and be completed by the end of the year. Newly added credits will also be fully refunded on a monthly basis starting on April 1.

Tao Jin, deputy director of the macroeconomic research center, the Suning Institute of Finance, said the meeting's arrangement is in line with the tasks mapped out by the 2022 Government Work Report, which said China will issue a total of 1.5 trillion yuan VAT credit refunds this year and all go straight to enterprises.

"The arrangement marked the government's latest efforts to stabilize growth," Tao said. "The government has given priority to micro and small businesses while focusing on supporting key sectors. Such a substantial increase in VAT credit refunds will help strongly boost cash flows of enterprises and spur business investment, which will further boost businesses and increase orders for industrial enterprises."

Tao said he expects China's GDP will expand 1.5 percent month-on-month in the first quarter with the help of government policy support for economic stability. On a yearly basis, he expects GDP to grow around 5.5 percent in the first quarter.

Despite pressures and uncertainties both at home and abroad, Tao said he believes China can still meet its annual GDP growth target of around 5.5 percent this year, saying more efforts should be made to boost demand and expectations as well as expand employment.

Wang Meiting, a researcher with the Bank of China Research Institute, spoke highly of the central government's decision to implement VAT credit refunds on a large scale, saying it will significantly help reduce costs for small and micro businesses and key manufacturing enterprises.

Wang warned of multiple pressures from domestic COVID-19 cases, weakening market confidence and rising commodities prices, and expects policymakers to take more steps to expand investment, stabilize market expectations and support small and micro enterprises in maintaining stable payrolls.

Looking ahead, Tang Dajie, a visiting fellow at Wuhan University in Hubei province, said there is still plenty of room for policymakers to step up fiscal support for China's economic stability, such as further reducing consumption taxes.

京公网安备 11010202009201号

京公网安备 11010202009201号