(Ecns.cn) – After setting an upper limit on lending rates charged by private non-bank institutions in Wenzhou city in late September, the Zhejiang provincial government held a videophone conference among its local governments at four levels on October 7, 2011, where they were required to make further efforts to help small- and medium-sized enterprises (SMEs) out of a cash-strapped situation.

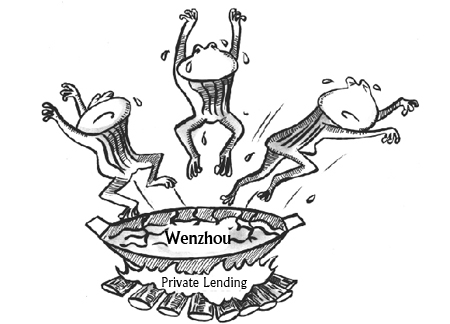

Although Wenzhou had already rolled out a raft of measures to curb the capital shortage, many local SMEs have still not been able to manage loans with considerable compound interest. A large number of company heads have even fled, as they were unable to pay back debts to local loan sharks, resulting in a wave of bankruptcies.

On October 4, 2011, during his visit to Wenzhou, Premier Wen Jiabao urged the local government to take action to support local firms and ordered a crackdown on illegal loan sharks. Wen reiterated the important status of Wenzhou as a business hub in South China, and asked local officials to implement concrete measures to prevent the business climate there from further deteriorating.

Runaway bosses

The Golden Week Holiday should have been a happy time for residents in Wenzhou; instead, the city was overcast and rainy – and so was the mood of many locals.

Since April, news of business leaders fleeing from their debts has frequently darkened the press. In September alone, it was reported that the number of bosses hiding out or committing suicide had reached 25, mainly caused by their failure to pay back loans with heavy interest charges. Some of those industry leaders are widely known to the public.

Zhou Dewen, chairman of the Wenzhou Small- and Medium-sized Enterprises Promotion Association, said banks are lending at usurious rates in some cases, causing a number of enterprises, even small ones, to have closed their doors since early 2011.

According to Zhou, the difficulty in obtaining loans from banks forced many SMEs to turn to private lenders for funds, which led to their collapse under the burden of high interest rates. Usually, the rate of return is about 10 percent for an enterprise, but the interest rate that many SMEs bear from their loans at the moment is between 15 to 20 percent, which means they cannot afford it even if they are making profits.

Zhou revealed that Hu Fulin, founder and president of the Zhejiang Center Group, is a typical example of a runaway boss. Hu suddenly disappeared on September 21, 2011, and reportedly left more than 2 billion yuan ($309.2 million) in debts behind. The Zhejiang Center Group is one of China's biggest eyeglass makers, but after Hu's disappearance five suppliers that had business partnerships with Center Group soon announced plans to cease operations.