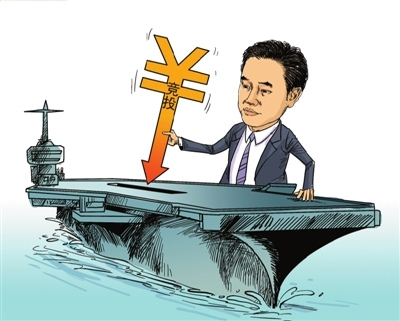

(Ecns.cn)--A company owned by Huang Guangyu, the incarcerated billionaire founder of Gome Electrical Appliances (Gome), is involved in a bid for a UK-retired aircraft carrier, with plans to convert it into the world's largest moving exhibition hall, the Beijing-based Legal Evening News reported Monday.

One of Huang's companies, Eagle Vantage Asset Management Limited (Eagle), confirmed that it had participated in the bidding for the carrier called the HMS Ark Royal. If Eagle wins the bid, the Ark Royal would become the fifth Chinese-owned aircraft carrier.

The 209-meter long, 36-meter wide Ark Royal, which has a full-load displacement of over 20,000 tons, began service in July of 1985 and retired in 2010.

Public information showed that Eagle is registered in Hong Kong and deals in home appliances, electronics, property and club operations. The company's business covers both the Chinese mainland and Hong Kong, and its ultimate beneficiary is Huang Guangyu.

He Yang Qing, vice president of Gome, also confirmed Eagle's participation in the bidding Monday in the Beijing News, but added, "The event has no direct connection with Gome."

He said Gome is also interested in Eagle's bidding for the carrier. If Eagle wins the bid, the project may become a platform for exploring new international marketing models. "It is similar to 'mobile stores,' which are popular overseas currently," said He.

Gome is one of the largest privately-owned electrical appliance retailers in the Chinese mainland and Hong Kong. It was founded by Huang Guangyu in Beijing in 1987. Huang holds about 31 percent of Gome's shares and his wife owns 1.4 percent.

Eagle plans to change the aircraft carrier into the world's largest moving exhibition hall for high-end leisure and tourism purposes, according to Zhang Qiguang, the bid project leader.

Zhao also said the bid project has no relevance to Huang. "The bidding for the aircraft carrier is the decision of Eagle's management. Although Huang is the company's big shareholder, he does not take part in the company's operation," added Zhao.

Whether Eagle can win the bid is still unknown. Its powerful competitor is Chinese businessman Lin Jianbang, who plans to transport the aircraft carrier back to Hong Kong and change it into an international school. Lin offered 40 million yuan for Invincible, another retired British naval aircraft carrier, in January 2011, but lost out.

Neither Zhao nor Lin revealed their prices since it was a private bidding. The results will be announced in mid-July, the report said.

Even though the bidding allegedly has no direct association with Huang, it has again pushed him under the spotlight of the Chinese media. Netizens have speculated about how much money Huang actually has, even after being put in prison and having millions in assets confiscated.

Huang, who was ranked as the mainland's richest person by Hurun's China Rich List from 2005 to 2008, with assets reaching 43 billion yuan ($6.3 billion), was sentenced to 14 years in prison for illegal business dealings, insider trading and corporate bribery last May. The former chairman of Gome was also fined 600 million yuan ($88 million), with another 200 million yuan worth of property confiscated, the Xinhua News Agency said.

His two firms, Gome and Beijing Pengrun Real Estate Development Company, were fined 5 million yuan ($735,000) and 1.2 million yuan respectively for giving bribes, according to a statement from Beijing No 2 Intermediate People's Court.

After Huang was jailed, Gome was hit hard by a leadership dispute between Huang and his successor Chen Xiao. Huang triggered the battle on August 4, 2010, through his wholly-owned Shinning Crown Holdings Inc, saying he wanted shareholders to strip Chen Xiao of his positions as Gome executive director and chairman of the board.

Huang also disagreed with Chen over decisions to slow store openings and to allow an investment by Bain Capital, one of the world's leading private investment firms.

But Chen struck back, winning support from the rest of the Gome board for a resolution to sue Huang. Thus Huang's recommendation to remove Chen was rejected at a shareholder meeting last September.

But less than two months later, Gome agreed to appoint Huang's corporate lawyer Zou Xiaochun as executive director and Huang's sister Huang Yanhong as non-executive director.

On March 10, Chen Xiao announced his resignation and Zhang Dazhong, with the support of Huang, took over as chairman and non-executive director of Gome. Zhang is the founder of Dazhong Electrical Appliances, which was acquired by Gome in 2007.

Gome's dispute was finally ended by Huang's success. However, the company’s home appliance retailing industry suffered a huge blow. The company posted revenue of 50.9 billion yuan for 2010, up 19.32% year-on-year, but was overshadowed by its biggest rival, Suning Appliance, which earned 75.5 billion yuan in sales revenue.

In addition to Gome's shares, Huang is also one of the shareholders of Beijing Centergate Tech (Holding) Co, which engages in the development of real estate and building construction, and was listed on the Shanghai Stock Exchange. Meanwhile, he is also the controlling shareholder of Beijing Pengtai Investment Co, Ltd.

"Huang's assets are so complicated that nobody knows how much he really owns," Liu Buchen, an industry insider told the Beijing News. "In addition to listed companies, Huang also owns many other businesses."