(Ecns.cn)--The convenience of online banking is causing millions of people to opt out of traditional banking, a trend that is luring legions of new criminals looking to raid online accounts.

Phishing websites nab millions

On December 9, 2010, six residents of Shaoxing, in east China's Zhejiang Province, were tricked out of millions by text messages sent from fraudsters, which warned of the "approaching" invalidation of their dynamic passwords for online bank accounts.

The customers were told to change their passwords through a website listed in the text message. After following the instructions, the six of them suffered combined losses of up to one million yuan ($154,700 USD). In shock, they called the local police immediately.

After reporting to the Department of Public Security of Zhejiang Province, Shaoxing police carried out a joint investigation in provinces such as Guangdong, Fujian and Guangxi, eventually busting a gang of online banking fraudsters based in Fujian on January 13, 2011.

This was the first time for Zhejiang to solve a crime related to online banking. Ni Bingshui, an official from the Shaoxing branch police, said, "Currently, a new type of online banking fraud based on dynamic passwords is spreading nationwide. Since the end of 2010, millions have been stolen from individual accounts in Zhejiang Province alone."

Fraud tricks revealed

Usually, criminals employ combined methods of fraud and theft to fleece unwary citizens.

One method is a text message kindly reminding account holders about their passwords or an updated version of an online banking system. Receivers are asked to follow the information in the message to log on to a phony phishing website.

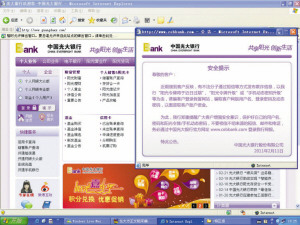

Other tricks include using a website registered in a foreign country to avoid supervision and security controls; another is a high-quality simulation of an official bank’s website.

Traditional phishing schemes are also still effective, which usually obtain personal information using email scams.

Vigilance, stricter supervision needed

Ni Bingshui advised that people should become more alert to text messages and emails from unknown sources.

Banks should also pay more attention to their online systems, ensuring timely upgrades on a frequent basis to fill loopholes.

For online payment platforms such as Alipay.com, Shao Xiaofeng, vice-president of Alibaba, said the website is frequently attacked by unknown hackers, even though it regularly updates its defense ability.

In the end, self-protection is the most important way to avoid online banking fraud. Customers must learn how to fend for themselves.