(ECNS) -- While the Russian economy is showing resilience in the face of heavy sanctions in the recent months, the Western countries are suffering from the weaponization of the U.S. dollars started by themselves, which also triggered ripple effects on global trade and financial system.

Will Russia and the global economy weather the unbearable blow? How have the global energy structure and globalization been impacted? And what lessons can be drawn by other countries from this crisis?

In the latest episode of W.E. Talk, Alexey Beloshitskiy, executive director of Big Data Storage and Analysis Center of Moscow State University, and Dr. Shao Yu, chief economist at Oriental Securities, shared their views on the issues above with Dr. Qu Qiang, Assistant Director and researcher at International Monetary Institute (IMI), Renmin University of China in Beijing.

Beloshitskiy noted that the Western countries have misjudged the resilience of Russia, adding that the influence of Pax Americana and the U.S. dollar-dominated financial system is waning. In addition, Beloshitskiy believes that the conflict between Russia and the Western countries paves the way for the sovereignty for other countries.

Here’s an excerpt of the dialogue:

Russia’s ruble rebounded quickly in spite of heavy sanctions

Qu Qiang: Western countries have been putting huge sanctions on Russian economy, so is Russian economy really been collapsing?

Alexey Beloshitskiy: As for financial services, there are some technical difficulties on how to cooperate with the Anglo-Saxon world right now. But as we can see, the trades with the Western countries are still going on. As they firstly impose their sanctions, now they have to find the ways to bypass them to continue the cooperation. The initial idea of the sanctions was to break the backbone of Russian economy within a month, but we withhold this initial blow.

Qu Qiang: What do you think of the financial sanctions against Russia and the freezing of Russia’s foreign reserves?

Alexey Beloshitskiy: When the Western countries imposed sanctions on us, the key idea of the swift blow was for us to forgo our sovereignty. But they misjudged our resilience, and they misjudged that it was not just one of the actions from our parts. We will always find new ways to import what is necessary and to export what we have. And Western countries still rely on us in terms of resources, agriculture, and technology.

Shao Yu: There are legal risks and consequences if you freeze another country’s foreign reserves. As U.S. Secretary of the Treasury Janet L. Yellen noted, it’s unfair or illegal to freeze a sovereign country’s reserve, like what the U.S. has done to Russia.

This means that any country can confiscate the currency of certain sovereign state out of ideological or other reasons. This would become a great concern in the entire currency system in terms of reserve security in foreign countries. So if you are not my friend, I’ll just hold your money, that sounds like a mafia style and it doesn’t apply to global exchanges and engagements.

Qu Qiang: I think probably 99% of the economists and financial practitioners have made it wrong because they've caused 100% depreciation of ruble in the very beginning of the war and sanction, but now they have to buy back ruble. Why is ruble so strong and how long do you think it's gonna last?

Alexey Beloshitskiy: It's actually a good sign for the economy, because initially the Russian ruble really depreciated when we compare it to U.S. dollar and euro. But our government made everything possible to stabilize the ruble, to stabilize the economy and to stop the panic. This is why in the medium and in the long run, we will have to depreciate the ruble back to its initial levels, to levels of January, when it was probably 70 to 80 rubles per dollar

Initially we appreciated our ruble and we bought all the necessary equipment to produce most of the goods. And now we can depreciated it again. This is not a perfect strategy. But any kind of strategies always depend on their realization on the medium- and the long-term standing of our economy. And I think that it will work out in the end.

The reshaping of geopolitical competition and global energy structure

Qu Qiang: The high energy price is gonna benefit Russia for now, but is it going to generate any negative effect for Russia and the world economy?

Shao Yu: The strengthening of ruble has shown the effect, at least at this stage, of Russia’s efforts in dealing with the sanctions by Europe and the U.S. Russia has taken oil, a necessity, as a weapon to preserve ruble’s sovereignty and ability. Russia’s position in supply chains seems unlikely to be replaced right now.

If there are some positive signs that can help stabilize the financial market gradually, a certain extent of depreciation of ruble will improve the export of energy.

But for the world, energy is currently extremely expensive. The logic of energy transformation puts that if the price of traditional energy is high, then consumers would turn to NEVs. Such shift may cause a revolutionary reshape of the global structures including the demand for fossil fuels and other traditional fuels.

Qu Qiang: What negative impact do you think the sanctions and the weaponization of the U.S. dollar would have on globalization?

Shao Yu: Globalization is an all-around exchange of personnel, materials, technologies, information and ideas. For the current globalization, we used to call it Globalization 3.0 in which different countries play their parts.

Three types of economies form a complete circle that keeps the system circulating. Firstly, there are energy- or resource-oriented economies such as Russia and Ukraine. Another type is production-oriented economies, whose surplus of their current accounts is supposed to be more than 4% of their GDP. And lastly, there are consumption-oriented economies, such as the United States and countries in southern Europe, whose deficit of their current accounts is supposed to be more than 4% of the GDP.

Now, due to geopolitical conflicts or competitions among some countries, the structure of globalization has all fractured. The world is now entering a process with intensified geopolitical competition or in which different countries and allies form competitive blocs. It’s like the globalization between WWI and WWII, a kind of global depression.

As far as we predict, such a state could last 10 years or even longer. So whether it is the transformation of resource-oriented countries, the improvement of the capacities of manufacturing countries, or the constraints on the excessive issue of currency of consumption-oriented countries, we should achieve a new balance point. But it will be very hard to do it.

Ruble challenges the U.S.-dollar hegemony, what can be learned?

Qu Qiang: The Russian government is trying to push forward the settlement between the Russian ruble and the trading partner countries’ currencies to pass over the U.S. dollar-dominated financial system. How will it affect the world financial and trade system?

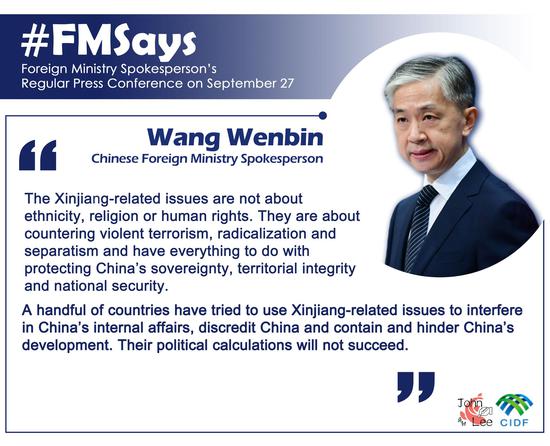

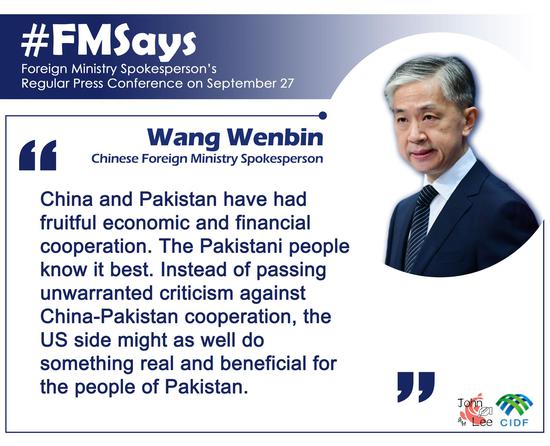

Alexey Beloshitskiy: I suppose that the Pax Americana is waning. We really don't care what kind of currency we use, but the policy against the Russian Federation is eye-opening.

In this light, we will see the diversification of international trade. As more countries trade separately and independently, I suppose the United States one day will have to join other countries on this fair and equal trade. Russia just paves the way for the sovereignty for other countries, and we will always be ready to sit at the round table.

Shao Yu: In short term, the U.S. dollar has a market share of 80%. So it’s still very strong, because the currency is not just used for trading, but also for investing. And there’s also a financial market big enough to absorb U.S. dollars. At present, after efforts of hundreds of years, the U.S. gets this privilege.

Russia’s direct currency trading system with other countries is a kind of alternative attempts. In the short term, it’s still hard to shake the current structure of U.S. dollars globally. But in the long run, unfriendly and unwise actions such as freezing the central bank reserves will eventually shake the current currency system.

So we may expect more options right now, including multiple settlement systems and global currencies, as well as e-currency or digital currency.

Qu Qiang: What can we learn from the Ukraine Crisis?

Alexey Beloshitskiy: The long run is the most important one. We adjust and then in the long run we live. We can rely on equal, stable and steady partnership. In this light, I suppose we'll find some equal footings with Europe, the United States and United Kingdom. Different countries have different situations, and the government always works for the sovereignty and for the well-being of the people. This is the world I want to live in.

Shao Yu: The technical issues in the sanctions and battles have significant implications. We can see that conflicts in the future will be all-around. Multiple areas, including public opinions, communication technologies, finance, trade, energy and supply chain, will be involved.

So what we should learn is how we can guarantee our self-sufficiency while maintaining the economic engagement and connection with the rest of the world.

Despite we may have to compete with others, as long as the competitions are healthy and benign and each side can keep an open mind and play on a level ground, then we can just weather all kinds of conflicts in the future. This is also the case for Russia.

京公网安备 11010202009201号

京公网安备 11010202009201号