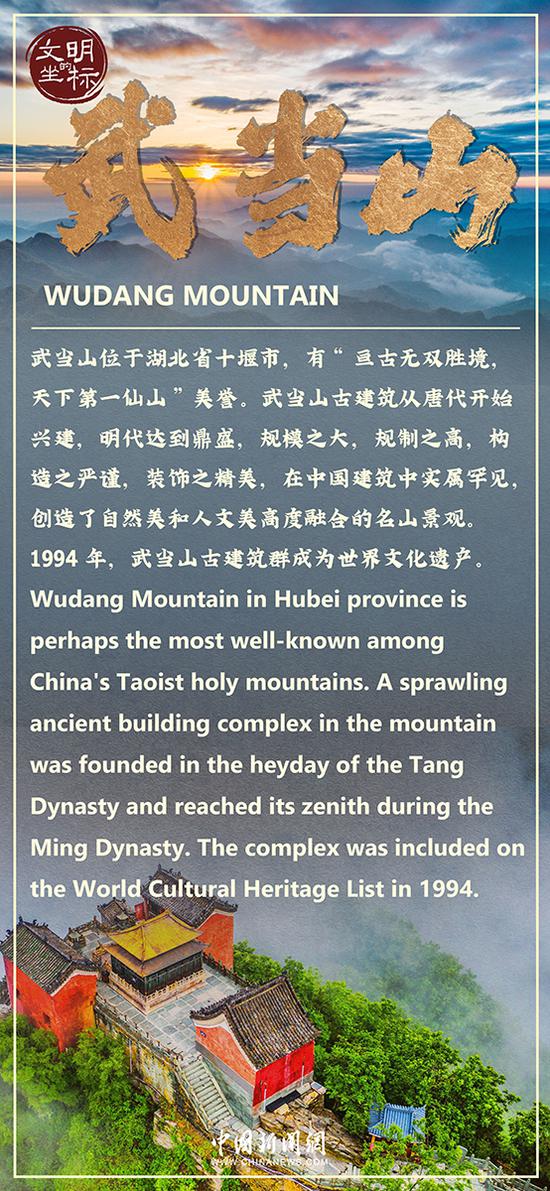

A staff member sorts out duty-free products at Haikou Meilan International Airport in Hainan province in November. (Photo by Luo Yunfei/China News Service)

Chinese consumers' willingness to spend on luxury goods has increased and entry level goods are becoming more popular, Yicai reported on Sunday.

As many as 58.26 percent of respondents chose luxury goods when asked "which areas of goods or services do you consume?" by a study that collected over 1,200 valid questionnaire responses.

The number is similar to those who chose to consume alcohol and baby products, which were 57.49 and 58.42 percent, respectively.

The study discovered that among those who plan to buy luxury goods, most respondents do not have a large budget for single items.

Around 87.43 percent of respondents chose 10,000 yuan ($1,451.8) to 20,000 yuan luxury goods, 2.33 percent chose 20,000 yuan to 50,000 yuan luxury goods and only a small number of respondents chose a higher budget.

In the past five years, China's luxury goods market has grown exponentially, reaching a peak of nearly 500 billion yuan in 2021, an increase of 42 percent from 2019, according to the China Luxury Goods Market 2022 Report released by consulting firm Bain &Company.

Although the growth momentum of China's luxury market significantly weakened in 2022 due to the impact of COVID-19, the market has begun to recover gradually in 2023.

From Jan 21 to 27 this year, the amount of duty-free shopping on offshore island rose 5.9 percent to 1.56 billion yuan compared with that in the 2022 Spring Festival holiday.

The number of people buying duty-free products increased 9.5 percent compared with that in 2022 Spring Festival holiday, according to statistics from Haikou Customs.

China's luxury goods industry is expected to grow 15 percent in 2023, outpacing the global luxury market's 9 percent growth, and surpassing the 7 percent and 6 percent growth of the US and European markets, according to analysts at Barclays Bank.

The share of China's luxury goods market is expected to reach 25 to 27 percent by 2030, becoming the world's biggest luxury single market, the report said.

京公网安备 11010202009201号

京公网安备 11010202009201号