Strategic reserves more important than profit motive

China will not necessarily benefit from the current global slump in the price of commodities and it should enhance its national-level storage scheme for strategic resources, experts said Wednesday.

Some foreign media reports have said that China has been able to take advantage of the falling prices by increasing its purchases of strategic resources such as crude oil, copper, iron ore, and soybeans.

"China has been a major importer of these resources for years, and must buy them regardless of price fluctuations. Now the price is low, it is only natural to buy more," Wu Chenhui, a metal analyst with industry consultancy website chinaiol.com, told the Global Times Wednesday.

Zheng Ping, chief analyst at industry portal chineseport.cn, said that although China's GDP growth has slowed and its economy is in a transitional period, the security of strategic resources is a more important consideration than short-term benefits.

Since 2013, global commodity prices have fallen to record lows amid the lingering effects of the 2008 financial crisis.

Brent crude fell on Tuesday to $46.55 a barrel, having hit the lowest level in almost six years on Monday.

It is currently down 60 percent from a peak reached in June 2014, partly because the Organization of the Petroleum Exporting Countries has refused to cut output, despite a global supply glut.

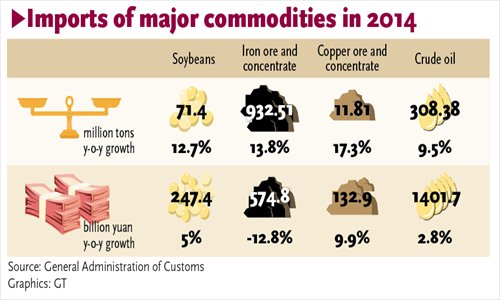

China's overseas oil purchases increased 9.5 percent year-on-year to 308 million tons in 2014, according to data released on Tuesday by the General Administration of Customs (GAC).

Imports of iron ore totaled 932.5 million tons in 2014, up from 820.3 million tons in 2013, the customs data showed. Shipments in December climbed 29 percent month-on-month to 86.85 million tons. In the global market, the price of iron ore fell by 47 percent in 2014

For soybeans, imports jumped 12.7 percent to 71.4 million tons in 2014, according to the customs data.

Because of the fall in global commodity prices, China saved about $46 billion in 2014, a spokesman with the Ministry of Commerce said on Wednesday.

"Uncertainty over the global economic recovery and China's move toward a 'new normal' in its pace of economic growth has dampened sentiment," Wu said. "For some commodities such as oil and gold, investors going short has pushed the price down."

The US pullback from its quantitative easing policy and expectations of an interest rate hike have also put downward pressure on global commodity prices, which are pegged in US dollars, Zheng noted.

"For individual Chinese companies, the slump in commodity prices has not necessarily translated into profits, due to time lags in the production and delivery process," Zheng told the Global Times on Wednesday.

Experts also noted that China had paid exorbitant prices for commodities such as iron ore just a few years ago. In 2013, China spent $106.33 billion on purchases of iron ore compared to $92.75 billion in 2014.

In 2013, Australia and Brazil provided about 70 percent of China's iron ore imports, and price negotiation power is still weighted in favor of the global mining giants, according to media reports.

"China should not stop its stockpiling of strategic resources just because some sectors are stagnating - these resources will surely be used someday," Zheng said.

While the decision on whether to buy or not is largely in the hands of individual companies, the central government should consider a national-level scheme for stockpiling non-renewable strategic resources, such as coal and oil, Zheng noted.

China published its strategic petroleum reserve program in November 2014, stating that it will stockpile 91 million barrels of crude oil, or about nine days of oil use, during the first phase of the government emergency stockpile program.

Media reports said that such a level is very low compared to the international standard of 90 days of oil use.

Wu said there have been production delays at some foreign mines that Chinese firms have invested in, which has reinforced China's dependence on imports of overseas resources.

For instance, China Minmetals Corp's Las Bambas copper mine project in Peru has seen production delays, Wu noted.

Nonetheless, experts said China's buying of global commodities has helped boost market confidence and slowed the speed of the price free fall.

"The fact that China has continued buying is helping to stabilize the market, but one single country cannot reverse the downward trend," Wu said.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.