Alternative energy sector may feel pinch

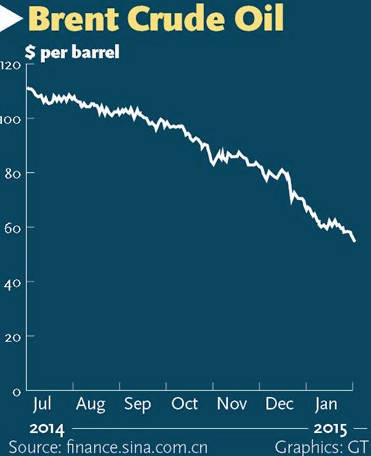

Oil prices extended their slump to hit their lowest point in more than five years on Tuesday as surplus oil supplies continued to drive a bear market.

While the continued oil price slump has delighted consumer countries and worried oil producers, its impact on China appears to be mixed as the country restructures its economy amid a persistent economic slowdown, analysts said.

Although persistent weakness in oil prices might reduce the country's import costs and provide more room for the Chinese government to fine-tune the economy, it may also put pressure on oil producers, increase deflationary risks and undermine efforts to reduce pollution, they said.

Brent crude LCOc1 fell as low as $51.23 a barrel on Tuesday, its lowest level since May 2009, Reuters reported. US crude CLc1 was at $48.54, down $1.50, after falling to $48.47, its lowest since April 2009.

Tumbling oil prices are acting as an unexpected stimulus to the Chinese economy, as the cost of oil imports for China - a net oil importer - shrinks substantially, muting the imported inflation effect, Xu Gao, Beijing-based chief economist at China Everbright Securities Co, told the Global Times.

China is one of the world's top net importers of crude oil, importing 278 million tons of crude oil in the first eleven months of 2014, up 9 percent year-on-year.

"Given the large volume of oil [China] imports every year, the continuous drop in oil prices on the international market could cut costs for companies that will see their profit margins widen, and consumers whose fuel costs will go down," Zhang Bin, director of the Global Macro Economy Research Division at the Institute of World Economics and Politics under the Chinese Academy of Social Sciences (CASS), told the Global Times on Tuesday.

According to Zhang's estimate, the decline in oil prices could save China between $50 billion to $60 billion a year and raise GDP by 0.3 percentage points.

Economists at Bank of America Merrill Lynch estimated that China's GDP could be pushed up by 0.15 percentage points with each 10 percent decline in oil prices.

As a result, Xu said, the Chinese government will subsequently have more leeway in fine-tuning its monetary policy to support economic growth.

Economic growth slipped to 7.3 percent in the third quarter from a year earlier. December's weak manufacturing figures suggest annual growth may not hit 7.5 percent for 2014.

The weak data has prompted economists and research institutes to downgrade forecasts for China's 2015 economic growth, and prompted predictions that the country may lower its annual growth target to around 7 percent at the national legislative session in March.

The Bank of Communications estimated on Tuesday China's economy may grow 7.2 percent in 2015 from a year ago. A more pessimistic estimate by the State Information Center, a State-owned think tank, said economic growth will slow to 7 percent in 2015 from an expected 7.3 percent in 2014.

Thanks to the record-low oil prices, Chinese consumers have been given a fresh incentive to spend money on cars, giving a boost to the government's efforts to restructure the economy along more consumption-driven lines, Zhuang Jian, a senior economist at Asian Development Bank in Beijing, told the Global Times on Tuesday.

The plunge in oil prices may result in unwanted side effects as well, said Zhuang, noting the country's push for green energy risks being delayed as the availability of low-cost oil may dent the eagerness to seek alternative resources.

In a joint statement issued by Chinese President Xi Jinping and US President Barack Obama in November, China pledged to peak its carbon dioxide emissions by around 2030, and increase the share of non-fossil fuels in primary energy consumption to around 20 percent by 2030.

"The lower prices are bad news for oil producers and put pressure on producer pricing index (PPI) and increase deflationary risks," Zhang from CASS said.

In a move to ease pressure on oil producers, China announced on December 26 it would raise the threshold for windfall taxes on oil output to $65 a barrel from $55.

PPI, which measures price changes for major commodities by manufacturers at the wholesale level, dropped 2.7 percent year-on-year in November, its 33rd straight monthly decline.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.