LI MIN/CHINA DAILY

FENG XIUXIA/CHINA DAILY

Healthy growth in services brings new momentum to economic restructuring

Is the economy at last turning? The Chinese government's policies to rebalance the economy seem to be bearing some fruit at last.

The latest economic data published by the National Bureau of Statistics on July 16 suggest China is moving to a more service-based economy that is less reliant on exporting cheap manufactured goods.

On the expenditure side of national income, consumption also continued to play a stronger role, contributing the largest share of GDP growth.

Achieving such shifts was the central aim of both the current 12th Five-Year Plan (2011-15) and last year's Third Plenum meeting-setting the economic course for the next 10 years.

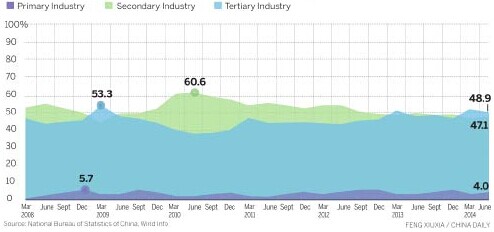

In the second quarter of this year, services accounted for 48.9 percent of GDP growth, compared with 47.1 percent for the secondary sector, mainly comprised of manufacturing.

This represented a complete turnaround from the second quarter of 2012, when services accounted for just 42.7 percent of growth with the lion's share (53 percent) fueled by the secondary sector.

Consumption also accounted for more than half of GDP growth for the second quarter in a row. It made up 54.4 percent, compared with 48.5 percent for investment, while net exports made a negative 2.9 percent contribution. Although the figure for consumption was down from the 64.9 percent in the first quarter, it could still provide evidence of a continued rebalancing.

The picture certainly appears better than last year when investment actually increased as a share of GDP from 45.7 percent in 2012 to 45.9 percent, mainly as a result of the mid-year mini stimulus for targeted infrastructure projects. Consumption also increased only marginally last year from 49.5 to 49.8 percent.

Central to the government's rebalancing strategy are initiatives such as the Shanghai Free Trade Zone, launched last year and at the vanguard of China's financial reforms.

Other moves involve setting up a better social security and health-care system so people become less reliant on having to save and can therefore consume more.

A major reform also involves the hukou, or household registration system, giving greater rights to migrant workers and their families to settle in cities and become consuming citizens.

Underpinning the reforms also is a change in mindset, with the government already demonstrating that it is less inclined to embark on major infrastructure projects just to maintain GDP growth at artificially high levels.

It did, however, announce in April a minor stimulus aimed at more social housing construction and accelerating railway development.

George Magnus, senior independent economic adviser for UBS in London, says the recent data clearly shows a trend.

"I think there is little question that rebalancing is happening. It was always going to happen in my view. The only questions were how and how quickly," he says.

The economist, who was author of Uprising: Will Emerging Markets Shape or Shake the World Economy, which warned of the risks of an investment bust in China if rebalancing did not take place, points out that one of the indicators of rebalancing is a decline in property investment.

Real estate investment was 4.2 trillion yuan ($677 billion) in the first six months, a 14.1 percent increase over the same period last year but down from increases of more than 19 percent that predominated throughout 2013.

"We can see the start of a protracted downswing in property and construction investment. This is of huge consequence as this sector has been the leading edge of China's expansion for over 10 years," he says.

Duncan Innes-Ker, regional editor for Asia at the Economist Intelligence Unit in London, says one explanation for the strong first half data suggesting rebalancing is the increased role consumption tends to play in the early part of the year.

"The first thing to remember is that consumption tends to be much stronger in the first quarter of the year in China, owing to the timing of the Chinese New Year, which means that you quite often see its contribution to GDP growth starting off strong and then easing through the rest of the year."

HSBC China data shows continually improving economy

2014-07-24China vows to ease financing costs for real economy

2014-07-24Xi stresses laws of economics in managing economy

2014-07-09China‘s GDP growth quickens to 7.5 pct in Q2

2014-07-16China‘s GDP grows 7.4 pct in H1

2014-07-16Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.