Slowing regional growth 'normal' amid restructuring

A majority of China's local governments saw their GDP growth rates fall short of targets, some by as much as 2.9 percentage points, adding to the challenges for the world's second largest economy.

As of Thursday, a total of 26 provinces, municipalities and autonomous regions had released local GDP growth rates for the first six months of the year.

None of them had attained the targets they set earlier this year or outpaced the growth of the same period in 2013, though most had expansion greater than the nation's overall yearly target of 7.5 percent.

Guangdong's economy, China's largest by GDP value in 2013, grew by 7.5 percent in the first half of this year, 1 percentage point lower than its annual target.

The country's other major contributors to GDP, including Jiangsu, Shandong and Zhejiang, fall short of their targets, though by less than 1 percentage point each.

"It shows that the local governments were over-optimistic in setting their targets," said Xu Hongcai, director of the Department of Information at China Center for International Economic Exchanges, a government think tank.

Yet slowing provincial growth is normal amid China's efforts to restructure its economy by cutting overcapacity and shifting from an investment to a consumption-driven economy, Xu told the Global Times on Thursday.

Following China's economy bottoming out and stabilizing in the second quarter, improvement is expected, although challenges of overcapacity and restructuring remain, Xu said.

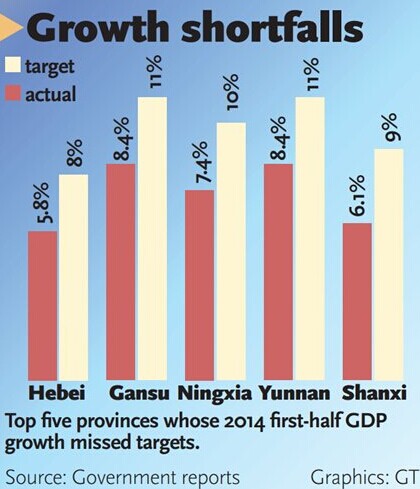

Among provinces who disclosed their first half-year local GDPs, North China's Shanxi Province, a major coal production base, grew only 6.1 percent in the first half of the year, 2.9 percentage points short of its target - the largest gap among all provinces.

Shanxi was followed by Southwest China's Yunnan, Northwest China's Gansu and Ningxia, which saw their local economic growth 2.6 percentage points lower than forecasts.

Beijing's neighboring Hebei Province grew only 5.8 percent in the first half of this year, a 2.2 percentage point gap with its yearly target.

"The underperforming provinces are mainly those with industrial overcapacity issues," Cao Jianhai, a research fellow at the Institute of Industrial Economics of the Chinese Academy of Social Sciences, told the Global Times on Thursday.

Shanxi and Ningxia were dragged down by coal mining - a local pillar industry suffering falling prices and lessening demand nationwide - while Hebei was plagued by steel oversupply and a sluggish market as a result of a weak property sector, Cao said.

The lackluster economic performances are believed to also be affected by the governments' efforts to cut energy consumption and heavily polluting manufacturing.

Hebei, the country's largest steel producer, plans to cut its steel production by 60 million tons by 2017 as the province is one of China's most polluted areas.

As the economies of these provinces are investment-driven, these local authorities will face increasing pressure to meet their full-year targets in the second half of the year, given that they are already heavily indebted to fund new investment projects, Cao noted.

China's total debt had soared to two and a half times the size of its economy by the end of June, surging from 147 percent at the end of 2008, according to Standard Chartered Bank.

By comparison, the US had a total-debt-to-GDP ratio of 260 percent and Japan had a ratio of 415 percent in 2013.

China's debt buildup underscores the difficulties the country faces in balancing growth with the risk of bubbles.

China's GDP grew by 7.4 percent in the first half of this year, slightly short of the yearly target of 7.5.

Economic activity picked up slightly in the second quarter thanks to net exports and the government's mini-stimulus measures including accelerating railway investment, tax breaks for small firms, and a cut on bank's reserves requirement ratios to increase lending to the farm sector and small businesses.

Industrial and fixed-asset investment both accelerated in June thanks to increased activity related to utility and infrastructure investment.

"The government continues to fine-tune the economy, which increasingly means shifting toward monetary easing, and this should be sufficient to keep growth close to its 7.5 percent target this year," Moody's Analytics said in a research note on Thursday.

China will most likely maintain the intensity of its ongoing mini-stimulus program in the second half of this year, which led to an upward revision of the official growth forecast, to 7.4 percent from 7.2 percent, according to Lu Ting, chief China economist at Bank of America Merrill Lynch.

HSBC raises China GDP growth forecast

2014-07-21GDP growth of 7.5% in range, premier Li says

2014-07-18China‘s GDP grows 7.4 pct in H1

2014-07-16Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.