China's economy expanded at its weakest pace since the third quarter of 2012 in the first three months of this year, but performed better than many expected. Alongside a March improvement in some economic indexes, it sent mixed signals as to what degree the government should act to aid the economy.

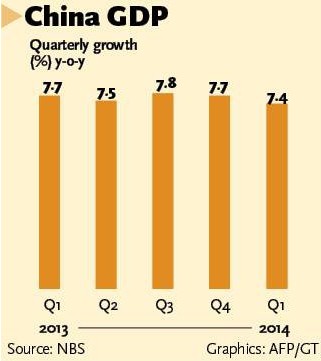

The country's GDP grew 7.4 percent from a year earlier in the first quarter, down from 7.7 percent growth in the previous quarter, data from the National Bureau of Statistics (NBS) showed Wednesday.

The central government set an annual growth target of around 7.5 percent for 2014.

The country is in a period of changing gears in economic growth, a period of short-term pain from structural adjustment as well as a period of dissolving the side effects from previous stimulus measures. It must pay some price during these periods, Sheng Laiyun, a spokesman for the NBS said on release of the data.

"Although economic growth slightly slowed in the first quarter, it was still within the reasonable range. There is no fundamental change in the improving trend of the economy. The economy is still moving in the expected direction," Sheng said.

"The 7.4 percent quarterly growth is slightly better than market expectation and stays close to the 7.5 percent annual target," Zhang Liqun, a research fellow at the Development Research Center of China's State Council, told the Global Times Wednesday.

"Besides, industrial output and consumption both improved in March, indicating the economy is moving toward a stable path," Zhang said.

Industrial output for China's major enterprises rose 8.8 percent year-on-year in March, up from 8.6 percent in the first two months, the NBS data showed.

Retail sales, an indicator of consumer spending, grew 12.2 percent in March from a year earlier, an expansion from 11.8 percent in the first two months.

The service sector accounted for 49 percent of GDP in the first quarter, up 1.1 percentage points from the same period last year.

Meanwhile, fixed-assets investment rose 17.6 percent in the first quarter from a year earlier, down 3.3 percentage points from the same period of last year.

"The increasing ratio of the service sector to GDP and decline of fixed-assets investment showed economic structure is further optimizing, a result that we most desire," Cai Jin, a vice chairman of the China Federation of Logistics & Purchasing, told the Global Times on Wednesday.

Despite the slight slowdown in the economy, the country managed to strike a balance between economic growth and employment, Cai said.

The country created more than 3 million new urban jobs in the first quarter while migrant workers in continuous employment for more than six months increased 2.88 million from the same period last year, up 1.7 percent year-on-year, according to Sheng.

An extended economic slowdown may put pressure on the government to act to arrest the persistent slowdown or limit the government's scope for economic restructuring.

Premier Li Keqiang said last week at the annual meeting of Boao Forum for Asia in South China's Hainan Province that the country will not resort to forceful short-term stimulus measures to boost the economy in the face of fluctuations.

Yuan Gangming, a research fellow at the Center for China in the World Economy at Tsinghua University, said the short-term decline in the economy tests the commitment of the leadership to structural adjustment.

The decline, partly caused by a decrease in investment, is benign. If the leadership can resist the pressure for massive stimulus, the short-term pain of slowdown from structural adjustment can translate into a growth engine in the future, Yuan said.

"The leadership can and must resist the pressure for rolling out stimulus to avoid pushing the economy down to the old path of being heavily reliant on investment," Yuan said.

In a sign appearing to help stabilize the economy, Premier Li said Wednesday at the regular executive meeting of the State Council that the country will reduce the reserve requirement ratio (RRR) for eligible commercial banks in rural areas to increase financial support for the agricultural sector.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.