Debt products from local government financing vehicles are darlings on the market

Li Jia, a fund manager with ICBC Credit Suisse Asset Management Co Ltd, has not had much time to talk to the media lately. The first-half bull market for bonds had her tied up in one meeting after another, discussing market strategies.

Among various investment options, she saids he feels that chengtou (urban infrastructure-related investment) notes are a safe bet. Her belief is widely shared in the investment community.

Chengtou notes are debt products issued by China's local government financing vehicles, of which there are believed to be more than 10,000.

These vehicles were created to fund urban construction projects, since municipal governments are barred from deficit financing under the current Budget Law. The explosive growth of LGFVs, which in the past few years have built numerous "new cities" across the country, propelled the extraordinary surge in China's debt in the aftermath of the 2008 global financial crisis.

"Chengtou won't default in the near term," Li said. But when asked about the longer term, she responded: "It's not clear. But we don't care. Nowadays, we're just looking at short-term holdings. Few hold these notes for the long term."

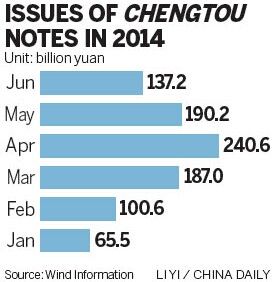

The market's fondness for chengtou debt prompted a surge in issues during the second quarter to a record 568 billion yuan ($91.6 billion), the highest since 2002, according to Shanghai-based Wind Information Co Ltd.

Issues totaled 353.1 billion yuan in the first quarter of the year.

The increasing popularity of chengtou notes, which are considered corporate notes, helped push down issuers' costs. Yields on two-year AAA-rated notes have dropped 137 basis points this year to nearly a 10-month low of 4.86 percent, according to Bloomberg.

Commercial banks have been quick to jump on the bandwagon, snapping up a majority of the high-rated bonds. One AAA-rated note drew bids for almost six times the amount offered, and even an AA-rated note attracted bids for three times the offered amount, Li said.

Several factors are contributing to the buoyant market, analysts said.

On the supply side, most of the LGFVs issued their first debt in 2009 as the markets were awash with liquidity, the result of the central government's stimulus spending to offset the global financial crisis. Many of those issues were in the form of five-year notes, which come due this year.

Refinancing demand is strong, and rollovers were approved in late February by the National Development and Reform Commission, which oversees corporate note issues.

On the demand side, ample liquidity is driving enthusiasm. The tight monetary policy that caused a credit crunch in mid-2013 essentially ended in March. Analysts said that if liquidity is tightened again in the second half of this year, bond yields could spike again.

Moreover, last year, the government began to limit banks' purchases of so-called nonstandard assets, such as trust loans, making chengtou relatively more attractive. Both types of assets have relatively high yields, making them useful for banks that repackage them into wealth management products for sale to clients.

But chengtou notes commonly offer at least implicit government backing, underwriters claim.

In late May, the Ministry of Finance for the first time allowed 10 provinces and cities to sell bonds independently in a pilot program, aiming to replace risky and opaque borrowing by LGFVs with a municipal bond market similar to that of the United States.

A document issued by the NDRC said the pilot program would expand and gradually replace bonds issued by LGFVs, whose debts generally do not carry explicit government guarantees. This document boosted expectations that the supply of chengtou notes will shrink, making them more popular.

Chengtou notes "are becoming a rare, high-investment-value option", said Lin Na, a bond analyst with China Galaxy Securities Co Ltd.

Another landmark event came in early March, when Shanghai Chaori Solar Energy Science&Technology Co failed to repay its debt, becoming the first corporate bond to default in China. The event reminded the market of the potential risks of corporate bonds, which unlike chengtou - have neither explicit nor implicit government guarantees.

"March was a watershed. Since then, sales of chengtou kept rallying," said Liu Dan, another analyst at China Galaxy Securities.

Ivan Chung, senior vice-president at Moody's Investors Service Inc, said that in late 2013, market sentiment was totally different. Liquidity was tight, and the market was anxious about the scale of local government debt, which had not recently been tallied.

Then, on the last day of 2013, the National Audit Office disclosed the size of local government debt: more than 10 trillion yuan. And later came the NDRC's move to allow rollovers of LGFV debts.

"It was like all of a sudden, the fate of chengtou notes became clear," Chung said.

Some of the money raised by new chengtou issues went into urban renovation projects and infrastructure, which helped offset the downward pressure of the sagging property market this year. However, the benefit did not come without a cost.

The major cost was that the market turned a cold shoulder to private companies' bonds. Many companies had to delay planned bond offerings, and some issues failed for lack of bids.

"We've suggested to several of our clients to delay their issue plans because the current cost of debt is too high. How can these private firms finance at above 8 percent yields? They are not State-owned enterprises," said a broker with a securities firm who declined to be identified.

The chengtou segment is now so dominant that it accounted for nearly 90 percent of the new corporate notes on offer in th epast quarter.

Referring to numerous LGFVs that have rarely been prudent in their borrowings, Xu Gao, chief economist with Everbright Securities Co, said: "While the bond market has been liberalized, not all the participants are market-oriented entities."

The real solution is for these entities to exit the market, Xu said.

Public projects such as roads, gas pipelines and affordable housing, which are critically important for China, should be built by a more "proactive" fiscal policy, Xu said.

Questions still linger over a possible chengtou default. Xu and many other analysts said it is almost impossible for local governments to allow that to happen because a single default would cast a shadow overall chengtou notes and trigger systemic risks.

That view sustains the market's appetite for chengtou, at least for now.

Growth in Chinese local government debt slows

2014-06-25Debt crisis looms for local governments

2014-06-18Local govts face massive debt repayment pressure

2014-06-17Fiscal reforms to ease local govt debt pressure

2014-06-11More local govts ‘may issue debt directly‘

2014-05-20Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.