Local government debt. GT

Repayment remains problematic due to huge pileup

The growth of China's local government debt has slowed down since June 2013, but the amount of money that some local governments borrowed to repay old debts was still huge, the State auditor said Tuesday, underlining the risks in local debt.

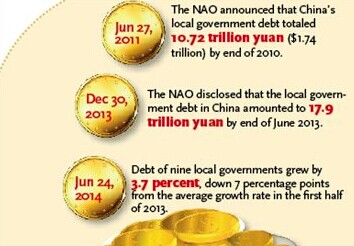

The debt balance of nine provincial governments and nine city-level governments audited grew by an average 3.79 percent from the end of June 2013 to the end of March 2014, 7 percentage points down from the average growth in the first six months of 2013, an audit report released by the National Audit Office (NAO) showed Tuesday, without specifying the name of the provinces and cities.

The amount of money that the nine provinces newly borrowed to repay old debts reached 57.9 billion yuan ($9.3 billion), with 821 million yuan of matured loans yet to be repaid, the report said.

"The sample of nine provinces and nine city-level governments is small. To accurately access the risks, we need to know whether the projects that the money went to could generate adequate cash flow," Jia Kang, director of the Research Institute for Fiscal Science under the Ministry of Finance, told the Global Times Tuesday.

"Compared with the more than 7 percent economic growth, the 3.79 percent debt growth of some local governments was not significant. But the issue of debt maturity mismatch deserves attention," Jia said.

The result of the latest nationwide government debt audit released at the end of 2013 showed that local government liabilities had swollen to around 17.9 trillion yuan at the end of June 2013, up 67 percent from 2010. The NAO said at that time that the risk was controllable.

"The conclusion is generally reasonable but we still cannot ignore the fact that the debt ratio of some local governments is still very high and the risks associated with local government finance vehicles are big," Zhang Bin, director of the taxation office at the Beijing-based National Academy of Economic Strategy, told the Global Times Tuesday.

"There has long been a problem of maturity mismatches in local debt and local governments either use new loans to repay mature debts or use income from land sales," Zhang said.

But as China's economy has slowed down and the central bank has resisted calls for all-around monetary easing to inject more money into the market, local governments are facing pressure to get loans from banks.

Meanwhile, the property market remains weak, with the official data showing last week that the average home prices fell for the first time in two years in May, which led to dwindling income for local governments from land sales.

Finance Minister Lou Jiwei said on Tuesday that the ministry will carry out a pilot project to allow local governments to float and repay local government bonds and properly handle local debt default cases according to market principles. Luo did not give details about the market-based measures.

On Monday, in a first for China, South China's Guangdong Province sold five-year, seven-year and 10-year local government bonds totaling 14.8 billion yuan with interest rates of 3.84 percent, 3.97 percent and 4.05 percent respectively.

The move followed a statement in May by the Ministry of Finance that China will allow local governments including Beijing, Shanghai and Guangdong to raise money by selling municipal bonds directly but they should also be responsible for repaying the borrowed money.

"Providing local governments the legal channel of bond sales to raise money is a good start," Zhang said.

Due to a huge debt buildup, China banned local governments from raising money through bond sales on their own in 1994. But local governments have long dodged the ban by setting up companies known as local government financing vehicles which raise money by taking bank loans, issuing bonds or turning to shadow banking on behalf of local governments.

Local debts need central attention

2014-05-22Local govt solvency tested on debts due

2014-02-21Local govt debts get high-level attention

2013-12-14Rules on local govt debts to be rewritten

2013-12-13Roadmap ‘will curb local debts‘

2013-11-21Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.