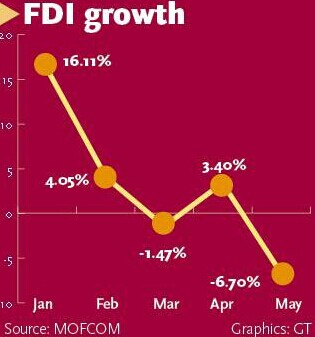

China took in $8.6 billion in foreign investment in May, a fall of 6.7 percent from a year earlier, figures from the Ministry of Commerce (MOFCOM) showed Tuesday, indicating more fluctuations in foreign investment inflows.

The reading for May marked the second slide this year, following a drop of 1.47 percent logged in March, when foreign direct investment (FDI) into China fell for the first time in 14 months.

In remarks that eased concerns over whether the nation could continue to be a magnet for overseas investors, Shen Danyang, a MOFCOM spokesperson, told a press conference in Beijing on Tuesday that the country's service sector has apparently seen brisker growth in drawing foreign investment compared to the manufacturing sector, indicating that the economy remains appealing to foreign investors.

In the first five months of the year, capital flows into the service sector rose by 19.5 percent year-on-year to account for 56.2 percent of the total FDI.

In comparison, the entire FDI into the country recorded $48.91 billion from January to May, an increase of a mere 2.8 percent from the previous year, the ministry statistics showed.

The economy's rebalancing toward vigorous development of service industries has offered more opportunities for foreign enterprises eyeing growth in China, and this will be a trend, Shen said, adding that the country still wants to attract continued flows of investment in advanced manufacturing.

There are no grounds for claims that the Chinese market has been losing its attraction for foreign investors, the spokesperson noted, rebuffing pessimistic assessments of overseas investment in the country.

A breakdown of the country's actualized FDI by countries and regions showed that capital flows from South Korea and the UK saw a surge of 87.9 percent and 62.2 percent, respectively, during the first five months, while a shrinkage was seen in investment flows from Japan, the US and Europe, the ministry said.

Yao said that the deteriorating political ties between China and Japan led to an unfavorable business climate between them.

The findings of a survey by the European Union Chamber of Commerce in China (EUCCC) were released in late May and indicated that more European firms have revised down expectations for the Chinese market and scaled back investment plans, weighed down by a slowing economy and an increasingly tough business climate.

Despite the fluctuations, analysts say the country will be expected to see continued foreign investment inflows.

"The lackluster Chinese economy will have certain impediments [on capital flows into the country] as investors will have misgivings about the rewards of investing in a cooling economy," Liu Dongliang, a Shanghai-based senior analyst at China Merchants Bank Co, told the Global Times on Tuesday.

But Liu forecast that the economy will gain further momentum after having seen more signs of stabilization in May, contributing to sustained investment inflows at large.

A sustained improvement is expected in the Chinese economy, which is on course to rebound in the second and third quarters, as a series of mini-stimulus measures that have been taken by the government in recent months help result in a lift in economic activity, economists at UBS Securities led by Wang Tao said in a note sent to the Global Times on Tuesday.

Still, Liu said that from a global point of view, the improving US economy might help attract more investment into the US, which would potentially be unfavorable for capital flows into China.

MOFCOM on Tuesday also released the country's non-financial outbound direct investment for the first five months, which has fallen 10.2 percent to $30.81 billion. In May alone, the figure was $5.12 billion, a rise of 6.9 percent from a year earlier.

FDI drops, but no cause for concern

2014-06-18China‘s FDI inflows down 6.7 pct in May

2014-06-17China ‘can lead‘ in FDI rules: UN official

2014-05-27China‘s FDI inflow up 3.4 pct in April

2014-05-16Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.