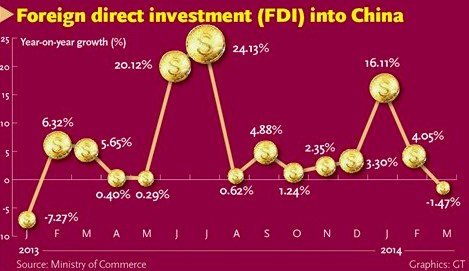

Foreign direct investment (FDI) into China fell in March for the first time in 14 months, data from the Ministry of Commerce (MOC) showed Thursday.

However, ministry spokesman Shen Danyang said that monthly fluctuations are normal and the nation is still attractive for foreign investors.

Excluding capital flows into the banking, securities and insurance sectors, the country took in $12.24 billion in FDI in March, down 1.47 percent from a year earlier, Shen told a news conference in Beijing on Thursday.

In the first quarter, there was a 5.5 percent rise in FDI year-on-year, reaching $31.55 billion, according to the ministry's statistics.

The slight fall in China's actualized FDI in March is normal, Shen said in response to questions raised by the Global Times.

FDI inflows may see small fluctuations in a single month, due to a number of factors such as changes in the value of specific projects and in the yuan's exchange rate, he explained, adding that it won't affect the future growth of foreign investment.

"We are still full of confidence in the FDI's stable growth for the whole year," Shen said.

The last time the country saw negative FDI growth was in January 2013, when inflows shrank by 7.3 percent year-on-year, an eighth consecutive month of falling foreign investment.

Zhuang Jian, a senior economist at the Asian Development Bank, attributed the dip in FDI to base effects and the recent fluctuation in the yuan's exchange rate.

"The monthly drop barely indicates a trend reversal," he said.

Figures over a longer period of time offer a clearer reflection of the overall situation, Zhuang told the Global Times on Thursday. But he said foreign investment inflows may continue to fluctuate this year as both the global economy and the domestic economy are still fraught with uncertainties.

The fall in March FDI shows foreign investors' concern about the recent depreciation of the yuan and the slowdown in the Chinese economy, Huo Jianguo, head of the Chinese Academy of International Trade and Economic Cooperation, told the Global Times Thursday.

However, Huo said the reforms that are underway will unleash the economy's growth potential and preserve China's attraction for global investors. The nation's move toward a market-based floating exchange rate regime will also help calm investors' concerns about currency fluctuations.

Shen also forecast a rebound in China's exports and imports in the second quarter, following an unexpected fall last month.

The country's exports fell 6.6 -percent year-on-year in March, while imports fell 11.3 percent, according to customs data released last week.

There are uncertainties over the trade outlook this year, given the slow recovery of developed economies and the lack of growth momentum in emerging markets, Shen said, while noting that the country still has the right conditions to maintain stable growth in foreign trade.

MOC and the General Administration of Customs have recently conducted a survey of managers of the country's several thousand exporting enterprises, which found a rise in the number of enterprises that are confident about export prospects, according to Shen.

The ministry has been active in implementing relevant policies and measures to facilitate stable trade growth, Shen also told reporters on Thursday.

"Active progress will be seen in fostering stable trade growth and rebalancing of the economy as well," he said.

FDI inflow falls as economy cools

2014-04-18FDI drops for first time in 14 months

2014-04-17China‘s FDI inflow falls as economy cools

2014-04-17China‘s FDI inflow down 1.47 pct in March

2014-04-17Slowdown seen in Feb FDI inflows

2014-03-19Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.