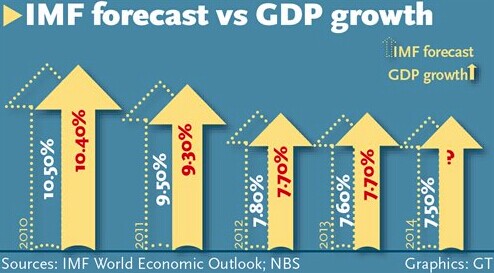

China's economy is on course to meet the official growth target of about 7.5 percent in 2014, as an improving global outlook should support exports during the second half of the year that will expect to compensate for the slowing domestic demand, a senior official at the IMF said on Thursday.

In remarks that forecast reasonably favorable near-term outlook, IMF Deputy Managing Director David Lipton maintained the fund's 2014 growth projection for China's economy which was ratcheted up to 7.5 percent in April from 7.2 percent in October 2013.

As part of the Washington-based fund's annual review, Lipton has in recent days met with some senior Chinese officials including Vice Premier Ma Kai and People's Bank of China Governor Zhou Xiaochuan to discuss the economy. Lipton said the discussions showed broad agreements on underlying vulnerabilities and challenges faced by the economy.

Although the government still has sufficient buffers to prevent any kind of sharp growth slowdown, "continued efforts to reduce vulnerabilities are still an important priority," Lipton said at a press conference in Beijing on Thursday, cautioning against further stimulus measures.

"Vulnerabilities have risen to the point that containing them should be a priority, and therefore additional stimulus should only be deployed if growth slows significantly below this year's chart," he said.

In a sign of addressing both short-term downturn risks and longer-term restructuring pressure, the central government has in recent months rolled out a series of targeted and mini stimulus measures to put a floor under growth of the flagging economy that hit an 18-month low of 7.4 percent in the first quarter.

The latest such measure was Premier Li Keqiang's announcement at a State Council meeting on May 30 that the country will cut the reserve requirement ratio (RRR) for those banks which have a certain ratio of lending to the rural sector and small and micro-sized enterprises, in an expansion of targeted RRR cuts.

When asked about the health of China's property sector which has seen more signs of cool-down in both transaction volumes and home prices, Lipton remarked the correction is under way, but rather than signifying a turning point, the current situation is part of a cyclical period where there are adjustments from the previous overheating.

"We know also from international experience that once correction takes place, there can be a resumption," Lipton told the Global Times at the press conference.

China's long-term housing need remains very substantial, as people are inclined to move to more modern and larger dwelling as their income rise and there are still many people moving from rural to urban area, Lipton said, pointing to confidence in China's housing sector in the long run.

For next year, a target range for growth of around 7 percent will be consistent with the goal of transitioning to a sustainable growth path, Lipton said, revising down the fund's April forecast of 7.3 percent for China's economic growth in 2015.

"A lowered growth rate for next year is reasonable, as the reform-driven Chinese economy will inevitably retreat and embrace a cooling yet more sustainable growth path," Zhang Lei, a Beijing-based macroeconomic analyst with Minsheng Securities, told the Global Times on Thursday.

The Third Plenary Session of the 18th Communist Party of China Central Committee in November 2013 laid out an ambitious and comprehensive agenda of reforms, which would lead the country to achieve the fastest sustainable growth and continue its convergence toward high-income economies, Lipton said.

Provincial Q1 GDP data adds to slowdown concerns

2014-04-30China‘s GDP growth still high: Foreign Ministry Spokeswoman

2014-04-18China‘s GDP grows 7.4 pct in Q1

2014-04-16Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.