Activity in China's factory sector picked up in March, official data showed Tuesday, the latest sign of a possible improvement in the country's economy. But analysts warned that the figure shows only a regular seasonal rebound, and that the outlook remains dubious.

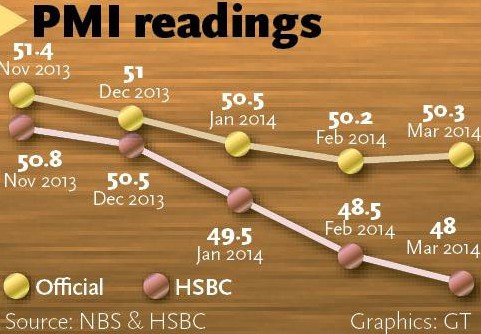

The official Purchasing Managers' Index (PMI) was announced by the National Bureau of Statistics (NBS) to have edged up 0.1 percentage points to 50.3 in March, the first rebound since November 2013.

The official PMI reading for large enterprises expanded 0.3 percentage points to 51 in March, while the PMIs for small and medium-sized enterprises were 49.3 and 49.2 for the month, compared to 48.9 and 49.4 in February, according to the bureau.

A reading above 50 indicates an expansion in manufacturing, while a score below 50 points to contraction.

But Tang Jianwei, a senior macroeconomic analyst at the Bank of Communications in Shanghai, told the Global Times Tuesday that the data simply shows a seasonal rebound rather than an all-round recovery.

Last month's reading was actually the lowest on record for official PMIs in March, when manufacturing activity quickens as it recovers from the impact of the Spring Festival holiday, when workers return home to their families, according to the Bank of Communications.

The HSBC PMI, focusing on small and private enterprises, also offered a mixed picture of the economic situation, with its reading falling to 48 in March from the previous month's 48.5, the bank said Tuesday.

Concerned by the discrepancy between the two figures, Zhang Zhiwei, chief China economist at Nomura in Hong Kong, said in a research report sent to the Global Times Tuesday, "We are not convinced the economy has passed a turning point and growth will recover from here."

However, Hong Kong-based economists at Barclays Capital noted Tuesday the official PMI with a larger industry coverage and a sample size of 3,000 "gives a better picture of overall economic conditions" than the HSBC survey of only about 420 enterprises.

The improvement in last month's official PMI is noteworthy, as it comes at a time when domestic restructuring efforts were under way as the Chinese government tries to combat overcapacity across some major sectors, including steel and cement, they told the Global Times in a note.

But the rebound remains seen as "tentative signs of improvement" by the economists at Barclays Capital, who suggest the country's policymakers may be only granted a temporary relief.

"The Chinese economy is likely to bottom out during the second quarter, but it will face greater risks this year as there may be more bad news about Chinese enterprises' debt defaults throughout the year," Chen Wei, an analyst at Beijing-based brokerage firm China Minzu Securities Co, told the Global Times on Tuesday.

Premier Li Keqiang said last week that that economic growth must be maintained at a reasonable range and the government has policies in store to counter any volatility this year.

Both monetary and fiscal policies are expected to be loosened in the second quarter to prop up the economy, Nomura's Zhang forecast.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.