Workers fix protective film onto a car at Dongfeng Peugeot Citroen Automobile Co Ltd in Wuhan, Hubei province. Foreign direct investment in Central China surged 75 percent to $2.62 billion in the Jan-Feb period, the Ministry of Commerce said. Cheng Min / Xinhua

Recent economic weakness in China hasn't deterred foreign direct investment, with inflows maintaining robust growth in the first two months of this year, figures from the Ministry of Commerce indicated on Tuesday.

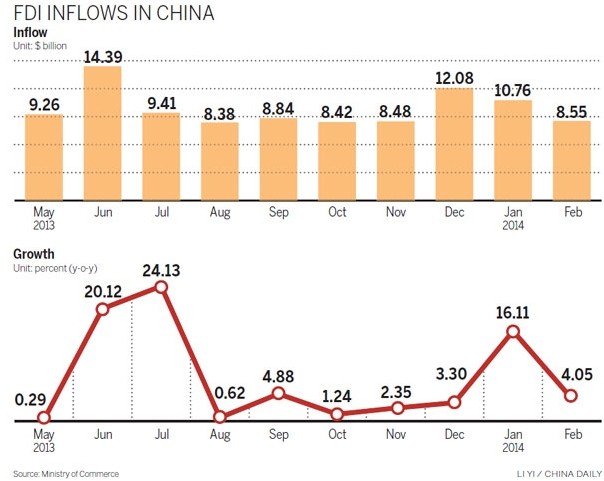

During January and February, FDI (excluding the financial sector) rose almost 10.5 percent year-on-year to $19.31 billion, the ministry said. In February alone, inbound FDI went up 4 percent to $8.55 billion.

Analysts said that global investors' confidence was strengthened by the nation's planned reforms and opening-up initiatives.

And although eastern regions continued to draw the lion's share of the money, inbound FDI to landlocked central and western provinces and regions expanded at a much faster pace.

"Despite sluggish global investment and problems in China's economic development, foreign investors remain confident in investment in China," Shen Danyang, a ministry spokesman, told reporters in Beijing.

Recent economic data have suggested weakened growth momentum in the world's second-largest economy. Louis Kuijs, chief economist in China at the Royal Bank of Scotland Plc, on Monday lowered his forecast for 2014 GDP growth to 7.7 percent from 8.2 percent originally.

Earlier this month, the government announced a 7.5 percent GDP growth target for this year. It also forecast that FDI inflows would rise 3.5 percent to $121.7 billion.

Wang Jun, an expert at the China Center for International Economic Exchanges, a government think tank, said the "outstanding" FDI figures show that foreign investors "are optimistic about China's economic growth prospects and market potential in the medium and long term.

"Industrial leaders aren't as downbeat about China's economic prospects as some media reports and Western economists claim," Wang added.

Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a think tank at the Ministry of Commerce, agreed.

Huo said that China is at an inflection point in terms of deepening reform and accelerating its opening-up.

"The new leadership took practical measures, including expanding access into the service sector and easing controls on the financial markets, which strengthened foreign investors' confidence in the market potential of China and the benefits of reform.

"The ongoing economic recovery in the United States and the European Union improved the cross-border investment outlook for multinational corporations," Huo said.

Investment from the US surged 43.3 percent to $711 million, but that from the EU declined 13.8 percent to $1.05 billion, according to the ministry.

A group of 10 Asian economies, including Japan and South Korea, accounted for the bulk of the FDI at $16.94 billion, up 11.6 percent.

South Korea's investment in China soared 223.6 percent to $834 million in the period. In contrast, Japan's investment plunged 43.6 percent to $716 million.

Huo said that the acceleration of negotiations on a China-South Korea free trade agreement boosted South Korean FDI, while continued political tensions with Japan dampened FDI from that nation.

Investment grew quickly in China's inland regions. FDI in the central region surged 75 percent to $2.62 billion, accounting for 13.6 percent of the total.

In the western region, FDI expanded 29 percent to $1.39 billion, about 7.2 percent of the total.

The bulk of FDI continued to flow into the eastern region, which totaled $15.3 billion, up 2.6 percent.

Better infrastructure and improved government services are helping inland regions draw more FDI, Wang said.

Outward direct investment contracted 37.2 percent to $11.54 billion in the first two months. Investment headed to Hong Kong tumbled 63 percent, while that to the EU sank 11.6 percent.

Shen said that outbound FDI figures were affected by a high base of comparison. In the same period last year, China National Offshore Oil Corp closed its $15 billion takeover of Canada's Nexen. Had that transaction been excluded, the FDI figure would have been up 33.6 percent, he said.

Starting this year, China has released yuan-denominated trade and investment statistics in addition to those expressed in dollars.

Shen said that the move was intended to follow international practice and reflect market demand.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.