Foreign direct investment (FDI) inflows into China accelerated in January, underlining overseas investor confidence in the country as a favorable investment destination, the Ministry of Commerce (MOC) said Tuesday.

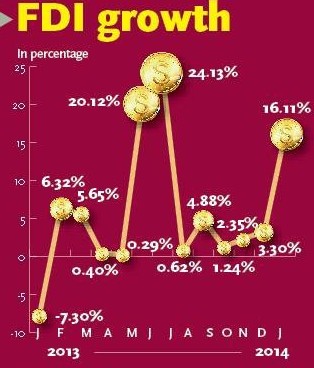

FDI reached $10.76 billion in January, up 16.11 percent from a year earlier, Shen Danyang, a spokesperson for the ministry, told a press conference in Beijing. The year-on-year growth of FDI was 3.3 percent in December 2013.

"The double-digit growth provided the most solid and convincing answer to doubts as to whether China still has a favorable investment environment and whether foreign investors are confident in China's economic development," Shen said.

He attributed the robust growth in FDI to three factors - firmer investor confidence buoyed by a reform blueprint unveiled by China's leadership, the country's stable political and economic conditions, and growth in the service sector.

The service sector drew $6.33 billion in FDI last month, up 57.02 percent year-on-year, data from the ministry showed, which Shen said is a result of China's further opening-up of the sector.

"We expect FDI will maintain a good growth momentum this year," Shen said.

Some experts suspect the fast growth in FDI may be inflated by hot money inflows.

"As liquidity was tight in the monetary market ahead of Spring Festival holidays, some speculative foreign capital flowed into China in the guise of FDI in January," Li Youhuan, a research fellow with the Guangdong Academy of Social Sciences, told the Global Times on Tuesday.

Chen Hufei, an analyst with the Bank of Communications in Shanghai, played down the effect of hot money inflows, and attributed the high growth rate to a low base effect from last year.

"If you look at the data on a month-on-month basis, January's FDI actually declined from the December reading of $12.08 billion," he told the Global Times on Tuesday.

But January's FDI still underlined overseas investor confidence in China's growth potential, Chen said, as other emerging economies such as Indonesia, India and Brazil have witnessed capital flight in recent months after the US planned to taper its quantitative easing policy.

Shen also denied suspicions that China's strong export figures in January were inflated by falsified deals and said such guesses are groundless.

China's exports increased by 10.6 percent year-on-year to $207.13 billion in January, data from the General Administration of Customs showed last week.

"We cannot rule out the possibility that some companies conducted illicit transactions, but in general, January's export growth is reasonable and logical if looking at breakdown figures for different products and destination markets," said Shen.

Meanwhile, China's outbound investment rose to $7.23 billion in January, up 47.2 percent from a year earlier, data from MOC showed Tuesday.

In a regional breakdown, investment to Japan and Russia soared by 500 percent and 281.8 percent year-on-year, respectively, in January.

The growth is significant given the deteriorating relationship between China and Japan following Japanese Prime Minister Shinzo Abe's visit to the notorious Yasukuni Shrine on December 26.

Shen said it is difficult to analyze the trend of outbound investment to Japan merely based on a single month's data, and noted that certain large deals might push up the growth rate.

Also at Tuesday's press conference, Shen said it is irresponsible and not objective for the US to include Chinese companies and marketplaces in a Notorious Markets List.

The list, which was published last week by the Office of the US Trade Representative, includes video streaming site xunlei.com, Beijing Silk Market and Buynow PC Malls, which were accused of dealing in pirated or counterfeit goods.

"The US side should comprehensively and objectively reflect Chinese enterprises' efforts and progress in intellectual property protection and give fair judgment, thus preventing negative influence on the Chinese companies involved," Shen said.

FDI surge reflects confidence in China economy

2014-02-18China‘s Jan FDI inflow rises 16.11 pct

2014-02-18FDI inflow grows 5.25 pct in 2013

2014-01-17Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.