China is well on track to boost short-term economic recovery while leaving policy room to solve structural problems, including excessive reliance on the property market and the local government debt issue, a senior economist said on Monday.

"My own calculation shows that China's potential growth rate is still 5.5 percent on average. But (for) this year and also last year, the growth targets were (both set at) around 5 percent. I think the government has intentionally left some room over there for structural adjustments," said Yao Yang, director of the China Center for Economic Research at Peking University, during an exclusive interview with China Daily.

He made the remarks as data from the National Bureau of Statistics showed on Monday that China's economy gained more steam in the first two months with improvement in key indicators, including production and investment.

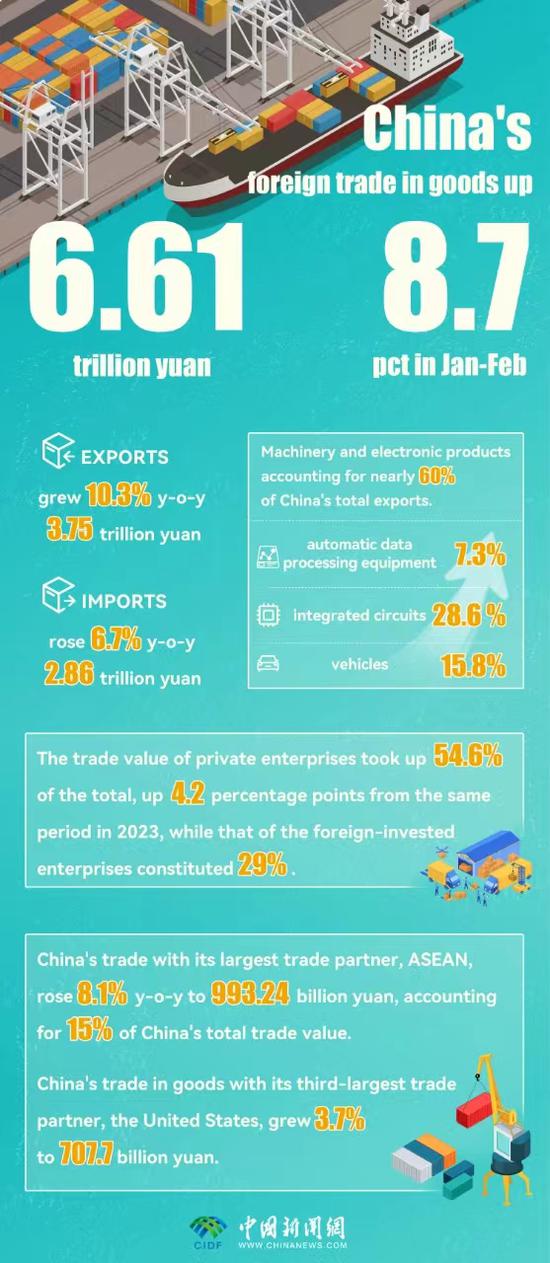

Data from the General Administration of Customs also showed earlier that the country's exports grew by 10.3 percent year-on-year to 3.75 trillion yuan ($520 billion) in the January-February period.

Yao dismissed speculation that China's economy has reached its peak. "In the end, the world still needs more Chinese exports. The whole world still needs China. I'm always confident about the fundamentals of the Chinese economy."

The Chinese economy, he said, enjoys a solid foundation, given the notable technological progress in fields like artificial intelligence and alternative energy.

While the broader economy is still facing problems like the continued weakness in the property sector, they will be short-lived as they are a consequence of the government's deliberate adjustments, since relying on the housing sector is not going to be sustainable, he said.

"You must always balance the long-term goals with short-term fluctuations," he said.

Yao noted the country has made similar moves in terms of tackling local debt issues.

"In the short run, that's going to have a contractionary effect. In the long run, it's going to be good for the Chinese economy," he said.

He said China should take more measures to offset the short-term impact of such deliberate adjustments on the economy.

The central government, he suggested, should allow local governments to issue special bonds to tackle their deficits, as some local governments have accumulated huge deficits over the past several years.

"Issuing such bonds will be equivalent to injecting liquidity into the economy," he said, adding that production and demand of private enterprises will be boosted this way because many local governments debts are owed to them.

In addition, he called for a plan designed by the top authorities at the national level to digest the stock of local government debt, as some regions lack adequate financial resources to effectively address the problem themselves.

It is also important to control the expansion of new debt by including local government debt in the public budget that need to be approved by the local legislatures, thereby making the issuance of local government debt more open and transparent, he said.

As for the property sector, he suggested allowing the market to "fully adjust", which means home prices should decline to a certain level where people will feel encouraged to buy new homes. That could be achieved with progress in government-led affordable housing projects, he said.

京公网安备 11010202009201号

京公网安备 11010202009201号