Chinese yuan's international payment share hit a record high of 3.71 percent in September and retained its position as the fifth most active currency for global payments, data from the SWIFT system showed on Wednesday.

Overall, the yuan's payments value increased by 2.77 percent compared with the previous month, whilst in general all payments currencies decreased by 3.96 percent, SWIFT data revealed.

Since the beginning of the year, there have been a series of notable developments, such as surpassing the Euro to become the second-largest currency in Brazil's foreign exchange reserves, Argentina's first-ever using of yuan to repay foreign debts, and Pakistan's inaugural payment of Russian crude oil expenses in yuan.

The first time that the yuan exceeded the 3 percent benchmark was in January 2022, when it reached 3.2 percent.

The yuan has become the world's fifth largest currency for reserves, payments and trading, and the third-largest currency for trade financing. In May 2022, the IMF increased the yuan's weight in the Special Drawing Rights currency basket from 10.9 percent to 12.3 percent.

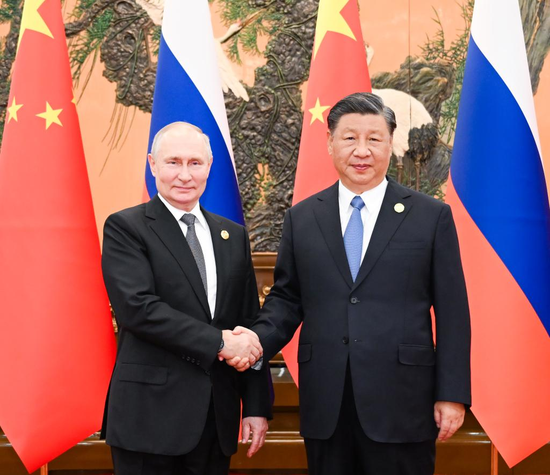

As China's economic strength steadily grows, its position in the global industrial and supply chains continues to rise, and the functions of the yuan as an international reserve currency and payment currency continue to strengthen. More and more countries are actively promoting currency arrangements and partnerships with China, experts said.

The latest cases include Chinese company Universal Energy signing a power purchase agreement (PPA) with the Uzbekistani government settled in yuan, which was announced by the company on Tuesday.

The deal was Uzbekistan's first yuan-settled PPA, marking a great step forward in the exploration of bilateral cross-border yuan settlement, the company said.

In China's own cross-border transactions, the proportion of yuan settlements reached 49 percent in the second quarter of 2023, surpassing the US dollar for the first time, according to media reports.

China's central bank, the People's Bank of China, has vowed to steadily advance the currency's internationalization and make it more convenient to use the yuan in cross-border trade and investment, according to the Xinhua News Agency.

In the process of yuan's internationalization, China upholds the principle of letting the market be the driver and pursues mutual benefits and win-win cooperation, the central bank said.

京公网安备 11010202009201号

京公网安备 11010202009201号